New York Community (NYCB) Q1 Earnings Beat on Lower Costs

New York Community Bancorp, Inc.’s NYCB shares gained 8.2%, following the release of first-quarter 2020 results. Earnings per share of 20 cents surpassed the Zacks Consensus Estimate of 16 cents. Also, the figure compared favorably with the prior-year quarter figure of 19 cents.

Lower expenses and higher loan balance drove the company’s performance. Also, higher net interest income came as a tailwind. Capital position remained strong. However, a fall in revenues negatively impacted the company. Also, results were affected by a drastic rise in provisions due to the adoption of new accounting guidance and the impacts of the COVID-19 outbreak.

The company reported net income available to common shareholders of $92.1 million compared with $89.4 million in the prior-year quarter.

Revenues Fall, Loans Rise and Expenses Decline

Total revenues were $261.4 million in the quarter, down 1.8% year over year. Also, the top line lagged the Zacks Consensus Estimate of $262.5 million.

Net interest income was up 1.3% year over year to $244.5 million. The rise mainly resulted from lower interest expenses, partly muted by a fall in interest income. Adjusted net interest margin of 1.92% shrunk 3 basis points (bps).

Non-interest income was $16.9 million, down 31.8% on a year-over-year basis. The fall was primarily due to lower gain on securities.

The company reported non-interest expenses of $125.5 million, down 9.5% from the year-earlier quarter. Lower compensation and benefits along with occupancy and equipment and reduced general and administrative expenses chiefly resulted in the fall.

As of Mar 31, 2020, total deposits rose 1% sequentially to $32 billion. Total loans increased nearly 1% to $42.3 billion in the reported quarter.

During the first quarter, loan originations were $2.7 billion, down 18% sequentially. The company had $2.1 billion of loans in its current pipeline, including $1.6 billion of multi-family loans, $101 million of CRE loans and $379 million in specialty finance loans as of 2019 end.

Credit Quality Worsens

Credit quality for New York Community Bancorp reflected mixed credit metrics. Non-performing assets increased 18% year over year to $58.8 million. Furthermore, provision for loan losses was $20.6 million against recovery of $1.2 million in the prior-year quarter.

Net charge-offs escalated significantly to $10.2 million. Net charge-offs, as a percentage of average loans, climbed 2 bps to 0.02% from the year-ago quarter.

Strong Profitability and Capital Ratio

New York Community Bancorp’s capital ratios remained strong. As of Mar 31, 2020, return on average assets and return on average common stockholders’ equity was 0.75% and 5.95% compared with 0.76% and 5.86%, respectively, in the year-ago quarter.

Common equity tier 1 ratio was 9.81% compared with 10.27% as of Mar 31, 2019. Total risk-based capital ratio was 13.16% compared with 13.83% in the year-ago quarter. Leverage capital ratio was 8.47%, down from 8.68%.

Our Viewpoint

New York Community Bancorp delivered a decent performance in the first quarter. Lower expenses reflect prudent expense management. In addition to this, we believe its efforts to originate loans for investment will augur well for earnings in the subsequent quarters.

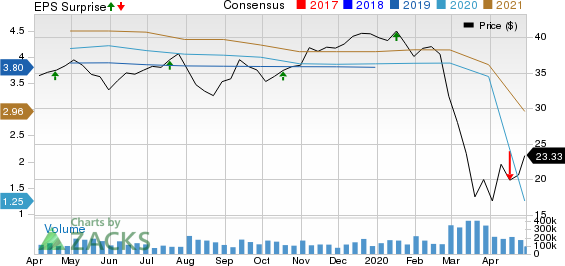

Citizens Financial Group, Inc. Price, Consensus and EPS Surprise

Citizens Financial Group, Inc. price-consensus-eps-surprise-chart | Citizens Financial Group, Inc. Quote

New York Community Bancorp currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Commerce Bancshares, Inc.’s CBSH first-quarter 2020 earnings per share of 44 cents lagged the Zacks Consensus Estimate of 50 cents. Also, the bottom line represents a decline of 45.7% from the prior-year quarter.

Impacted by higher provisions, UMB Financial UMBF reported first-quarter 2020 net operating loss of 4 cents per share, lagging the Zacks Consensus Estimate of earnings of 89 cents. The reported figure also compares unfavorably with the prior-year quarter’s earnings of $1.19.

TCF Financial Corporation TCF reported first-quarter 2020 adjusted earnings per share of 57 cents, beating the Zacks Consensus Estimate of 35 cents. However, the figure plunged 45.2% from the prior quarter.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

TCF Financial Corporation (TCF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research