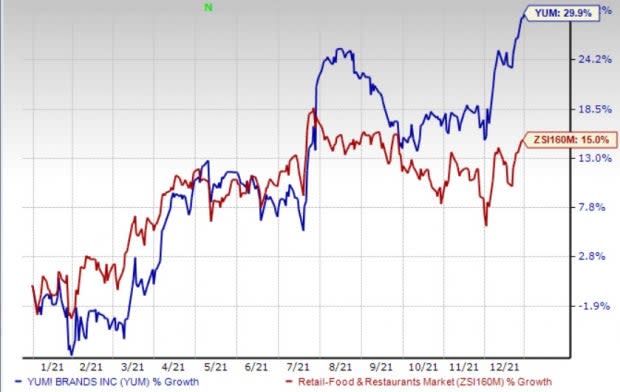

Yum! Brands (YUM) Up 30% YTD: Will the Rally Continue in 2022?

Despite the coronavirus pandemic, 2021 has turned out to be an encouraging one for Yum! Brands, Inc. YUM. The company’s shares have gained 29.9% year to date, compared with the industry’s rally of 15%. Continued focus on off-premise channels, strategic investments in digital technology and refranchising efforts bode well. The question is whether the company can sustain the uptrend in 2022. Let’s delve deeper.

Growth Drivers

The company’s performance in 2021 benefited from strong digital sales, robust unit development and a diversified global business model. YUM reinforced its digital capabilities with the acquisition of Dragontail, which offers AI-based integrated kitchen order management and delivery technologies. The initiative paves the path for strengthening store operations and enhancing customer experience. During the quarter, it reported digital sales of more than $5 billion.

Yum! Brands implemented various digital features in mobile and online platforms across all brand segments to enhance the guest experience. The company has been working toward accelerating its delivery services and the results have been positive so far. At the end of third-quarter 2021, the company had more than 41,000 restaurants offering delivery globally.

Despite the pandemic-induced challenging environment, the company impressed investors with robust same-store sales growth in third-quarter 2021. The company delivered same-store sales growth of 3% on a year basis. At KFC International, same-store sales rose 6% during the quarter. The robust performance of several European markets, where sales returned to the pre-pandemic level, drove the company’s results in third-quarter 2021. Sales in the European markets were driven by robust digital and off-premise growth, and exciting products. At KFC U.S., same-store sales increased 4% during the quarter under review. Meanwhile, at Pizza Hut international, same-store sales grew 6% in the quarter.

The Zacks Rank #3 (Hold) company aims to revamp its financial profile. This, in turn, will improve organizational efficiency and cost structure globally. It believes that a “slimmer Yum Brands” would lead to efficiency gains. Considering its existing footprint of more than 50,000 restaurants worldwide, YUM! Brands believes it can roughly triple its current global presence over the long term. During the first, second and third quarter of 2021, the company opened 435, 603 and 760 net new units, respectively. KFC opened 428 net new units in second-quarter 2021.

Taco Bell continues to impress investors with robust same-store sales. The company’s comps climbed 21% and 5% during the second and third quarter of 2021, respectively. During first-quarter 2021, Taco Bell generated same-store sales growth of 10% on a two-year basis.

Image Source: Zacks Investment Research

Concerns

Maintaining liquidity has become a herculean task amid the coronavirus pandemic for most of the companies. At the end of Sep 30, 2021, the company’s long-term debt stood at $11.2 billion, up from $10.3 billion at the end of Jun 30, 2021. However, the company ended third-quarter 2021 with cash and cash equivalent of $1,001 million, up from the prior quarter’s $$552 million. Although cash and cash equivalent has increased it may not enough to manage to a high-debt level.

An increase in the cost of employee wages, benefits and insurance, and other operating costs such as rent and energy costs put significant pressure on the company’s margins. A competitive retail environment weighed on the restaurants’ costs. The company is susceptible to profit margin pressure due to relentless expansion. In third-quarter 2021, its net costs and expenses amounted to $1,079 million from $977 million in the prior-year quarter. Costs associated with brand positioning in all key markets and ongoing investments in initiatives are likely to put pressure on margins in the near term.

Key Picks

Some better-ranked stocks in the same space include Papa John's International, Inc. PZZA, Arcos Dorados Holdings Inc. ARCO and McDonald's Corporation MCD.

Papa John's currently carries a Zacks Rank #2 (Buy). The company benefits from its off-premise business model. Sales at off-premise business model have exceeded pre-pandemic levels. We believe that a boost in customer count coupled with targeted off-premise marketing is likely to drive the channel’s performance in the upcoming periods. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Papa John's has a trailing four-quarter earnings surprise of 27.2%, on average. The company’s fiscal 2021 earnings is likely to witness growth of 142.1%. PZZA stock has gained 64.2% in the past year.

Arcos Dorados carries a Zacks Rank #2. ARCO has a long-term earnings growth of 42.9%. Shares of the company have increased 13.1% so far this year.

The Zacks Consensus Estimate for Arcos Dorados current financial-year sales and EPS suggests growth of 31% and 112.5%, respectively, from the year-ago period’s levels.

McDonald’s carries a Zacks Rank #2. A robust drive-thru presence and investments in delivery and digitization in the past few years have helped the company to tide over the pandemic. The company has a trailing four-quarter earnings surprise of 6.8%, on average.

The Zacks Consensus Estimate for McDonald's current financial year sales and EPS suggests growth of 20.9% and 55.7%, respectively, from the year-ago period’s levels. MCD has rallied 28% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Yum Brands, Inc. (YUM) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research