Yum! Brands (YUM) Q1 Earnings & Revenues Surpass Estimates

Yum! Brands YUM delivered better-than-expected results for first-quarter 2018. Adjusted earnings of 90 cents per share surpassed the Zacks Consensus Estimate of 68 cents. Further, earnings surged 38% year over year. The shift to refranchising substantially bolstered the company’s operating margin and earnings per share. Further, the trend is expected to continue.

Total revenues of $1,371 million were down 3% year over year but surpassed the Zacks Consensus Estimate of $1,082 million. The decline in total revenues was mainly due to decrease in company sales as an impact of its continued strategic refranchising initiative.

Despite reporting better-than-expected results the company’s shares are down nearly 5% in pre-market trading session after its comps growth of 1% came in below the analyst expectations. Nevertheless, shares of Yum! Brands have rallied 27% over the past year, outperforming the industry’s gain of 6%.

Segmental Performance

Yum! Brands reports under three segments — KFC, Pizza Hut and Taco Bell.

KFC revenues were $658 million, down 10% on a year-over-year basis. Comps at the KFC division dipped 2% compared with the year-ago quarter’s rise of 2% and the previous quarter’s increase of 3%.

Segment operating margin was up 5.3% to 33.6% year over year owing to refranchising and same-store sales growth.

At Pizza Hut, revenues were $251 million, up 8% on a year-over-year basis. Comps were up 1% against the year-ago quarter’s decline of 3% and preceding quarter’s increase of 1%.

Segment operating margin was down 0.6% year over year to 35%.

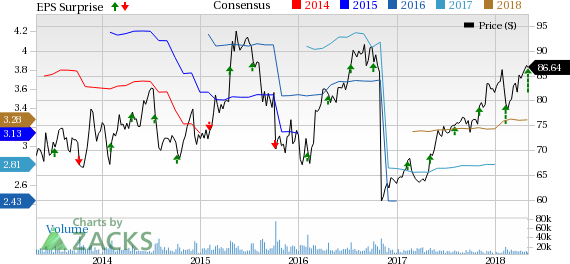

Yum! Brands, Inc. Price, Consensus and EPS Surprise

Yum! Brands, Inc. Price, Consensus and EPS Surprise | Yum! Brands, Inc. Quote

Taco Bell revenues were $462 million, up 2% from the year-ago quarter. Comps were up 1%, which compared unfavorably with the year-ago quarter growth of 8%.

Segment operating margin was down 2.7% to 28.5% year over year.

Zacks Rank & Peer Releases

Yum! Brands carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Darden DRI reported mixed third-quarter fiscal 2018 results, wherein earnings surpassed the Zacks Consensus Estimate while revenues lagged the same. Adjusted earnings of $1.71 per share increased 29.5% year over year on the back of higher revenues.

Restaurant Brands’ QSR first-quarter 2018 earnings and revenues surpassed the Zacks Consensus Estimate. Earnings under the previous accounting standard came in at 67 cents, improving 86.1% year over year.

Chipotle’s CMG first-quarter 2018 earnings surpassed analysts’ expectations while revenues were in line with the same. Adjusted earnings of $2.13 surged 33.1% from the year-ago quarter, driven by higher revenues and lower food costs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research