Yum China (YUMC) Q4 Earnings & Revenues Top Estimates, Stock Up

Yum China Holdings, Inc. YUMC reported solid fourth-quarter 2020 results, with earnings and revenues surpassing the Zacks Consensus Estimate and increasing on a year-over-year basis. While the bottom line beat the consensus mark for the 13th straight quarter, the top line outpaced the same for the fifth straight quarter. Following the results, the company’s shares moved up 1.7% in after-hour trading session on Feb 3, 2021.

Earnings & Revenue Discussion

During the fourth quarter, the company reported adjusted diluted earnings of 35 cents that beat the Zacks Consensus Estimate of 24 cents by 45.8%. Moreover, the reported figure increased 40% from the year-ago quarter’s levels. Excluding gains from its equity investment in Meituan and foreign currency translation, the top line surged 58% and 47%, respectively.

Meanwhile, quarterly revenues of $2,259 million not only surpassed the consensus mark of $2,160 million, but also increased 11.3% on a year-over-year basis. Excluding foreign currency translation, the top line increased 5% year over year.

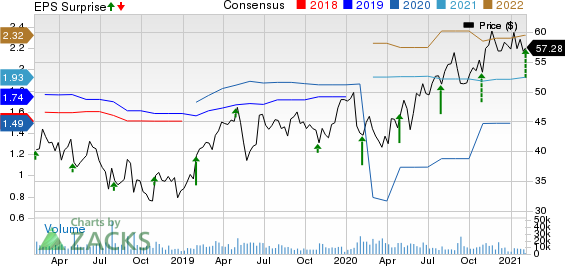

Yum China Holdings Inc. Price, Consensus and EPS Surprise

Yum China Holdings Inc. price-consensus-eps-surprise-chart | Yum China Holdings Inc. Quote

Total system sales in the reported quarter increased 5% year over year. Notably, system sales at KFC moved up 3%, while that of Pizza Hut fell 3%. Meanwhile, same-store sales declined 4% year over year, primarily owing to a decline of 4% at KFC and 5% at Pizza Hut.

Operating Highlights

In the fourth quarter, total costs and expenses expanded 7% year over year to $2,079 million compared with $1,935 million in the year-ago quarter. The deterioration can be primarily attributed to 8% increase in food and paper costs along with 6% increase in occupancy and other operating costs.

Restaurant margin in the quarter under review was 15.1%, up 270 basis points from the year-ago quarter’s levels. The upside was primarily led by lower commodity prices, relief provided by landlords and government agencies and other store cost savings. However, this was partially offset by dismal same-store performance, value promotions and wage inflation.

During the quarter, adjusted operating profit totaled $182 million, up 73.3% from the year-ago quarter’s figures. Adjusted net income came in at $153 million compared with $98 million in the prior-year quarter.

Balance Sheet

Cash and cash equivalents as of Dec 31, 2020, totaled $1,158 million compared with $1,046 million as on Dec 31, 2019. Inventories in the fourth quarter were $398 million compared with $380 million at 2019-end.

The company’s board of directors announced a dividend of 12 cents per common share. The dividend is payable on Mar 25, 2021, to shareholders of record at the close of business as of Mar 3.

Unit Development and Other Details

In the fourth quarter, Yum China opened 505 new restaurants and remodeled 297. During the quarter, the company’s delivery contributed nearly 29% of KFC and Pizza Hut's company sales, up from 22% in the prior-year quarter.

Digital orders during the fourth quarter contributed 83% of KFC and Pizza Hut's company sales compared with 61% in the previous-year quarter. Notably, loyalty programs and member sales of KFC and Pizza Hut led to year-over-year growth.

2020 Highlights

Total revenues in 2020 came in at $8,263 million compared with $8,776 million in 2019.

General and administrative expenses in 2020 came in at $479 million compared with $487 million in 2019.

In 2020, adjusted diluted earnings per share came in at $1.53 compared with $1.88 in the previous year.

2021 Outlook

Yum China continues to focus on expanding its store footprint and developing emerging brands. Notably, the company expects to open 1000 (gross) new stores in 2021. Also, increased investments in terms of digitization and infrastructure are likely to support their expansion plans. Meanwhile, capital expenditures in 2021 are expected to be approximately $600 million.

Zacks Rank & Key Picks

Yum China currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the same space are Del Taco Restaurants, Inc. TACO, Jack in the Box Inc. JACK and Yum! Brands, Inc. YUM, each carrying a Zacks Rank #2 (Buy).

Del Taco has a three-five-year earnings per share growth rate of 15%.

Jack in the Box’s 2021 earnings are expected to rise 20.4%.

Yum! Brands has a trailing four-quarter earnings surprise of 18.9%, on average.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jack In The Box Inc. (JACK) : Free Stock Analysis Report

Del Taco Restaurants, Inc. (TACO) : Free Stock Analysis Report

Yum China Holdings Inc. (YUMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research