Zscaler (ZS) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

Zscaler ZS reported first-quarter fiscal 2020 adjusted earnings of 3 cents per share that beat the Zacks Consensus Estimate by 200%. The figure jumped 50% from the year-ago quarter.

Revenues of $93.6 million surged 47.9% year over year driven by growing adoption of the company’s cloud platform security solutions by global enterprises. The figure comfortably surpassed the consensus mark by 5.6%.

Americas accounted for 51% of revenues, while EMEA contributed 41%. The rest came from APJ.

Calculated billings increased 37% year over year to $88.3 million in the reported quarter.

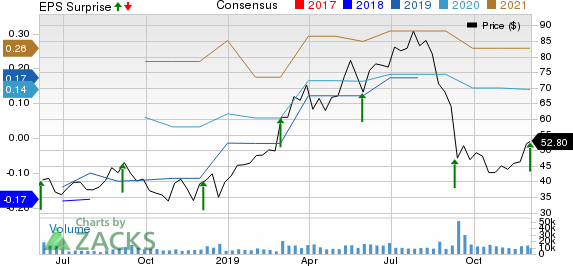

Zscaler, Inc. Price, Consensus and EPS Surprise

Zscaler, Inc. price-consensus-eps-surprise-chart | Zscaler, Inc. Quote

Customer Details

Zscaler continued to win customers and its net dollar retention rate was strong at 120%.

The company ended first-quarter fiscal 2020 with more than 3,900 customers. Total global 2,000 customers increased to more than 400 as of Oct 31, up from more than 300 a year ago. Moreover, 100 of the Fortune 500 companies are Zscaler’s customers.

Remaining Performance Obligations (RPO) were $555 million on Oct 31, up 35% year over year.

Operating Details

In the reported quarter, gross margin contracted 180 basis points (bps) to 79.1%.

Sales & marketing (S&M), research & development (R&D) and general & administrative (G&A) expenses jumped 62.6%, 53.7% and 24.6% to $59.4 million, $20.3 million and $12.6 million, respectively.

However, as a percentage of revenues, S&M, and R&D expenses expanded 570 bps and 80 bps while G&A expenses declined 250 bps, respectively.

Non-GAAP operating income was $2.9 million in the reported quarter compared with $1.2 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Oct 31, Zscaler had $377.6 million in cash, cash equivalents and short-term investments compared with $364.6 million in the previous quarter.

In the reported quarter, cash provided by operations was $21.4 million. Free cash flow was $9.4 million.

Deferred revenues soared 49% year over year to $245.9 million.

Guidance

For second-quarter fiscal 2020, Zscaler expects revenues between $97 million and $100 million.

Non-GAAP income from operations is expected between $3 million and $4 million. Non-GAAP earnings is projected to be around 3 cents per share.

For fiscal 2020, Zscaler expects revenues between $405 million and $413 million.

Non-GAAP income from operations is expected to be $15-$18 million. Non-GAAP earnings are expected between 13 cents and 15 cents per share.

The company’s fiscal 2020 calculated billings are expected between $500 million and $510 million, indicating growth of 28% to 31%.

Zacks Rank & Stocks to Consider

Currently, Zscaler carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Marchex, Inc. MCHX, Fortinet, Inc. FTNT and Baidu, Inc. BIDU. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Marchex, Fortinet and Baidu is currently pegged at 15%, 14% and 2.27%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Marchex, Inc. (MCHX) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research