Zscaler (ZS) Q2 Earnings and Revenues Beat Estimates, Up Y/Y

Zscaler ZS delivered better-than-anticipated second-quarter fiscal 2022 performance.

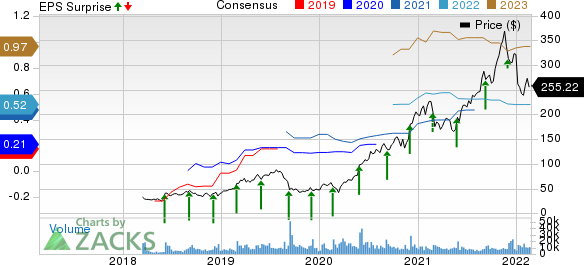

The company reported non-GAAP earnings of 13 cents per share, which beat the Zacks Consensus Estimate of 11 cents per share. The bottom line grew 30% year over year.

Zscaler’s second-quarter fiscal 2022 revenues were $255.6 million, surpassing the Zacks Consensus Estimate of $242 million. The top line improved 63% from the prior-year reported figure.

Zscaler, Inc. Price, Consensus and EPS Surprise

Zscaler, Inc. price-consensus-eps-surprise-chart | Zscaler, Inc. Quote

Top-Line Details

During the second quarter of fiscal 2022, Zscaler’s calculated billings increased 59% year over year to $367.7 million.

Geographically, the Americas accounted for 51% of revenues, while the EMEA contributed 35%. The Asia Pacific and Japan made up the remaining 14%.

Zscaler's Zero Trust Exchange platform acted as a key catalyst in the second quarter. The company benefited from sustained demand for its products, given the healthy environment of the global security market. Increased cyber and ransomware risks, coupled with accelerated digital transformation, contributed significantly to growth.

Customer Details

In the second quarter, Zscaler continued to win multiple customers in each of its three market segments: financial services, enterprise market and federal. Its net dollar-based retention rate was over 125%.

Remaining Performance Obligations (RPO) representing Zscaler’s committed non-cancellable future revenues were $1.95 billion as of Jan 31, significantly up 90% year over year.

During the second quarter, Zscaler had 251 customers with $1 million or higher annualized recurring revenues (“ARR”). The figure, which is the highest so far, improved 84.6% year over year.

The company had 1,751 customers with $100,000 or higher ARR. The figure reflected year-over-year growth of 48.1%.

Operating Details

In the second quarter, non-GAAP gross profit was $205.5 million. Non-GAAP gross margin contracted 100 basis points (bps) to 81% on both year-over-year and quarter-over-quarter basis.

Non-GAAP research & development (15% of revenues), sales & marketing (50% of revenues), and general & administrative (7% of total revenues) expenses flared up 62.9%, 66.3% and 34.4% to $39.1 million, $127.2 million and $16.8 million, respectively.

Total non-GAAP operating expenses, accounting for 72% of revenues, climbed 62.3% to $183.2 million. Operating expenses as a percentage of revenues remained flat year over year despite higher expenses related to travel and increased investments for the acquisition of Trustdome and SmokeScreen.

Non-GAAP operating income was $22.3 million compared with the previous quarter’s $23.9 and the year-ago quarter’s $14.8 million. Non-GAAP operating margin remained flat year over year at 9%. Sequentially, the margin contracted by 100 bps.

Balance Sheet & Cash Flow

As of Jan 31, 2022, Zscaler had $1.62 billion in cash, cash equivalents and short-term investments compared with the previous quarter’s $1.58 billion.

Cash flow generated through operating activities was $48.3 million, down from the previous quarter’s $93.3 million. Consequently, free cash flow stood at $29.4 million, significantly lower than $83.4 million in the first quarter of fiscal 2022.

However, free cash flow margin expanded 100 bps to 12% in the quarter reported. Deferred revenues were $759.9 million, up 70% year over year.

During the first six months of fiscal 2022, Zscaler generated $141.5 million worth of cash through operating activities and $112.8 worth of free cash flow. Free cash flow margin expanded 300 bps to 23% during the same time frame.

Guidance

For the third quarter of fiscal 2022, Zscaler projects revenues between $270 million and $272 million. Non-GAAP earnings are projected to be 10-11 cents per share.

Non-GAAP income from operations is estimated to be $19-$20 million.

Zscaler updated its fiscal 2022 guidance. It anticipates revenues of $1.045-$1.05 billion, up from the previous guidance of $1.00-$1.01 billion.

Calculated billings are anticipated in the range of $1.365 billion to $1.37 billion, up from the previously guided range of $1.300-$1.305 billion.

Non-GAAP earnings for fiscal 2022 are expected to be 54-56 cents per share, up from the previous forecast of 50-52 cents.

Non-GAAP operating income is estimated to be $95-$98 million, up from previous guidance of $90-$93 million.

Zacks Rank & Other Key Picks

Zscaler currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader computer and technology sector include the iPhone maker Apple AAPL and Axcelis Technologies ACLS, both sporting a Zacks Rank #1 (Strong Buy), and Analog Devices ADI carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Apple’s second-quarter fiscal 2022 earnings has been revised upward by 3.6% to $1.43 per share over the past 30 days. For fiscal 2022, earnings estimates have moved north by 5.9% to $6.15 per share in the past 30 days.

Apple’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 20.3%. AAPL stock has appreciated 34.5% in the past year.

The Zacks Consensus Estimate for Axcelis’ first-quarter 2022 earnings has been revised upward by 2 cents to 89 cents per share over the past 30 days. For 2022, earnings estimates have moved north by 10.8% to $3.99 per share in the past 30 days.

Axcelis’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 30.3%. Shares of ACLS have rallied 85.3% in the past year.

The Zacks Consensus Estimate for Analog Devices’ second-quarter fiscal 2022 earnings has been revised upward by 7 cents to $2.08 per share over the past seven days. For fiscal 2022, earnings estimates have moved north by 27 cents to $8.32 per share in the past seven days.

Analog Devices’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6%. Shares of ADI have gained 4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.