Zumiez (ZUMZ) Q4 Earnings & Sales Beat Estimates, Grow Y/Y

Zumiez Inc. ZUMZ delivered robust fourth-quarter fiscal 2020 results, with the top and the bottom line not only beating the Zacks Consensus Estimate but also rising year over year. Management is quite impressed with the overall holiday performance beating the tough operating environment. Also, the company’s one channel approach to retail looks impressive.

We note that shares of this Lynnwood, WA-based company have surged 27.4% in the past three months compared with the industry’s growth of 25%.

Results in Detail

Zumiez posted quarterly earnings of $1.68 per share that surpassed the Zacks Consensus Estimate of $1.61. The bottom line jumped 13.5% from $1.48 reported in the year-ago quarter. Higher net sales along with efficient expense management supported bottom-line growth.

Total net sales edged up 0.8% year over year to $331.5 million and beat the Zacks Consensus Estimate of $327 million. The upside was supported by a 4.7% rise in comparable sales and the net addition of three new outlets during the fiscal year, partly offset by temporary store closures because of the pandemic in the quarter. In the year-ago quarter, comparable sales increased 6.4%.

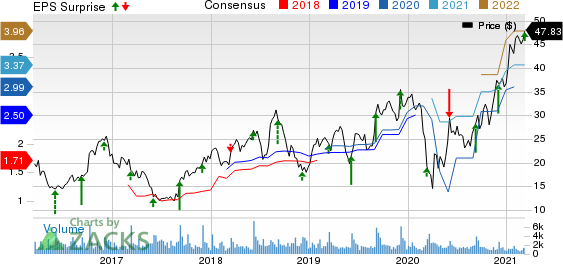

Zumiez Inc. Price, Consensus and EPS Surprise

Zumiez Inc. price-consensus-eps-surprise-chart | Zumiez Inc. Quote

In the fiscal fourth quarter, the hardgoods category stood out as the company’s largest positive comping category, followed by accessories and men's. Meanwhile, footwear was the company’s largest negative comping category, followed by women's.

We note that the company experienced meaningful digital strength with comparable web sales increasing 31.8% in the fiscal fourth quarter, while comparable sales for physical stores declined 3.1% year over year. Further, management highlighted that the company’s stores were open for nearly 94% of potential operating days in the reported quarter.

Region-wise, North America net sales grew 1.5% to $285.2 million, while other International net sales, consisting of Europe and Australia, declined 3.2% to $46.3 million.

Furthermore, gross profit inched up 1% year over year to $129.6 million, while gross margin expanded 10 basis points (bps) to 39.1%. The increase in gross margin was fueled by an 80-bp improvement in inventory shrinkage in obsolescence, 40 bps of leveraged occupancy costs and 20-bp growth in product margin. Growth was partly hurt by increased web shipping costs and adverse impact with respect to the STASH loyalty program deferred revenue adjustment made last year coupled with higher distribution and fulfillment costs.

We note that SG&A expenses contracted 4.7% to $75.8 million during the quarter. As a percentage of sales, SG&A expenses declined 120 bps to 22.9%. Furthermore, the company reported operating profit of $53.8 million, up nearly 10% from the prior-year quarter’s figure. Again, operating margin rose 130 bps to 16.2%.

Financial & Other Updates

As of Jan 30, 2021, this Zacks Rank #2 (Buy) company had cash and current marketable securities of $375.5 million compared with $251.2 million as of Feb 1, 2020. The upside was driven by cash generated through operations, including deferment of $30.1 million comprising landlord payments, reduced inventory levels, extended vendor terms and payroll tax payments along with net income improvements associated with abatements, credits and expense reductions. Growth was somewhat offset by $13.4 million of share repurchases via the company’s stock buyback program prior to the stores closing in March due to the pandemic and other anticipated capital expenditures.

Total shareholders’ equity at the end of the quarter stood at $552.6 million. The company had no debt at the end of the quarter and maintained full unused credit line of $35 million. It ended the fiscal year with $134.4 million inventory, down 0.5% from $135.1 million last year.

For fiscal 2021, capital expenditures are projected in the band of $20-$22 million versus $9.1 million in fiscal 2020. Most of the capital spending will be used toward store openings and planned remodels.

We note that as of Mar 6, 2021, Zumiez operated 722 stores, including 602 in the United States, 52 in Canada, 54 in Europe and 14 in Australia. In fiscal 2021, management intends to open 22 stores, comprising about five stores in North America, 12 stores in Europe and five stores in Australia. Simultaneously, it plans to close nearly five to six stores during the fiscal year.

Things to Note

Management provided details regarding first-quarter-to-date performance. Sales for the 35 days ended Mar 6, 2021, were down about 3.8% year over year. Comparable sales for the same period fell 0.4%. By channel, open store comparable sales fell 6.9% while e-commerce sales rose 29.5%. For the first quarter-to-date period, the company had nearly 7% fewer open store days compared with the year-ago period. This was due to government directives as well as safety concerns. The company also witnessed significant traffic metering and lower hours required by local governments. As the quarter progresses, management expects store closures and other operating restrictions to persist at fluctuating levels.

First-quarter-to-date comparable sales decline was driven by lower transactions, partly offset by a rise in dollars per transaction. Moreover, the hardgoods category remained the largest positive comping category, followed by accessories. Again, footwear was the company’s largest negative comping category, followed by women's and men's.

Region-wise, total sales in North America fell 6.1% in the first quarter through Mar 6, while the metric at other International business increased 11.4%. Many factors including the delay of U.S. tax returns and store closures impacted the North America business.

In fiscal 2021, management expects quarter-to-quarter volatility to persist as it transitions back to a more normalized sales and expense landscape. Nonetheless, management is encouraged about fiscal 2021 given its advanced in-store fulfillment capabilities, including Zumiez Delivery and other strategic efforts. The company believes that it is well positioned to continue on the growth track backed by strong brand presence and efficient operating fundamentals. Moreover, the inventory on hand is solid and selling at a favorable margin entering the fiscal year.

3 More Hot Stocks in Retail

Abercrombie & Fitch ANF has a long-term earnings-growth rate of 18% and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Boot Barn BOOT, also a Zacks Rank #1 stock, has a long-term earnings-growth rate of 20%.

Tapestry TPR boasts a long-term earnings growth rate of 10% and currently flaunts a Zacks Rank #2.

5G Revolution: 3 Stocks to Make Your Move

With super high data speed, it will make current cell phones obsolete and unlock the full potential of big data, cloud computing, and artificial intelligence. In the next few years this industry is predicted to create 22 million jobs and a stunning $12.3 trillion in revenue.

Today you have an historic chance to pursue almost unimaginable gains like Microsoft, Netflix, and Apple in their early phases. Zacks has released a Special Report that reveals our . . .

Smartest stock for 5G telecom

Safest investment in 5G hardware

Single best 5G buy of all!

Download now. Today the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research