2014 Predictions from Some of the Smartest Market Watchers

Sure, making predictions is folly. No one really has a crystal ball and so no one really knows the future.

Still, speculation abounds because we love to pit our vision against the markets, we crave risk as much as we fear it and sometimes people really do nail it and make a killing.

So without further ado, here's a collection of predictions from some notable friends who are willing to put themselves on record.

Jonathan Krinsky (MKM Partners): The SPX will test its 200 day moving average at some point. It has currently gone 278 sessions without doing so, for the 8th longest streak since 1980. The remarkable aspect of the current streak is that it began following a very strong run in 2012. Most of the other streaks followed some period that was flat or down, resulting in pent up demand. Currently the SPX is over 8% above its 200 DMA. As that continues to rise, we suspect the SPX will test it at some point in 2014.

Ralph Acampora (New York Institute of Finance): I am bullish for 2014 but I expect some kind of correction (maybe a bad one) during the year. So, I would start accumulating the VIX as the early rally continues.

Tadas Viskanta (Abnormal Returns) My blog Abnormal Returns is by design “forecast-free” so predictions are not typically my game. However in 2014 I can pretty safely bet that there will be no shortage of self-serving financial advice that on the margin harms individual investors rather than helping them. In certain cases seeking out professional advice is not only advisable but necessary. However you won’t find a better set of personal finance guidelines that fit on an index card than we saw this year:

image via Harold Pollack

In the end you, and you alone, are in charge of your finances. Don’t let the financial media distract you from from what’s important.

Brian Gilmartin (Trinity Asset Management): Synchronous global economic recovery will occur faster than many think, which will cause global interest rates i.e US Treasuries, Japan govt bonds, German sovereign debt rates to rise in a correlated fashion.

We are moving from an environment of slower growth and subdued economic data globally to risk arising from stronger-than-expected growth, similar to 1994.

In 1994, SP 500 earnings growth was 19%, while SP 500 returned 1% after Fed raised fed funds rate 6 times, from February ’94 through early ’95.

The risk is shifting from “it’s worse than we think” to “It’s stronger than we think”.

Todd Sullivan (ValuePlays): The theme for 2014 will be housing. All doubters will turn to bulls. New home construction explodes to finally catch up to demand (>1M units annually). This causes unemployment to dive below 6.5%. GDP exceeds 4% for the FY as the government drag on GDP is gone.

Greg Harmon (Dragonfly Capital): Boring old materials will be big winners. Steel (AKS, X), cement (CX) and aluminum (AA) all moving out of long bases.

Howard Lindzon (StockTwits): Uber and Lending Club go public and Google hits 1500 per share and makes 20 more acquisitions greater than $100 million.

Gregor Macdonald (TerraJoule): Oil will finally begin its next repricing cycle late in 2014. It will begin quietly, and will bring together many of the same factors that led to the previous repricing, which began in 2003. Spare capacity, the cost of the marginal barrel, and the continued decline of the cheap barrel will all confront a new upswing in global demand. The upswing in demand will largely be led by a return to global growth, even as renewables and the powergrid will become the main avenue for global GDP. Oil's next repricing will not be as dramatic in percentage terms. But the road to $150 oil begins in late 2014.

JC Parets (All Star Charts) Crude Oil prices double in Gold terms. $CL_F/GC_F currently at 0.08 - goes to 0.15+. Interest rates see 2% before 4% (10yr). Corn Rallies 30%. Blackberry doubles in Price. And Lebron ends the regular season shooting 50% better from the field than Carmelo Anthony.

Josh Brown (The Reformed Broker) The 2009 Generational Bottom is replaced as the reference point for the current bull market with the new all-time highs of 2013. An acknowledgement of the fact that this is a secular bull leads to a rethinking of its starting point - just as we refer to the start of the '82 bull market from the new high and not the 1973 low.

Scott Redler (T3 Live) While Microsoft (MSFT) has come a long way in 2013, I think it still has a ton of potential going forward. The stock provides the rare combination of value AND growth in one package. The company sits on a pile of cash but current leadership has never really known how to deploy it effectively. With Ballmer stepping down they have the chance to go from tech dinosaur to an innovator again if they can find the right person - much like we saw with Yahoo! and Marissa Mayer this year (which was one of my top 2013 picks). The stock also offers a hearty 3% dividend yield. From an anecdotal standpoint, they now have a phone that stands out a little but in the Nokia Lumina with 41 megapixel camera, and I think the new Surface Pro tablets are pretty cool - sort of like a laptop and tablet in one.

Eric Jackson (Ironfire Capital): (SFX Entertainment (SFXE) will do very well. Electro Dance Music (EDM) is not a fad but the fastest growing music niche that’s here to stay and SFXE is the purest play way to ride its success through the growth of festivals, music, DJ talent, merchandising and sponsorship. CEO Bob Sillerman knows how to make money.

Brian Sozzi (Belus Capital): Wal-Mart’s stock is up a meager 11.83% in 2013, but it could finish in the red next year. Here is what you won’t hear anywhere else: Wal-Mart will issue a 2014 EPS warning in mid-February that hits the stock, due to a post-holiday inventory build brought on by aggressive HQ ordering and cautious consumers. Wal-Mart will announce a restructuring plan under its new CEO (focus: closing underperforming U.S. and international stores) that ratchets up the fear on the internal health of the company amongst the usually bullish Street.

Scott Krisiloff (Avondale Asset Management) We'll start to see signs of inflation for the first time in five years. The yield curve will flatten. The Fed will be viewed as acting too timidly. The economic cycle will crest, along with share prices. Democrats will win control of congress.

The banking system will finally put the ghosts of 2008 to rest and there will be consolidation among small and mid cap banks. Consumers will continue to focus on quality of life. That means eating healthier, building relationships and taking time for leisure. Unfortunately for capitalists it doesn't mean spending more.

Apple will release an iPhone with a bigger screen. More consumers will cut their cable subscriptions. More advertising dollars will be spent online. The PC market will stabilize

Health insurance companies will pretend to have a tough year adjusting to Obamacare but the transition will be smooth for healthcare providers. There will start to be a realization that genetic testing is crossing the chasm toward mass market relevance.

Dan Mirkin (TradeIdeas): Apple buys Tivo :-)

Brian Shannon (AlphaTrends): I predict that the people foolish enough to make predictions will be set up to look like jerks next year this time. Learn to tune out the noise and focus on price action and risk management for a lower stress approach to the market in 2014.

Craig Johnson (Piper Jaffray): We are on track to achieve our SPX 2,000 price target next year, possibly earlier than we thought. We suspect 2014 will be a good but not great year, up high single to low double digits on the S&P 500.

Stowe Boyd (Chautauqua): Whomping big prediction for 2014: The year that business leaders come to admit that, as Marco Steinberg said, we have 18th century organizations facing 21st century problems. And instead of fooling around at the margins of the issue, leaders and influencers will start to make real, substantive, and deep changes to how businesses operate.

Jamie Lissette (Hammerstone): Bitcoin crashes and trades below 100.

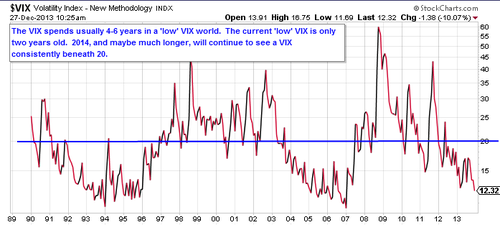

Ryan Detrick (Schaeffer's): We think the VIX will once again stay below the 20 area. Yes, the 20 area is the longer-term mean for the VIX, but it actually rarely trades around this area. It will spend years below, then years above this area.

In the ‘90s, it spent six years beneath this area and then last decade about four years below 20. The other periods were marked by multiple years above 20.

The recent ‘low’ VIX world started in early 2012 and very well could have multiple years left. In other words, 2014 should continue see very little volatility and any VIX spikes up to 20 should be faded.

Adam Warner (Schaeffer's): I predict that at some point in 2014, someone will make a huge long bet on either VIX calls or VIX futures or both. In fact I predict that will happen many times. I also predict that one of those times, they will time a market selloff very well, and the chattering class will internalize that any time someone makes a big VIX bet, its smart money, so sell everything!

Joe Donohue (UpsideTrader): Best Buy revisits the teens.

Andrew Thrasher (athrasher.com) Commodities were hated for nearly all of 2013 with the CRB Index off nearly 4% and gold down 27% through December 22nd, while the equity market has moved higher by almost 30%. Sentiment for agriculture and metals are at or near historic lows. For example, nearly all three categories of the Commitment of Traders report, Commercial, Large Traders, and Small Traders are short or near a net-short position for gold. Typically we see the most hated areas of the market one year rotate back to strength the following year. I'll be watching to see if this happens for the commodities market in 2014. While commodities are very weather dependent, there's a chance we see at least a partial rotation back to the beaten down agriculture and metal markets.

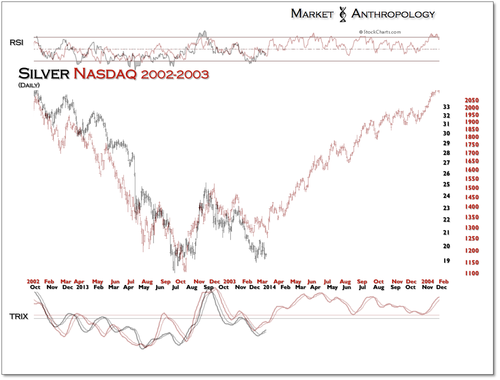

Erik Swarts (Market Anthropology): Silver rallies 50% in 2014 as inflation expectations rise and worldwide growth reaccelerates.

We have used the Nasdaq bust in 2000 as a comparative guide for silver and the precious metals complex over the past three years. From a momentum and performance point-of-view, silver found a cycle low this past summer. From a relative performance perspective, silver has been outperforming gold since late July. As such, we believe the low inflation backdrop is shifting discretely as gold and silver have tested the panic lows from early summer and look poised for reversal into 2014.

As obituaries are now being freshly penned for the precious metals sector, we pause at the timing - considering the trade had died almost three years before.

On the contrary, we believe a new birth announcement is in order.

Dynamic Hedge (Market Memory): Capital flows continue on the path of least resistance toward developed economies. Volatility will bite down hard, but S&P 500 continues in a long-term bull market. Our studies identified several historical market cases which model a relatively big correction in the first half of the 2014, after which the market begins to really accumulate upside momentum. I expect the US economy will fully recover from the 2008 financial crisis by the end of 2014, and we will head into the next phase of the bull market and the generation of the next (real) bubble.

Hard assets (Gold and Bitcoin) become synonymous with volatility and risk rather than stability and opportunity.

More people step out of the shadow of the 2008 crisis. The slow recovery continues, and liquidity gradually makes its way into the real economy and actual business development activities. Startups and business creation gather momentum as capital allocators realize that ZIRP money unattached to a great project is dead capital.

Quint Tatro (Tatro Capital): We see a major shift into base metal, energy and all things NON-Precious metals in commodity land.

Barry Ritholtz (The Big Picture): My annual Predictions for the coming year, 2014 edition:

Dow Jones Industrials: No idea

S&P500: Why are you asking me?

10 Year Bond: Could not fathom a guess

Emerging Markets: Who knows?

Fed Fund Rates: Haven’t a clue

GDP: Yes, we will probably have a GDP

Unemployment: Thhhhpppptttt?

ECB Rates: $%^&*!

2014 Election outcome: How the heck should I know?