2017 is a 'tipping point' for America's distressed retail industry

It’s a tough time to be a retailer in the U.S.

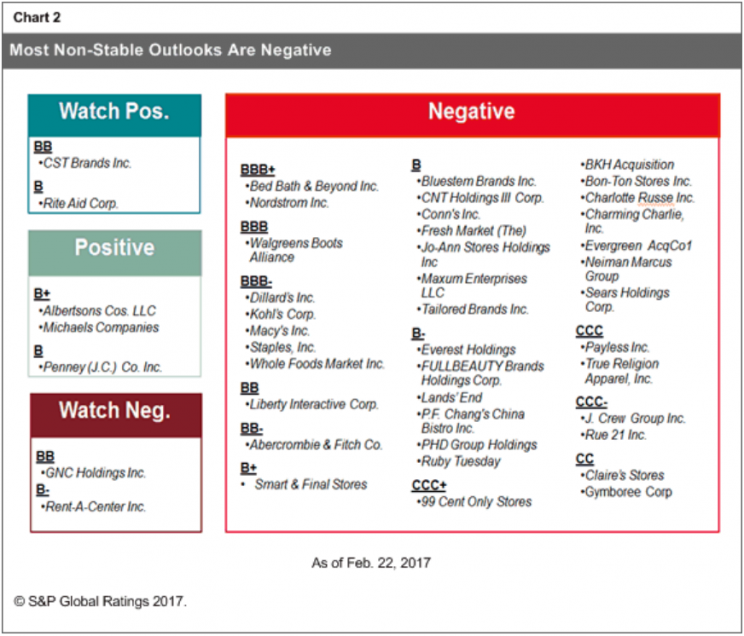

And in a recent report, analysts at S&P Global Ratings said that 2017 could be a “tipping point” for the struggling industry as financial outlooks — particularly for apparel retailers — grow increasingly bleak.

“Adverse secular trends are far more likely to accelerate than abate in 2017 and as holiday sales results have filtered in, many U.S. retailers continue to post earnings and guidance below S&P Global Ratings’ expectations,” the analysts, led by Robert Schulz, write.

“Our overall view of the sector is now more negative through 2017 versus an already negative view in 2016… we believe the combination of highly leveraged balance sheets through dozens of private equity buyouts over the past decade combined with retailers’ dangerous lag to online competition and shifting consumer preferences will continue to spell increased levels of stress for the sector in 2017.”

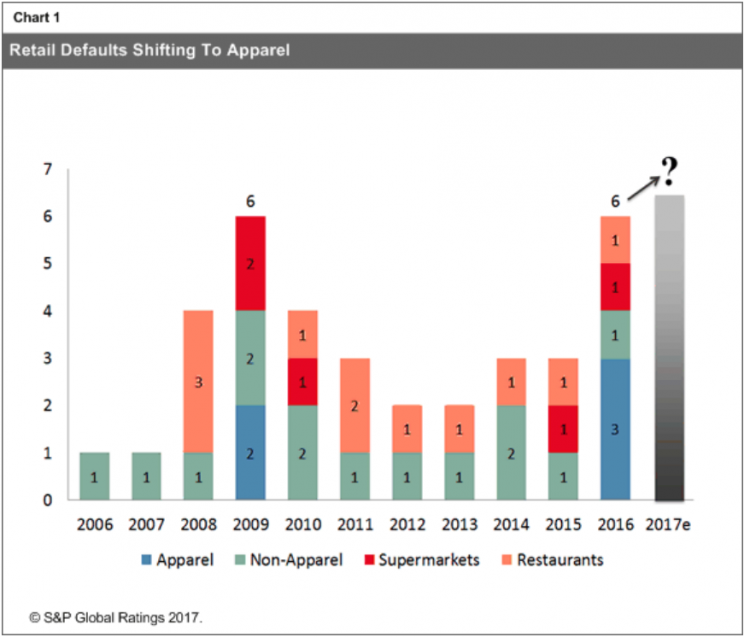

The firm notes that so far this year, it has taken 20 negative rating actions, including 14 downgrades, in the U.S. retail space. And defaults, of which there have been about three annually in the U.S., look set to rise in 2017.

Among the headline retailers that have reported falling sales in recent quarters are Macy’s (M), Target (TGT), Kohl’s (KSS), American Eagle (AEO), and L Brands (LB). And while some of these retailers beat on earnings, overall sales continue to disappoint.

And while many businesses — IBM (IBM) is a popular example — are able to maintain or increase profitability amid declining revenues, the retail business doesn’t offer managements the same range of possibilities.

“With a few exceptions,” S&P writes, “most distressed retailers are not entities that can sell unencumbered assets or deeply cut capital spending to keep afloat.” Declining sales, and as a result less cash coming into the business, makes the path forward treacherous.

Another major issue looming over the retail sector is an increase in spending options for U.S. consumers. As we’ve seen in recent quarters, overall consumption remains strong, while the January retail sales report topped expectations.

But as S&P notes, “ongoing competition from large ticket items such as autos and other spending, such as health care, technology and ‘experiences’, are challenges since wage growth has been fairly sluggish.” The data indicate that consumers are spending. Where they spend money, however, is the real story.

Bright spot for malls

The news for retail isn’t all bad, however.

And at least some malls, which have been held up as the avatar of declining retail fortunes, have a clear path to enjoying success in a changed retail environment.

“E-commerce and shifting consumer spending preferences are headwinds for all retail landlords,” S&P writes, “but we expect the headwinds for lower-quality malls and other retail locations to remain acute as space is reduced, while lack of supply (especially for higher-quality space) proves to be a critical support for those locations.”

In a note to clients in January, analysts at Credit Suisse wrote that, “we believe that deep-value retail (the combination of Off Price and fast fashion retail) will grow from 20% of industry sales to well over 30%. In short, we are at (or even past) a tipping point for the traditional full-price mall environment, particularly in tier-two and tier-three locations.”

As we’ve seen recently, Amazon has now started to make a push into the brick-and-mortar retail space, making clear that in-person shopping experiences are not dead. It’s just that the legacy experience of driving to a suburban mall anchored by familiar department stores is dying.

Making retail an industry-specific way to see the biggest trend in the US economy over the last generation play out: increasing inequality.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: