3Q GDP, OPEC to Drive USD/CAD Volatility- Shorts at Risk into 1.3370

DailyFX.com -

Talking Points

USD/CAD correction targeting initial support- CAD GDP, OPEC meeting on tap

Updated targets & invalidation levels

Click Here to be added to Michael’s email distribution list.

USD/CAD 120min

Technical Outlook: Loonie has continued to trade within the confines of these descending slope lines highlighted last week. A critical support zone (near-term bullish invalidation) rests at 1.3388where the 61.8% retracement converges on a pair of long & short-term median lines. Note that this levels is backed closely by confluence Fibonacci support at 1.3367/76 and a daily close below this threshold would be needed to validate abreak with such a scenario targeting subsequent support objectives at 1.3314, 1.3259 & 1.3231.

That said, the immediate short-side bias is at risk while above this key support zone with interim resistance seen at the weekly open / upper parallel at 1.3498. A breach above 1.3539 is needed to signal continuation of the broader uptrend targeting 1.3575. From a trading standpoint, heading into Canada’s 3Q GDP report I would be looking to fade weakness while above this 1.3367.

Keep in mind that the growth rate is expected to recover to an annualized rate of 3.4% from previous contraction of 1.6% (beleaguered by the Alberta fires). The OPEC meeting in Vienna will also be central focus tomorrow and could charge additional volatility in Crude & CAD crosses – keep an eye on the Real-Time News feed for headlines.

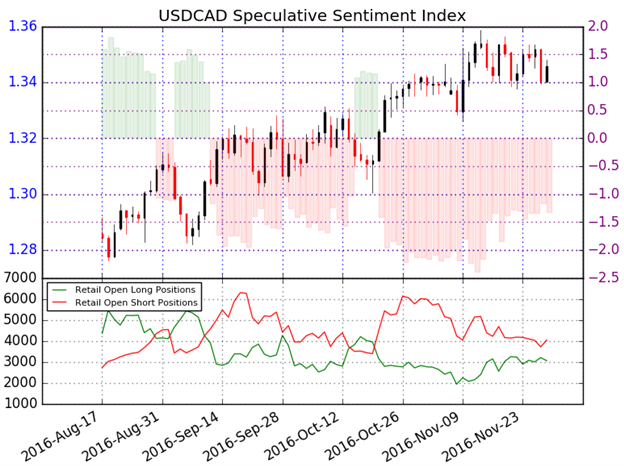

A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net short USD/CAD- the ratio stands at -1.31 (43% of traders are long)- weak bullish reading

Long positions are 4.7% lower than yesterday and 7.9% below levels seen last week

Short positions are 9.6% higher than yesterday but 4.3% below levels seen last week

Open interest remains subdued at 5.9% below its monthly average

The current dynamic of building short-exposure suggests the immediate risk remains higher- That said, it’s worth noting that as SSI continues to come off the recent extreme (-2.45), a move out of negative territory may mimic market conditions during the mid-October decline when traders flipped net long. In that instance, the pair snapped back from a fresh monthly low (where traders turned net-short following the move) before rebounding sharply to new highs.

Relevant Data Releases

Looking for trade ideas? Review DailyFX’s 2016 4Q Projections

Other Setups in Play:

Webinar: USD Rally Looks Tired Ahead of NFPs with Fed Hike Priced In

USD/JPY Resistance- Rally Eyes Durable Goods, FOMC Minutes for Fuel

---Written by Michael Boutros, Currency Strategist with DailyFX

Join Michael for Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

FollowMichael on Twitter @MBForex or contact him at mboutros@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.