86% of American renters can't afford to become homeowners

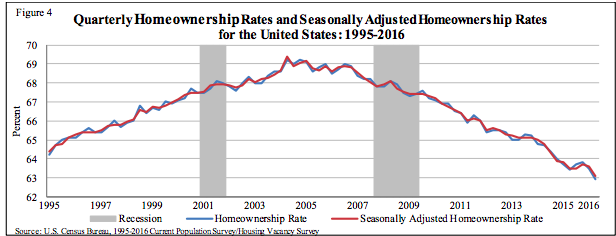

86% of American renters don’t have a sufficient credit score or income to afford to buy a home in their local market, according to a new study by Zillow. The US has seen homeownership rates in a steady decline since the 2007 housing bubble collapse; we’re now approaching a 48-year low. The new numbers from Zillow paint a bleak picture about the future of homeownership in the US.

As Americans flock to rentals, the vacancy rate is approaching a 40-year low. Rents have increased 7% between 2001 and 2014 while household incomes dropped 9% over the same period. Nearly 50% of renters in the US are “cost-burdened” by their rent, meaning they spend more than 30% of their pre-tax income on housing.

According to economists at the Urban Institute, 59% of all households formed between 2010 and 2030 will rent their homes; this will create a surge in rental demand that the current market is unable to meet, potentially creating a rental affordability crisis.

A bump in average income and credit scores wouldn’t necessarily reverse the trend, according to Zillow. Chief Economist Dr. Svenja Gudell says the decrease in homeownership in the United States is largely an income problem, but extends beyond that. “When faced with hurdles of high prices and low inventory, first-time homebuyers are renting longer than ever before even if they are qualified to buy,” says Gudell. “This is a conundrum for many young people who move to those cities because of their strong job markets, only to find tight inventory and steep competition standing between them and their dream home.”