Actively Managed ETFs Quick to Add Lending Club

Lending Club (LC), the California-based peer-to-peer lender that is not even a week old as a public company has already found its way into a pair of actively managed exchange traded funds.

The ARK Web x.0 ETF (ARKW) , which debuted on Sept. 30, and the ARK Innovation Fund (ARKK) are among the first ETF holders of Lending Club. The peer-to-peer lender saw its shares surge 56% in the first day of trading last Thursday.

The ARK Innovation Fund “seeks to invest in the cornerstone companies included in the other three thematic funds that further the fund’s focus on investing in disruptive innovation. Such companies may include ones that benefit from big data, cloud computing, cryptocurrencies, the sharing economy, genomic sequencing, molecular medicine, agricultural biology, 3D printing, energy storage, and autonomous vehicles,” according to New York-based ARK Investments.

ARKK debuted in late October and the ETF’s emphasis on companies with disruptive, game-changing potential makes it a logical destination for Lending Club, the first peer-to-peer lender to go pubic. As of Dec. 11, ARKK’s 46 holdings included an array of beloved game-changers such as Amazon (AMZN), Elon Musk’s Tesla (TSLA), Apple (AAPL) and Alibaba (BABA), according to issuer data.

It is expected that Lending Club will initially be a small part of ARKK’s portfolio. No stock accounts for more than 4.45% of the ETF’s weight. http://www.etftrends.com/2014/10/ark-investment-adds-genomics-innovation-etfs/

Lending Club and rivals such as Prosper have filled a void created by traditional banks’ post-financial crisis reluctance to make small and mid-sized personal loans to borrowers. Borrowers can tap Lending Club for up to $35,000 for loans for debt consolidation, medical expenses and business expenses, among other reasons. Although talk of sub-prime lending has risen in relation to Lending Club, it is rare that the companies lends to borrowers with sub-700 credit scores.

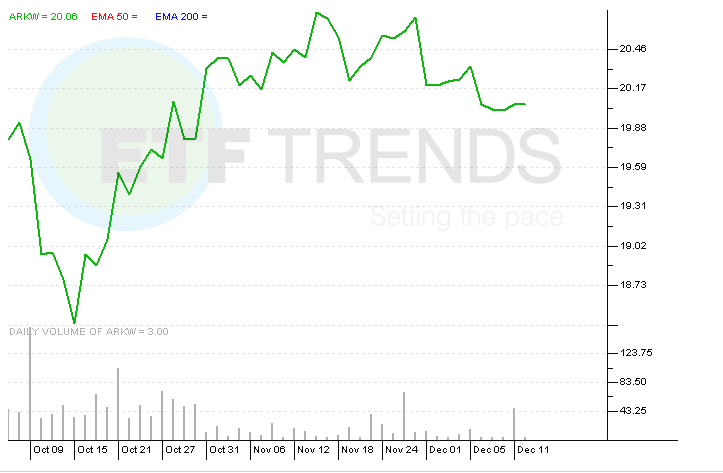

ARKW, the older of the two ARK ETFs highlighted here, also took a small stake in Lending Club. Importantly, ARKW is showing investors there are advantages to active management when it comes to stock picking in the volatile Internet and social media industries.

ARKW is home to many of the Internet and social media stocks investors have come to expect from comparable ETFs. However, because the new fund is not limited by geography or industry classification, it is able to mix in other prominent names with the usual suspects. Although it holds many of the same names found in passively managed ETFs, ARKW has outperformed its passively managed Internet and social media rivals since coming to market. [A New Internet ETF Player]

As of Dec. 11, ARKW’s 37 holdings included Amazon, Alibaba, Facebook (FB) and Netflix (NFLX). No stock accounts for more than 6.05% of the ETF’s weight.

The Renaissance IPO ETF (IPO) is expected to add shares of Lending Club at the close of U.S. markets on Dec. 19.

ARK Web x.O ETF

Tom Lydon’s clients own shares of Apple and Facebook.