This Aerospace ETF Could Take-Off

Despite a challenging domestic political environment, aerospace and defense ETFs have produced stellar year-to-date returns. The iShares U.S. Aerospace & Defense ETF (ITA) and the PowerShares Aerospace & Defense Portfolio (PPA) are up an average of 32.5% this year, easily trouncing the 19.4% upside offered by the S&P 500.

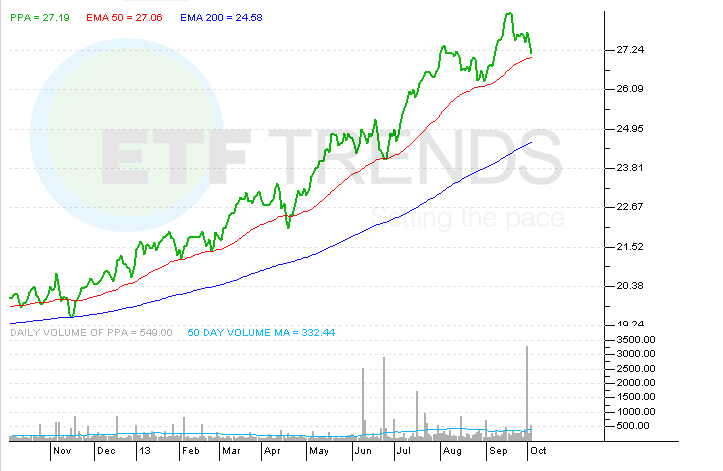

PPA, the smaller of the two aerospace ETFs with $74.3 million in assets under management, could be poised to take off even more. The fund has surged 8.8% in the past three months, more than double the returns offered by the S&P 500 and one technical analyst sees more upside on the way.

PPA has broken out twice over the past few months, according to Deron Wagner of Morpheus Trading Group. “If an ETF is so strong that is manages to continue trending higher, even while the broad market is range-bound, that ETF typically surges much higher when the major indices eventually rally as well,” said Wagner.

“Since breaking out to new highs three weeks ago, $PPA has pulled back to support of its rising 10-week moving average, which has held up all year during every pullback,” added Wagner. He sees solid support for PPA at its 50-day moving average, which hovers around $27.

Wagner’s bullish technical assessment of PPA comes just days after S&P Capital IQ offered up favorable fundamental outlook on industrial ETFs.

““According to Michael Jaffe, Group Head of Industrials equity research for S&P Capital IQ, the primary reasons for his team favoring a number of Industrial stocks at this time are that European economies finally seem to be stabilizing after a lengthy downturn, and that business trends in China seem to be bouncing back following a period of sluggishness. In addition, Jaffe sees recovery of housing markets in the U.S.boosting several areas of the Industrial sector, as materials and equipment are needed for both the building of new homes and the renovation of existing homes,” according to a new research note by S&P Capital IQ. [A Bullish View on Industrial ETFs]

There could be more good news for PPA and rival funds: October, not always the best month of the year for the broader market, is historically kind to industrial stocks.

PowerShares Aerospace & Defense Portfolio

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.