Another Monday, Another Neves Surge for Brazil ETFs

It is déjà vu for Brazilian equities and exchange traded funds Monday as the group is soaring on more election-related news.

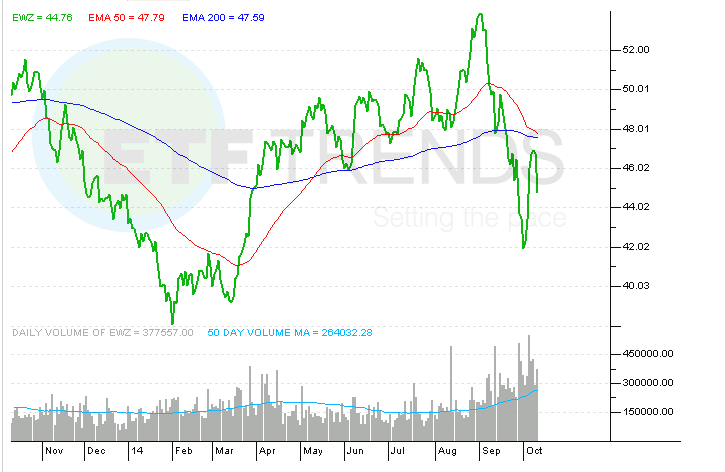

Shares of the iShares MSCI Brazil Capped ETF (EWZ) , the largest Brazil ETF, are higher 6.3% on volume that is already close to the daily average after Marina Silva, the pro-environment candidate that finished third in Brazil’s Oct. 5 first-round election, endorsed Aecio Neves over President Dilma Rousseff.

Last week, Silva’s Socialist Party announced Wednesday announced it will throw its support behind Neves, but the pro-markets Neves was still hoping for a personal endorsement from Silva and the support of Eduardo Campos’ family. Silva replaced Campos atop the Socialist party ticket after the latter died in an August plane crash. [Big Day for Brazil ETFs]

Silva’s support is particularly meaningful for the upstart Neves because four years ago, “Silva chose not to endorse any of the remaining two candidates and took a back seat as Dilma Rousseff went on to win the election, succeeding President Lula,” according to the BBC.

News of Silva’s endorsement of Neves sent shares of Petrobras (PBR), Brazil’s state-controlled oil company, higher by almost 13% on volume that has already eclipsed the daily average. Two Petrobras securities combine for over 12% of EWZ’s weight.

Underscoring the sensitivity of both EWZ and Petrobras to polling data, the stock has rallied on days when news favors Neves because he has promised “to auction exploration licenses more frequently, raise fuel prices and ease made-in-Brazil requirements mirror recommendations from the industry,” report Sabrina Valle and Juan Pablo Spinetto for Bloomberg.

Under Rousseff, shares of Petrobras have languished and the company’s debt burden as swelled as hostile government policies have kept Western oil producers from partnering with Petrobras to tap Brazil’s bountiful oil reserves, which are among the largest for a non-OPEC nation. [Energy ETFs are Voting for Neves]

While a Neves win would appear to be a boon for EWZ and Petrobras, investors cannot forget the inherent volatility in Brazilian data. That volatility was on display last week when after starting the week sharply higher, EWZ and Petrobras closed the week in the red after polling data should Neves and Rousseff in a dead heat. Investors also pulled over $293 million from EWZ last week after pouring $908.5 million into the ETF as it slumped during the third quarter.

iShares MSCI Brazil Capped ETF