AUD/USD Technical Analysis: Down Trend Set to Resume?

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

AUD/USD Technical Strategy: Flat

Aussie Dollar Bounce Stalls at Key Trend Line, Hints at Possible Downturn

Opting to Pass on Short Position Pending Bearish Reversal Confirmation

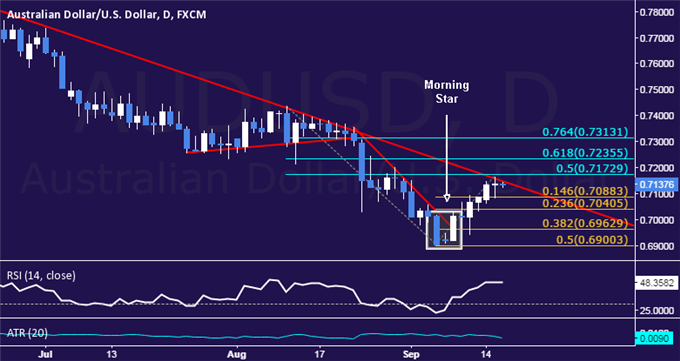

The Australian Dollar moved higher against its US counterpart as expected following the appearance of a bullish Morning Star candlestick pattern. Prices have now stalled at trend line resistance capping gains since mid-May, with a Doji-like candle hinting a rejection downward may be in the cards ahead.

Near-term support is at 0.7088, the 14.6% Fibonacci expansion, with a break below that on a daily closing basis clearing the way for a challenge of the 23.6% level at 0.7041. Alternatively, a push above the 50% Fib retracement at 0.7173 – a barrier reinforced by the aforementioned trend line barrier – opens the door for a test of the 61.8% threshold at 0.7236.

Positioning is inconclusive for now. The candlestick setup points to indecision and may merely represent prices’ acknowledgement of an important technical ahead, marking a pause prior to an upside break rather than on-coming reversal lower. With that in mind, we will remain flat for now and wait for confirmation before pulling the trigger on a short position.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.