AUD/USD Technical Analysis: Waiting to Sell Into Upswing

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

AUD/USD Technical Strategy: Flat

Price Rise as Expected After Forming a Morning Star Candlestick Pattern

Waiting for Corrective Upswing to Yield a New Short Trade Opportunity

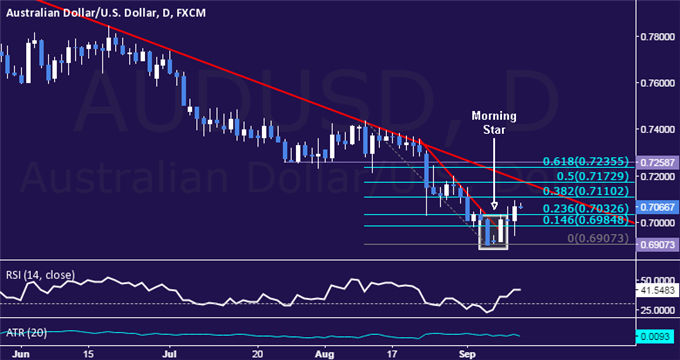

The Australian Dollar advanced against its US namesake as expected after prices produced a bullish Morning Star candlestick pattern. The currency rallied on the back of an unexpectedly strong set of employment figures that helped weigh against RBA interest rate cut speculation.

From here, a daily close above the 38.2% Fibonacci retracement at 0.7110 clears the way for a challenge of 0.7173, the intersection of falling trend line resistance and the 50% level. Alternatively, a turn back below the 23.6% Fib at 0.7033 opens the door for a test of the 14.6% retracement at 0.6985.

Current positioning does not offer an attractive trading opportunity. The available trading range at 77 pips is smaller than 20-day ATR, suggesting prices are wedged too closely between near-term support and resistance to justify taking a trade from a risk/reward perspective. Furthermore, the dominant trend remains conspicuously bearish. With that in mind, we will remain on the sidelines and wait for the upswing to yield a new selling opportunity.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.