Bill Ackman Says Valeant Diversified Pharma Is a Buffett 'Cigar Butt' in Conference Call

- By Holly LaFon

Pershing Square head Bill Ackman (Trades, Portfolio) updated investors on his outlook for Valeant Pharmaceuticals (VRX), a holding that suffered a catastrophic drop last year, on a third-quarter conference call Thursday, covering the difference in its three businesses and what it needs to do to move forward.

Warning! GuruFocus has detected 2 Warning Sign with VRX. Click here to check it out.

The intrinsic value of VRX

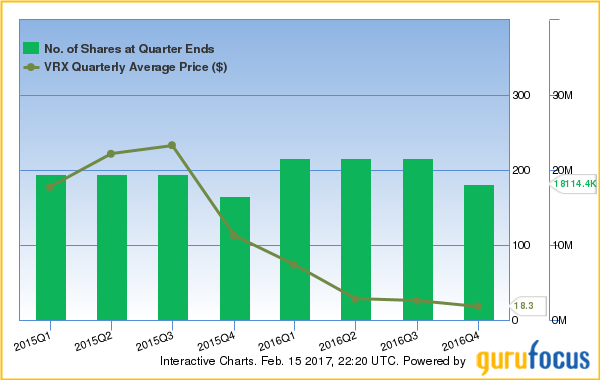

Ackman owns 6.2% of Valeant and has lost an estimated 82% on the holding. The stock's year-to-date decline of 83% extends its drop from July 2015 highs above $250 to a cumulative 93% at Thursday afternoon's trading price around $17. After increased government scrutiny, accounting infractions and other questionable practices led to its stock collapse and departure of its CEO, Ackman has actively been working to turn the company around.

In the conference call, Ackman said people should not look at the company as a "combined business" but use a sum-of-the parts analysis of its three different segments: branded generics, specialty pharmaceutical, and diversified and other. The third, diversified and other, he likened to a Buffett "cigar butt" business, in which a dying company has a small amount of value left that may provide some final meager returns before lying to rest.

That business buys drugs several years before they go generic and squeezes profit out of them by marking up prices before revenues plunge. Buffett, chairman of Berkshire Hathaway (BRK-A)(BRK-B), has said he no longer uses the strategy and seeks only "high-quality" companies.

Diversified and other is the segment, Ackman said, that "caused it the most trouble" when its raising of prices life-saving drugs by hundreds of dollars drew political and regulatory attention. Ackman predicted that diversified and other would diminish next year to 10% of Valeant's revenues from its current 19% as "higher quality" businesses become a "disproportionate" part of the company.

Branded generics, Ackman said, has durable growth and is a strong business that as an independent company would be valued at 14-15x EBITDA. Specialty pharmaceuticals, another "high quality" segment, would trade for 9-10x EBITDA.

"I don't think the world will look at [Valeant] as a sum-of-the parts valuation until it addresses its balance sheet," Ackman said.

The drug company ended the September quarter with $30.39 billion in debt, up from $30.27 billion at the end of 2015. Its cash holdings stood at $658.5 million, up from $597.3 million for the same periods.

Ackman said Valeant if Valeant sold non-core assets it could pay off its debt, have cash on its balance sheet and own a mix of businesses of higher quality. Valeant could benefit from the active M&A market in pharmaceuticals, where he thinks it would have multiple buyers for each of its assets but whether it could achieve fair value for the assets is not guaranteed. Valeant has already interest in assets it did not have scheduled for sale, such as Salix.

"The most important thing is not short-term operating performance but deleveraging," he said.

Valeant posted an 11% year-over-year decline in revenue to $2.48 billion in the third quarter, primarily impacted by lower product sales revenues, foreign currency exchange and divestitures, offset by revenues from last year's acquisitions. Its net loss was $1.22 billion, or $3.49 per share, compared to net income of $49.5 million, or 14 cents. A goodwill impairment charge of $1.05 billion due to changes in its segment financial reporting also adversely affected earnings.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with VRX. Click here to check it out.

The intrinsic value of VRX