If You Like Buying Caterpillar Near an All-Time High, Then You'll Love These Two Dividend Stocks With More Room to Run

While the market seems to be led by growth stocks, a look at sector performance tells a different story.

There are 11 sectors in the S&P 500, but only four are outperforming the benchmark year to date. One of them is the industrial sector, up more than 10% so far this year.

Industrial behemoths like Caterpillar (NYSE: CAT) have contributed to the sector's gains, but so has Illinois Tool Works (NYSE: ITW).

If you're looking for a beaten-down stock, American Water Works (NYSE: AWK) may be a good option.

Here's why all three dividend stocks are worth buying now.

Investors expect Caterpillar's earnings growth to maintain momentum this year

Lee Samaha (Caterpillar): The construction, mining, transportation, energy, and infrastructure equipment company had an outstanding 2023, reporting record sales, adjusted operating profit, and profit per share. In addition, its free cash flow of $10 billion came in at the high end of management's (upwardly revised) target range of $5 billion to $10 billion.

The question now is whether the earnings momentum can continue in 2024. Opinions are divided on the matter, but at least one Wall Street analyst thinks consensus estimates are too low for Caterpillar. If the analyst is correct, and a combination of infrastructure spending and investment related to the clean energy transition kicks in, the stock will likely go higher.

In addition, a lower-interest-rate environment later in the year could boost construction spending and raise commodity prices. The former would benefit Caterpillar's construction equipment sales, and the latter could encourage miners to spend more on Caterpillar's mining machinery equipment.

These considerations highlight the cyclical nature of Caterpillar's sales. It's not unusual for cyclical stocks to rapidly overshoot expectations in an upcycle and undershoot when the downcycle occurs. That much is understood; the tricky bit is predicting when the cycle will turn.

If you think rates are heading lower, commodity prices higher, and infrastructure spending -- stimulated by the $1 trillion Infrastructure Investment and Jobs Act -- will kick in, then Caterpillar's stock may well have upside this year, even if Wall Street is pricing in flat earnings growth for 2024.

A well-deserved all-time high

Daniel Foelber (Illinois Tool Works): Illinois Tool Works, commonly known as ITW, reached a new all-time high on March 21 for a very simple reason -- the story is working.

Plastered on the company's investor relations home page are clearly stated 2030 goals -- namely a 30% operating margin. The company continues to make progress toward that target. And the market is loving it.

ITW is guiding for a 25.5% to 26.5% operating margin in 2024, along with a 5% increase in generally accepted accounting principles (GAAP) earnings per share (EPS) at the midpoint of the forecast. If ITW achieves those goals, it would mark an all-time high annual operating margin and EPS.

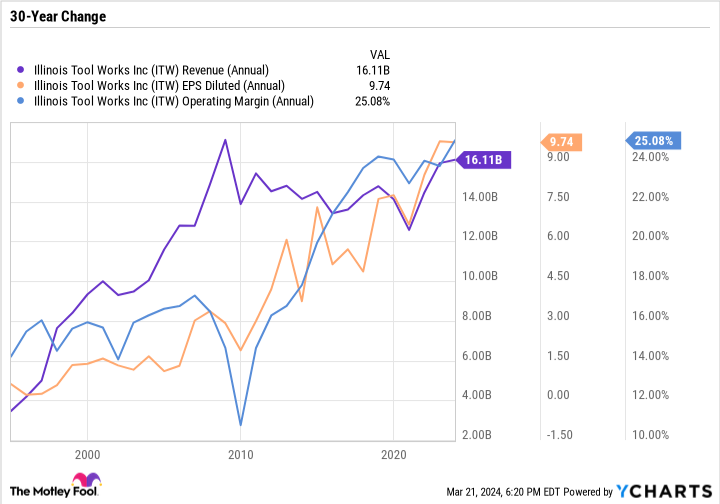

The easiest way to understand where ITW is headed is to see where it has been. As you can see in the following chart, ITW has completely transformed its business from a low-margin sales focus to a high-margin profit focus.

Sales are down over the last 15 years, but profits have soared. Shareholders have been very happy with the shift.

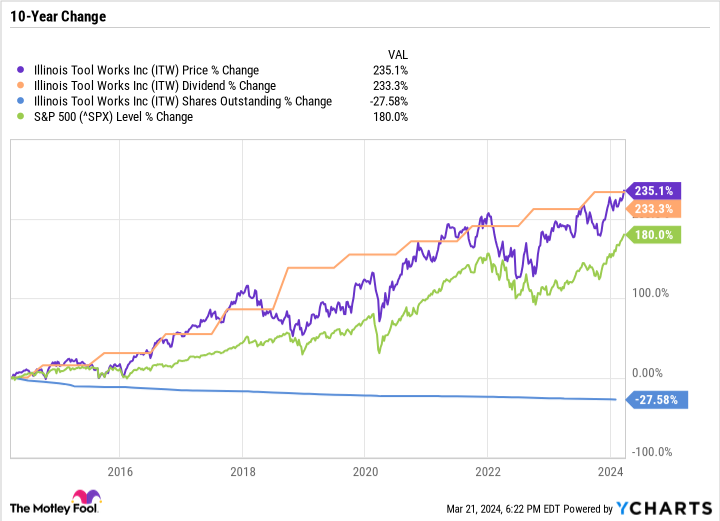

ITW stock has increased by 235% over the last decade, and its dividend has grown at nearly the same pace. ITW beat the S&P 500 over that time frame, and reduced its share count by over a quarter thanks to buybacks.

Given that tech-oriented growth stocks have contributed a good chunk of the S&P 500's gains in recent years, it's impressive for an industrial conglomerate to achieve outsized returns.

ITW isn't a cheap stock by any means, trading at a 27.8 price-to-earnings ratio compared to 28.5 for the S&P 500. But ITW is a Dividend King with over 50 consecutive years of dividend raises. Quality often deserves a premium valuation.

ITW has a straightforward investment thesis. It will grow moderately while boosting efficiency with higher margins. And it will return a boatload of cash to shareholders through buybacks and dividends.

If you're interested in buying Caterpillar stock at an all-time high, then ITW is definitely worth a closer look as well.

American Water Works continues to grow through acquisition

Scott Levine (American Water Works): Shares of American Water Works, a leading water utility, have ebbed recently, but that's not to say that the tide won't flow back in. Over the long term, American Water Works has proven to be a winner for shareholders, outperforming the market. While the S&P 500 has provided a total return of 416% over the past 20 years, American Water Works has provided a 744% total return. For patient investors looking to mitigate risk, picking up shares of American Water Works -- with their forward dividend yield of 2.4% -- is a great move.

Providing water and wastewater services to more than 14 million people, American Water Works is the largest regulated water utility available to investors based on market capitalization. While the company may be a boring business, it will entice conservative investors looking for investments that won't jeopardize their personal finances. Because its business is largely in regulated markets (averaging about 88% of operating revenue over the past three years), American Water Works has good foresight into future cash flows with guaranteed rates of returns.

Proof of this deft capital management comes in the form of its investment-grade balance sheet, which is rated by Moody's and S&P Global. This provides some reassurance that the company will meet management's target of raising the dividend at a 7% to 9% annual growth rate for the foreseeable future.

One of the company's proven methods for growth is acquisitions (it closed 23 acquisitions in 2023), and it seems that the company will continue pursuing this route in the near future. Currently, American Water Works has agreements related to 25 future acquisitions valued at $589 million. This has the potential to add more than 88,000 customers, and management claims it has visibility toward adding another 1.3 million customer connections in the future. For conservative investors, American Water Works looks like now's the time to dive right in with an investment.

Should you invest $1,000 in Caterpillar right now?

Before you buy stock in Caterpillar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Caterpillar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Moody's and S&P Global. The Motley Fool has a disclosure policy.

If You Like Buying Caterpillar Near an All-Time High, Then You'll Love These Two Dividend Stocks With More Room to Run was originally published by The Motley Fool