Chase's Sapphire Reserve is very worth it, even with the slashed bonus

Chase’s Sapphire Reserve (JPM) made enormous waves in the credit card landscape when it debuted last year carrying 100,000 points as a sign-up bonus. By enticing so many with over $1,000 worth of miles, it marked a sea change for many people in terms of what they were willing to pay for a credit card.

And when the company announced it was cutting that generous sign-up bonus in half last month, its many fans tried to figure out how they could still take advantage of the benefit and if the card was now as worth applying for, considering the steep $450 annual fee.

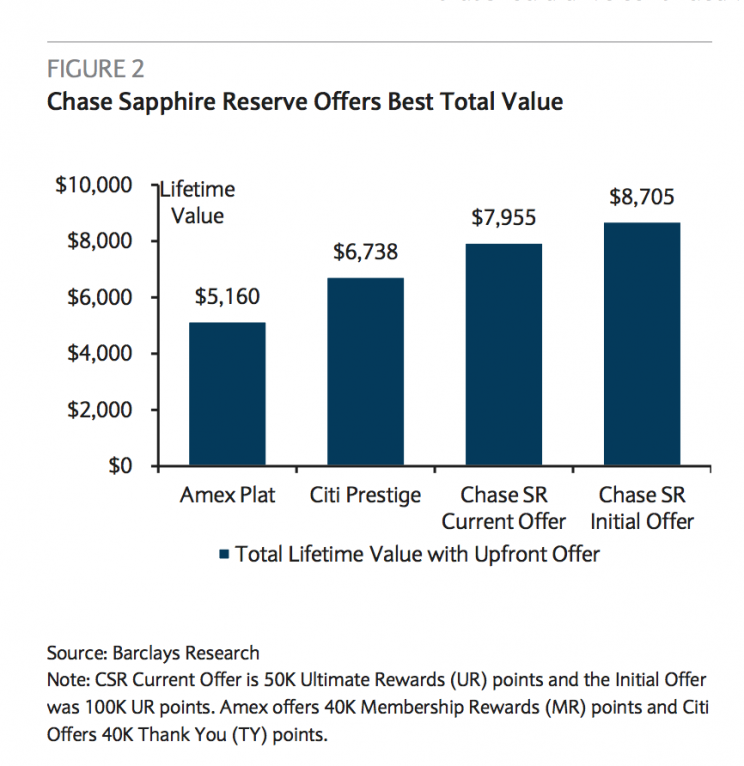

New research from Barclay’s shows that the card still pays back a whopping amount—that is if you don’t let it and the race for points change your spending behavior. According to the analysis, the card is “well above the competition” in terms of how it rewards dollars spent.

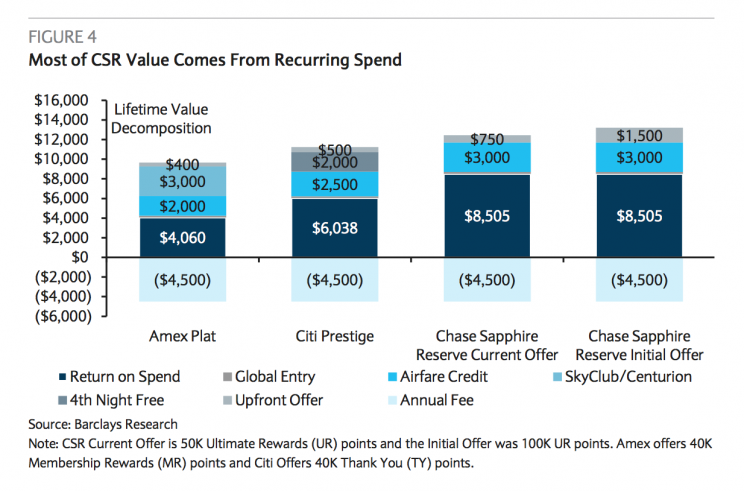

It’s easy to focus on the sign-up bonus, but for long-term users, the bonus is less important than it might seem. When factoring in the average household spending from the Bureau of Labor and Statistics Consumer Expenditure Survey of $2,916 per month, the card comes out well in front of American Express’s Platinum and Citi’s Prestige with a 2.06% return on spend, Barclay’s calculated. For a year of spending $2,916, that equals $721 back—almost $100 more than Citi’s best.

Add the sign-up bonus to the equation and it’s even more compelling. While the initial offer would put you almost $2,000 above Citi’s option—the best of the rest—the current offer of 50,000 signup points still trumps the Citi’s Prestige by more than $1,200.

Perks on top of perks

Though the Sapphire Reserve carries an annual $450 fee, it offers a $300-per-year travel reimbursement, $100 credit for travel prescreening programs like TSA PreCheck and Global Entry (which cost $85 and $100, respectively), as well as 3X points and 50% more in travel redemption through Chase’s marketplace for airline tickets and hotels. If you spend $300 a year on travel and renew PreCheck every four years, this means the card only costs $135 a year, which will be made back in points if you spend enough.

The massive signup bonus, however, was phased out quickly, slashed to 50,000 points, raising the break-even point and making the card much less appealing for churners who might get the Sapphire Reserve’s bonus and dump or downgrade it to a cheaper card after a year. (However, it’s hinted that you could still get the full 100,000-point bonus if you apply in person at a Chase branch until March 12, according to the Points Guy.)

One of the more interesting differences between the Chase Sapphire Reserve and the other cards in its class is how it makes it “worth it.” Barclay’s analysis shows that what distinguishes the card from the competition is the return on spending, not other perks that may be useful to some but less to others—like airport lounge access.

However, this also shines light on the biggest issue in credit cards—you can go up against the house and win, to use a casino analogy, only if you make sure you don’t shift your spending habits (like start buying $200 steaks for you and all your friends) or put you into debt, two things that can cost you much more than any benefits.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, tech, and personal finance. Follow him on Twitter @ewolffmann.

Read more:

Veterans group uses Trump’s well-known habits to target him with an ad

Trump Obamacare replacement may come long after Congress pulls the plug

President Trump’s predecessors learned about tariffs the hard way

51% of all job tasks could be automated by today’s technology