China A-Shares ETFs Wait on MSCI Decision

Bucking global market trends on Tuesday, Chinese mainland stocks and related A-shares exchange traded funds inched higher ahead of MSCI’s indexing decision due in the evening.

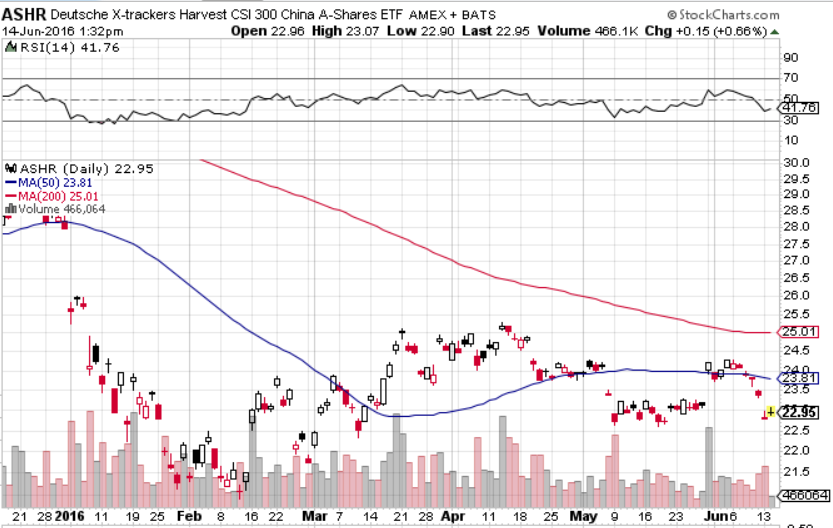

The db X-trackers Harvest CSI 300 China A-Shares Fund (ASHR) , the largest China A-shares-related ETF, rose 0.7% Tuesday. ASHR has declined 18.5% year-to-date.

Chinese markets strengthened on bets that MSCI could add China A-shares to one of its flagship indices, which could bolster A-shares demand among asset managers who track MSCI benchmarks.

Related: China A-Shares ETFs Surge on Renewed MSCI Indexing Optimism

If the MSCI begins including China A-shares in its indices, Chinese shares would make up 1.1% of the indexer’s popular Emerging Markets Index tracked by $1.5 trillion in global funds, the Wall Street Journal Reports.

HSBC projected the inclusion could add an additional $20 billion to $30 billion into Chinese stocks over the next year.

Looking further out, MSCI estimated that Chinese stocks’ index weighting could grow toward 20% in the future if Beijing loosens controls over foreign access.

Trending on ETF Trends

First Trust Debuts RiverFront Emerging Markets ETF

An Affinity for Australia ETFs as Inflows Continue

Popular Emerging Market ETF Holds Off China A-Shares Exposure

High Volume Sell-Off in Nigeria ETF

U.S. Steel Upgrade, Nucor Guidance Lift Materials ETFs

Chinese A-Shares are a specific class of equity securities issued by Chinese companies and denominated in RMB. Under current Chinese regulations, foreign investors may access A-Shares if they are a designated foreign institutional investor or gained access through either the Qualified Foreign Institutional Investor (QFII) or a Renminbi Qualified Foreign Institutional Investor (RQFII) programs.

BlackRock Inc., which offers the iShares ETF suite, is MSCI’s largest customer by revenue and has been preparing for the inclusion of Chinese stocks, according to the Wall Street Journal. In May, the money manager said it had been granted the right ti invest an additional 2 billion yuan, or $320 million, in mainland markets under China’s Renminbi Qualified Foreign Institutional Investor program.

Related: China A-Shares Back on MSCI EM ETF’s Radar

Some other broad China A-shares ETFs include the KraneShares Bosera MSCI China A ETF (KBA) , Market Vectors ChinaAMC A-Share ETF (PEK) and CSOP FTSE China A50 ETF (AFTY) .

For more information on Chinese markets, visit our China category.

db X-trackers Harvest CSI 300 China A-Shares Fund