The US consumer is spending more, but it's only benefiting 2 parts of the economy

It’s a good time to be an American business — especially if that business is related to services or e-commerce, according to a new Macquarie Research report led by analyst David Doyle.

This is because the US consumer has been thriving and has consequently been demanding more services and goods online. Overall retail sales for June rose 0.6% sequentially, and were up 2.7% year over year. This continues a longer-term trend, with retail sales in May also growing year over year. Consumer confidence, as tracked by the University of Michigan, has also been trending upwards, and remains at relatively high levels despite a recent dip.

Moreover, record-low gas prices have also contributed to Americans’ ability to purchase other, more elastic goods.

This bodes very well for the economy, as around 70% of America’s GDP comes from consumer spending. However, the Macquarie Research report found that virtually all of the increase in consumer spending has been occurring in services and e-commerce.

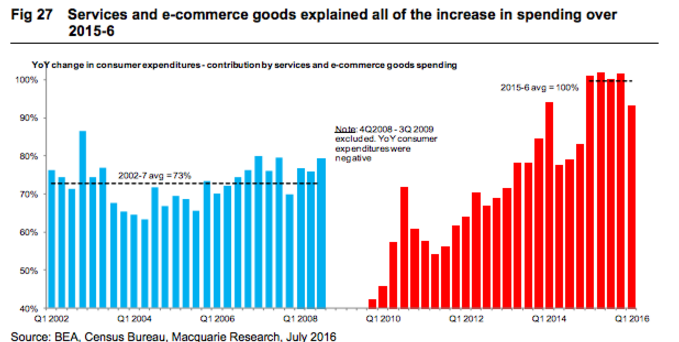

As can be seen from the chart above, 100% of the growth in consumer spending over the past two years was allocated towards services or e-commerce goods. This is a big jump from the earlier part of this century, when 73% of consumer spending growth was going towards e-commerce or services.

Overall, services now represent 68% of America’s GDP while goods represent 32%. Forty years ago, that ratio was more like 50-50. However, it isn’t that we’re buying fewer goods these days; it’s just that outsourcing has made goods a lot cheaper in the US in recent years. On the other hand, services can’t be easily outsourced, which results in the price increasing over time. In fact, the average price of services has increased by 50% since 2000, while goods increased a mere 8%.

Macquarie Research expects this trend to continue, as its tracking shows the price of goods in the past year has actually gone down by 1.8%, while the price of services has increased by 2.2%.

The e-commerce sector will still continue to do well even with the price of goods dropping, since it’s captured so much market share from brick-and-mortar retailers. Those traditional retailers have seen collapsing sales, with department stores like Macy’s (M), Kohl’s (KSS) and Nordstrom (JWN) seeing their stock prices suffer, and their balance sheets loaded up with inventory.

At the same time, e-commerce giant Amazon (AMZN), has seen tremendous growth.

This decline is even apparent from the retail sales reports, which have shown a trend of online retailers growing their sales, while department stores sales fall, year after year.

Clearly, even with the consumer stronger than ever, investors need to be selective. Given the macroeconomic trends, Doyle is positive overall on e-commerce and services, but warns against “clothing & footwear, consumer lenders and transports with more industrial exposure.”

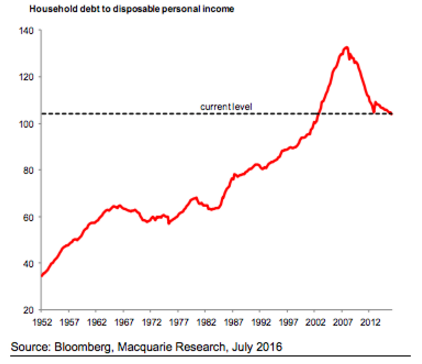

Lest you think that the increased spending is simply coming from consumers loading up on debt, the ratio of household debt to personal income has actually been plummeting over the past several years, as can be seen from the chart below:

Things are going well for the consumer in more ways than one too; borrowing costs are also way down, as interest rates rest at all time lows. Therefore, it is unsurprising that the amount of money consumers spend on interest payments has fallen to historic lows.

There’s even more potential for continued growth in consumer spending as well, given that income growth has actually exceeded spending growth over the past two years. All of this bodes well for the overall economy, even if some sectors may be left behind.

—

Rayhanul Ibrahim is a writer for Yahoo Finance.

Read more:

From biomass to nuclear: The evolution of American energy usage since 1776

How pros are advising clients in this bizarre world of negative rates

As the stock market hits new highs, Wall Street is getting more skeptical