Crude oil rises after China’s money injection, increased demand outlook

Main Points

Oil futures are being traded well above double bottom neckline

Chinese central bank announced additional money supply, IEA upgraded demand forecast for oil

Oil poised for short term correction that provides buy-on-dips opportunity

Bullish sentiment is being witnessed in crude oil futures for March delivery after demand optimism and recent credit action by Chinese central bank amid growth concerns about Asia’s largest economy.

At the moment of writing oil is being traded at $94.65 per barrel during Asian session with an immediate support seen around $94.52, 100 Simple Moving Average (SMA) at four hour timeframe. A break and four hour closing below this support shall be targeting 93.84 as shown in the following chart.

It is pertinent that crude oil has recently printed Higher High (HH) which ultimately turned our short and medium term bias into bullish. The commodity is likely to show some correction up to 93.84 before resuming further upside movement. A rebound from 93.84 will result in Higher Low (HL), an additional confirmation about bullish continuity.

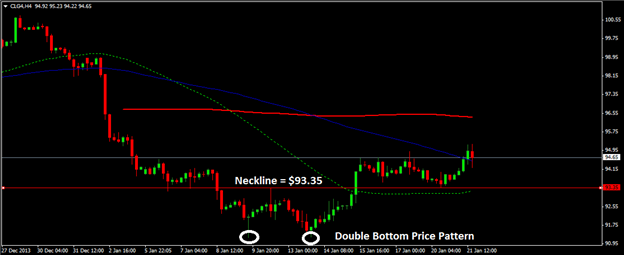

Earlier the black gold had formed a classic double bottom pattern that can be shown in the following chart.

The neckline (the highest point between two lows) is at $93.35 which shall now act as critical support level. The commodity may target $100.74 in coming weeks that will complete this double bottom price pattern.

In light of above mentioned price action signals, buying at 93.85 with a stop at 93.00, just below 55 MA and double bottom neckline, can be a good option. An initial target may be $98.48 and final target $101.00 just as pictured below;

Earlier two important developments reinforced bullish sentiment in crude oil that were China’s credit injection announcement and increased demand forecast for crude oil.

Keeping in view the concerns about China’s slow growth after country’s quarterly growth report remained below expectations; Chinese central bank announced on Tuesday that it would inject additional funds into financial system that in turn reduced fears about credit squeeze.

International Energy Agency (IEA) also increased its forecast for crude oil demand during the course of current year. The agency now sees daily crude oil demand at 92.5 million barrels every day compared to previous estimate of 90,000 barrels daily. Paris based energy agency also noted increased crude oil production in the US last year which was 990,000 barrels daily, significantly higher than previous year.

“The US crude oil supply witnessed one of the highest 12-year gains ever recorded in any country; this has helped in offsetting supply concerns from Iran and Libya,” agency said in its report.

Later this month FOMC policy makers are scheduled to gather in monetary policy meeting in which they may announce more trimming in monthly stimulus, according to median view of many analysts. More tapering in Quantitative Easing (QE) will strengthen the greenback and in turn increase pressure on commodities including crude oil. FOMC agreed on $10 billion tapering of stimulus in December meeting.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.