Daily ETF Roundup: PNQI Pops On Facebook Earnings, XLB Rises On Durable Goods

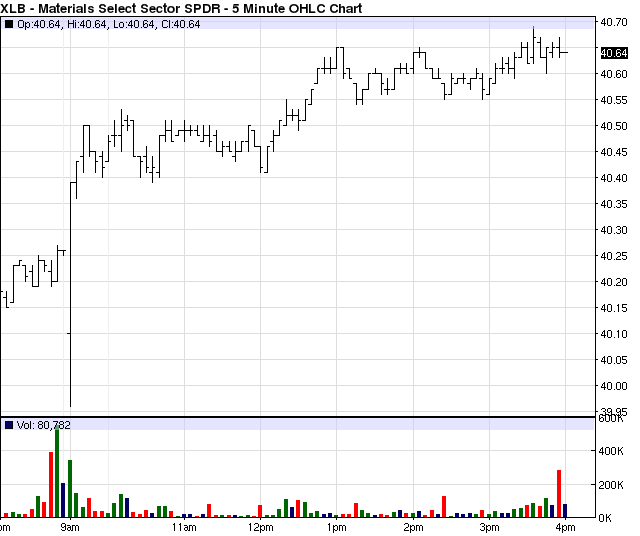

It was another choppy session on Wall Street today as investors digested yet another slew of mixed earnings reports. Conglomerate 3M (MMM) reported earnings that were in line with expectations, though the company posted a decline in sales of materials used in electronics and solar energy. Auto-maker General Motors (GM) beat the Street’s expectations, though profits dropped 24% from a year earlier. Meanwhile, social media giant Facebook (FB) posted stellar results, easily surpassing earnings and revenue estimates. On the economic front, initial claims for jobless benefits rose slightly more than expected to a seasonally adjusted 343,000, while durable-goods orders for June rose 4.2% [see The Cheapest ETF for Every Investment Objective].

Global Market Overview: PNQI Pops On Facebook Earnings, XLB Rises On Durable Goods

Following today’s earnings and economic reports, all three major U.S. equity indexes managed to close in positive territory. The tech-heavy Nasdaq ETF (QQQ, B+) rose 0.67%, as its underlying index logged in its best gain in nearly to weeks. The Dow Jones Industrial Average ETF (DIA, A) inched 0.1% higher, while the S&P 500 ETF (SPY, A) gained 0.24%.

In Europe, markets were broadly lower following lackluster economic and earnings data; the Stoxx Europe 600 shed 0.5%. Meanwhile, Japan’s Nikkei Stock Average fell 1.1% on a stronger yen, and China’s Shanghai Composite fell 0.6% on disappointment over new stimulus policies that include tax cuts for small businesses and accelerated railway construction.

Bond ETF Roundup

U.S. Treasuries rose today after a WSJ report speculated that the possibility of the Fed scaling back its bond buying program at its next meeting is quite unlikely. Yields on 10-year notes fell 1.5 basis points, while 30-year bonds yields rose slightly to 3.649%. Following a government auction, 7-year note yields fell 2.5 basis points [see also Seven Simple & Cheap ETF Model Portfolios].

Commodity Roundup

Crude oil futures traded slightly higher today, settling just above $105 a barrel, following an upbeat U.S. durable-goods orders report. In other energy trading, natural gas futures fell after the EIA reported a 41 billion cubic feet increase in supplies for the week ended July 19. Meanwhile, gold futures rose 0.7% to settle at $1,329.00 a troy ounce.

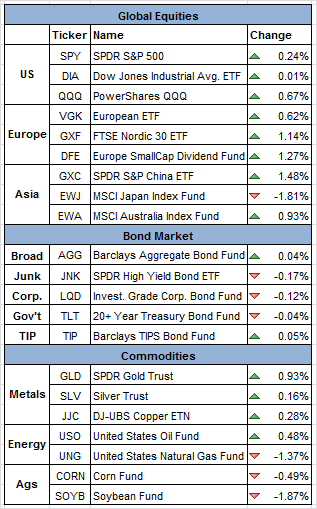

ETF Chart Of The Day #1: (PNQI)

The Nasdaq Internet ETF (PNQI, B) was one of the best performers today, gaining 4.74% during the session. As Facebook (FB) shares rallied following its stellar earnings results, this ETF gapped significantly higher at the open. PNQI inched higher throughout the day, eventually settling at $54.37 a share [see High Tech ETFdb Portfolio].

Click To Enlarge

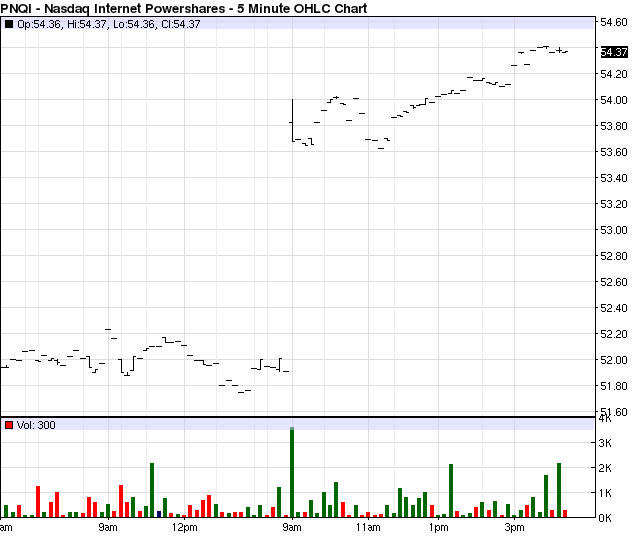

ETF Chart Of The Day #2: (XLB)

The Materials Select Sector SPDR ETF (XLB, A) also posted a strong performance, gaining 0.94% during the session. After durable-goods orders were reported to have risen 4.2% in June, this ETF jumped after initially gapping lower at the open. XLB eventually settled at $40.64 a share [see Commodity Guru ETFdb Portfolio].

Click To Enlarge

ETF Fun Fact Of The Day

The best-performing regional strategy over the trailing 4-week period has been the Africa-Centric Portfolio, which has gained 6.82%.

[For more ETF analysis, make sure to sign up for our free ETF newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: TLT Tumbles On Fed Tapering Fears, XLB Slumps

Daily ETF Roundup: Stocks Close Higher As Earnings Season Kicks Off

Daily ETF Roundup: Stocks End Flat, PEJ Rallies After Starbucks’ Earnings

Daily ETF Roundup: XLE Drops As Crude Retreats, IYW Pops On Apple Earnings