Why America's RV market is booming

The RV market is on a tear — thanks to retiring baby boomers.

And it’s a good signal for health of the American consumer, given the most important factor in determining the demand for recreational vehicles is real per capita net worth, according to a note this week from Wells Fargo senior economist Eugenio J. Alemán.

“As Baby Boomers continue to retire en masse, the demand for RVs is expected to continue to increase, especially if real per capita net worth continues to improve and the prices of homes, which seem to be helping households buy RVs since the end of the Great Recession, continue to appreciate,” Alemán writes.

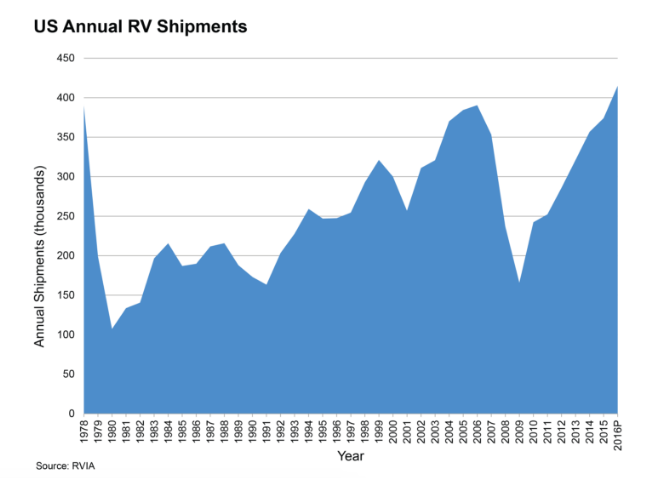

In fact, the demand for RVs is insatiable: RV shipments reached 430,961 total units in 2016, a 15.1% increase over 2015 — and the best annual total in 40 years, according to the Recreational Vehicle Industry Association (RVIA). We haven’t seen these levels since the late 1970s. Currently, there are about 9 million RVs on the road in the US, and an estimated 8% to 9% of all US households now own an RV.

After RV shipments dropped to a 30-year low in the downturn of the late 2000s, demand is stronger than ever, says Pete Reeb, principal at California-based John Burns Real Estate Consulting.

America’s RV boom is a hot opportunity for real estate developers

Real estate developers and homebuilders are even catering to the needs of RV owners. In hot retirement markets across states like Nevada, Arizona and Florida, developers are seizing the opportunity to accommodate the increasingly mainstream audience of RV aficionados.

Take, for example, Valencia Lakes, a community for “active adults” where at least 80% of the community must be over the age of 55. The community, developed by GL homes, has built a 48-space parking lot on its property to cater to RV owners.

Marisa Lufkin, a project manager for Valencia Lakes, said her team revisited its original building masterplan after recognizing a close competitor offered communal storage for boats and RVs. Instead of building two recreational centers, as it had originally planned, GL Homes used the second, smaller space to develop a softball field, a veterans’ circle of honor and an RV parking lot. There are only 48 spaces for roughly 1,631 homes and there’s currently a waiting list to reserve a space, which leases for $65 per month.

Lufkin says members of Valencia Lakes originally hail from all parts of the US and are seeking a mobile lifestyle. “Our residents are choosing to be on the road a couple months out of the year but aren’t sacrificing having a home,” she said.

Meanwhile, Heritage, an adult community in Henderson, Nevada, offers homes that include an RV garage, which is at least 15% bigger than the standard. There is about a $25,000 premium for a home with an RV garage plan. Lufkin says GL Homes is not planning to emulate this strategy but will take into account the insatiable demand for RV accommodations as it builds out future projects.

“RVs are certainly a discretionary purchase. Everybody needs shelter, but very few people need an RV,” Reeb says.

As baby boomers retire in droves…

If few people need RVs, then why are so many people suddenly buying them? One possible explanation for increased appetite in owning an RV is the changing way people are retiring, according to Reeb.

“With the rise of house and apartment rental websites like Airbnb and VRBO, suddenly baby boomers have access to way more vacation properties than you’ve ever had in the past. Instead of buying a second home somewhere and being locked in, you have the option of being mobile,” he says.

With the discretionary income that might have been used to save up for a second home, retirees may be opting for RVs instead.

Though baby boomers are retiring later in life than previous generations, more people are certainly leaving the workforce. With more time for leisure, this is good news for RV industry leaders like Winnebago (WGO), Drew Industries (DW) and Thor Industries (THO); the starting price for most campers is at least $100,000.

“New high-end motor homes can easily cost $100,000, $200,000, $300,000, or more—a sizable investment that you don’t necessarily want to just leave sitting out on the street,” Reeb says.

The demand for RVs is expected to continue to increase as real per capita net worth improves and the prices of homes keeps appreciating.

In response to this demand, homebuilders like Lennar (LEN) and Toll Brothers (TOL) will find innovative ways to offer individual garages or communal lots at a premium.

Melody Hahm is a writer at Yahoo Finance, covering real estate, entrepreneurship, and technology. Follow her on Twitter @melodyhahm.

Read more: