Dollar Volatility Guaranteed on Debt Talks, Risk Waves and NFPs…

Dollar Volatility Guaranteed on Debt Talks, Risk Waves and NFPs…

Fundamental Forecast for US Dollar: Bullish

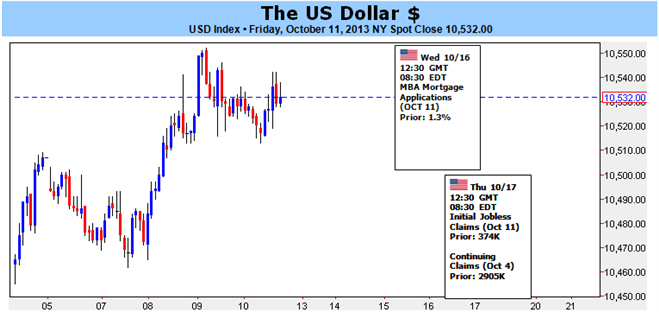

A rebound in equities and the dollar through the end of the week reflects confidence in US debt ceiling accord

For the dollar, a tempered default threat is bullish; but the real impact comes from risk trends and possibly NFPs

Whether a swell in risk rebound from default fear, the greenback can recover: Dollar Currency Basket

The Dow Jones FXCM Dollar (ticker = USDollar) broke a five-week bear trend while the benchmark S&P 500 leveraged a massive 3.5 percent intra-week rally this past week. Both performances were derived from hope that the US debt ceiling standoff would come to an end. The level of conviction in the market-wide adjustment to this optimistic scenario is not unexpected given the economic, financial and political ramifications of the alternative. However, the market impact realized from a confirming these expectations may not be as tidy as a new bull trend for equities, carry and Treasuries. And, there are certainly deep shades of grey for the dollar…

Heading into the weekend, there was a material change in tone from politicians and headlines about the impending debt ceiling breach. With October 17 (Thursday) closing in, it seemed both the US President and House Republicans were softening their respective ‘all-or-nothing’ posturing. The market seemed particularly encouraged by stories that a bill to push back the debt limit another six weeks (taking us out to November 22nd) and restore funding was on the table. That would very likely bring the markets back to another stalemate in a month’s time; but for speculators, it will buy time and reprieve from a critical breakdown now.

Working through the scenarios for these negotiations along with the market’s confidence run through the second half of this past week, there is a distinct short-term and long-term reaction we can expect. Volatility should be expected for the dollar and capital markets through the opening 24 hours of the new week. If there is no deal struck, the swell in optimism in US equities and risk discount in the volatility indexes will necessitate a quick shift in capital to seek out safety and insurance. For the greenback, its bearing will depend on the magnitude of the fear. Expectations that an agreement is imminent will cull panic and thereby the dollar’s safe haven status.

Alternatively, an accord to push back the day of reckoning – a full resolution is unlikely – can project a further relief rally. However, how far that optimism extends remains to be seen. After a 57 point rally for the S&P 500 and the 5 percentage point collapse in the VIX Volatility Index, we are already within reach of the historical extremes of optimism. Add to that doubts about what lies ahead with future fiscal confrontations, tepid growth forecasts and a turning stimulus tide; and there the next bull wave looks even ephemeral than the one that ushered us to this point. It is difficult to envision a full-scale ‘risk appetite’ drive given the circumstances of this situation and the general market conditions, and that may very well work in the dollar’s favor.

After the initial flush of volatility to start the week, conditions will become more complicated. Assuming there is no brinkmanship to an 11th hour crisis (which would cater to the dollar’s safe haven status the closer to October 17 we came); we will see the market struggle to develop clear momentum out of market-wide sentiment. One immediate risk that will be presented in a debt ceiling resolution is the scheduled release of a dense round of event backlogged economic event risk – delayed due to the government shutdown. In the crowd, we have inflation statistics, housing starts, capital flows, trade numbers and the budget statement. Yet, the release with larger ramifications will be the September labor statistics.

One of the handicaps of the monthly NFPs as a market mover is that it is typically released on a Friday. That prevents the market from building a head of steam on risk or rate expectations as speculators avoid holding momentum-based positions over the weekend. That said, if the US government is reopened; the jobs numbers could be released as early as Tuesday. And, there are larger consequences to this data than a simple short-term volatility burst. Recently, Fed officials have spoken about how close their September decision to delay the Taper was. Some have remarked that the fiscal standoff and absence of data could further postpone the inevitable moderation of the stimulus program. However, if the crisis is averted and jobs data end up impressing, it could seriously change expectations – exactly when the market is impressionable and sensitive to changes in the risk backdrop… - JK

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.