ETF Chart of the Day: Treasury Bonds

Last week amid a steep and sudden reversal in equities mid week and a very weak finish on Friday, we observed notable inflows in several fixed income based ETFs.

Specifically shorter and medium term duration bond ETFs caught a bid, and today we focus on two products that focus on medium term duration bonds of maturities between 7 and 10 years.

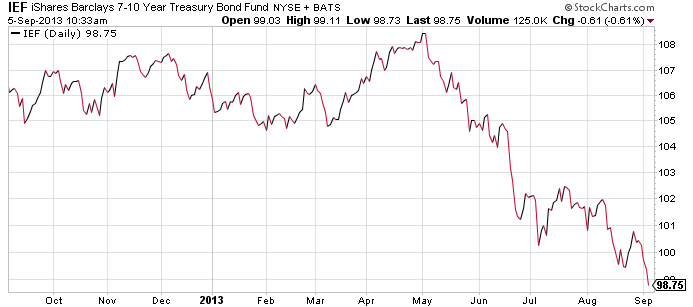

The iShares Barclays 7-10 Year Treasury Bond (IEF - News) rallied last week and closed at a multi-year high on above average volume throughout the week. The fund also reeled in approximately $200 million in new assets via creations.

It was only about a month and a half ago in mid to late March when U.S. Treasuries literally fell off a cliff before finding technical support at their 200 day moving averages, and since then Treasuries have steadily been bid up to current levels.

From recent trough to peak from late March of this year, IEF has rallied an impressive 4.5%.

We find the recent price action especially notable since short interest had been building, especially in longer duration U.S. Treasury bonds such as iShares Barclays 20+ Year Treasury Bond (TLT - News) and via leveraged inverse products such as ProShares UltraShort 20+ Year Treasury Bond (TBT - News) and Direxion Daily 20 Year Plus Treasury Bear 3X (TMV - News), to multi-year heights, only to see the bond bears disappointed by the quick reversal in treasury prices with most trading at new recent highs late last week.

In fact, bearish speculators have continued to surface in recent weeks here and there but continue to be “directionally wrong” in the big picture, as despite a few hiccups along the way, the longer term trend in Treasury Bond prices continues to be “up.”

Another ETF product in the 7-10 year U.S. Treasury bond category also saw significant inflows last week was ProShares Ultra 7-10 Year Treasury Bond (UST - News).

UST tracks the same index as IEF, only the fund is designed to deliver two times the daily return of that index, and is used heavily by short term speculative traders and also aggressive hedgers. UST attracted nearly $500 million last week and ranked among the top five in all ETFs in terms of net creations.

We find the price action last week in Treasuries, coupled with the institutional creation activity to be very notable, especially given the steep and sudden equity meltdown. It is entirely possible that nervous institutions have suddenly bailed from equities and moved into “safer” U.S. Treasury bonds for the near term, and thus are using products such as IEF and UST until the smoke clears in the equity picture.

iShares Barclays 7-10 Year Treasury Bond

For more information on Street One ETF research and ETF trade execution/liquidity services, contact pweisbruch@streetonefinancial.com.