Euro ETF: Concern, Yes — Fear, Not Yet

The longer-term prevailing technical theme for the CurrencyShares Euro Trust ETF (FXE) is still dominated by the large 2008 downtrend channel. However, the near-term picture is getting a bit worrisome as FXE began to flash warning signals during the past several months that concern over the Euro was again setting in.

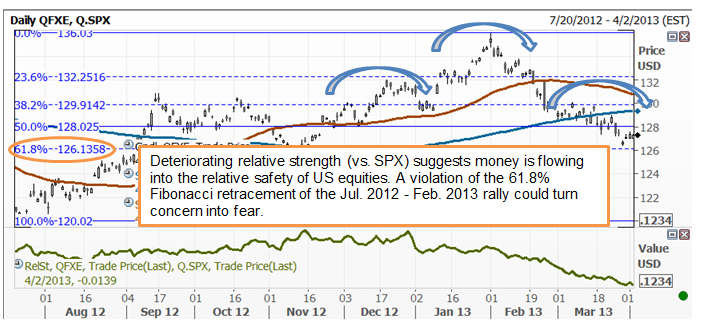

For example – a large negative outside month pattern emerged in February 2013, the July 2013 uptrend line was violated, relative strength (vs. the S&P 500) again resumed its 2009 downtrend, and a head and shoulders top pattern began to form.

The uptrend violation warned of a weakening or changing trend. The deteriorating relative strength suggests that investors are flowing into the relative safety of US equities. The head and shoulders top/negative outside month are classic technical patterns warning that distribution forces are at work. In other words, technical bounces should be eye skeptically.

The key now is going to be for FXE to hold onto support near 126 (give or take) as this corresponds to the November 2012 low as well as the 61.8% Fibonacci retracement of the July 2012 – February 2013 rally. A violation of this support will open the door for a complete retracement, a test of the July 2012 low (119.73) and the 2010 uptrend. However, panic might still be contained with FXE at these levels, but a convincing breakdown here negates a higher low pattern and could trigger stop/loss executions as risk management strategies begin to take the forefront.

This is the area that could signal that global fear has begun to set in over the crisis in Euro.

On the other hand, in order to start stabilizing the selling pressure, FXE likely needs to convincingly take out overhead supply near 130 or the converged 10/30-week moving averages. The ability to clear this resistance allows for a test of secondary resistance at the February 2013 peak (136.03). The top of the downtrend channel currently resides near 140-141 and remains intermediate-term resistance. A breakout here could signal the end to the Euro crisis.

CurrencyShares Euro Trust

J. Beck Investments is an independent provider of technical research for ETFs.