A Fine Year for This Dividend ETF

With 2014 drawing to a close, it is fair to say it was another solid though not spectacular year for dividend exchange traded funds.

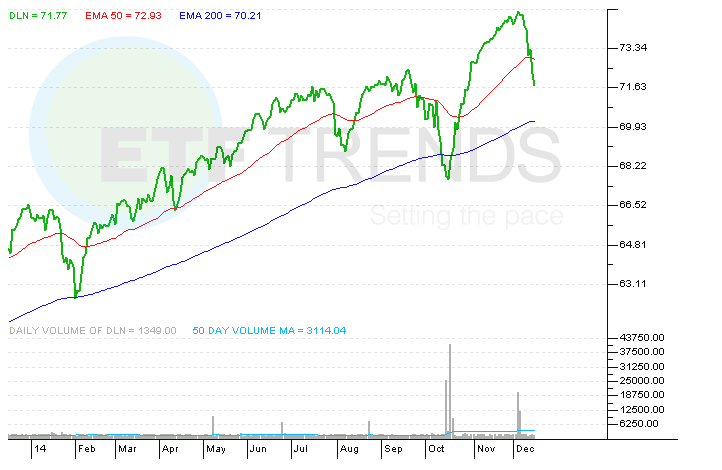

With over combined inflows of over $10 billion, dividend ETFs remain important drivers of asset growth for smart beta ETFs. Aided by robust dividend growth across multiple sectors, several big-name dividend ETFs are poised to outperform the S&P 500 on the year. One of those funds is the $2.3 billion WisdomTree LargeCap Dividend Fund (DLN) , an ETF that makes a habit of outperforming more than just the S&P 500. [A Look at Alternatively-Weighted ETFs]

Indicating that active managers can struggle with dividend stocks the same way they struggle with growth names, DLN has outperformed 91% of large-cap active managers this year, according to WisdomTree.

“For the year-to-date period through October 31, 2014, DLN’s performance against U.S. large-cap active managers was impressive. We believe the primary reason for this is that DLN has more than 99% of its weight in securities greater than $10 billion in market capitalization. Large-cap U.S. stocks have been performing well, and DLN by design does not have exposure to other market capitalization size segments,” said WisdomTree Research Director Jeremy Schwartz in a note out Tuesday. [WisdomTree Dividend ETF Outperforms]

DLN’s underlying index, the WisdomTree LargeCap Dividend Index (WTLDI), “is dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year, based on the most recently declared dividend per share,” according to WisdomTree. Translation: DLN eschews weighting by dividend increase or yield, the latter of which can lead investors toward stocks vulnerable to dividend cuts.

DLN is up about 10% this year, an impressive showing when considering the ETF is light on utilities stocks (just 5.9% of the fund’s weight). That performance puts DLN ahead of all four of the largest U.S. dividend ETFs, including the Vanguard Dividend Appreciation ETF (VIG) . DLN has topped VIG by about 300 basis points this year and nearly 800 basis points over the past three years.

Again, DLN’s out-performance is not new.

“DLN beat almost 99% of active managers in 2011—a much higher percentage than either of its market capitalization-weighted benchmarks. Focusing on dividends during this period led to a less than 10% average weight to Financials, a sector that tended to be much more heavily represented within the market capitalization-weighted benchmarks. Within both of these benchmark Indexes, Financials was one of the worst-performing sectors during this period, so DLN’s under-weight to this sector was helpful to relative returns,” said Schwartz.

As financial services dividends have recovered since the global financial crisis, the sector is now the third-largest in DLN at nearly 14% of the fund’s weight.

The ETF’s dividend growth potential is further buoyed by a nearly 18% weight to the technology sector. That includes Apple (AAPL) as the ETF’s largest holding and Dow components Microsoft (MSFT) and Intel (INTC) among the top 10 holdings.

WisdomTree LargeCap Dividend Fund

Tom Lydon’s clients own shares of Apple.