Forex Analysis: Dollar Waits for Catalyst as S&P 500 Hints at Rebound

THE TAKEAWAY: The US Dollar has pulled back as prices digest last week’s upward breakout. Traders now look to the S&P 500 for direction cues amid signs of a rebound.

US DOLLAR – Prices continue to retest resistance-turned-support at the upper boundary of a falling channel set from the June 1 high (9897) having broken higher after forming a bullish Piercing Line candlestick pattern. A rebound sees initial resistance remains at 9963, the 38.2% Fibonacci retracement, with a push above that exposing the 50% Fib at 10032. Alternatively, a drop below support targets rising trend line support at 9859.

Daily Chart - Created Using FXCM Marketscope 2.0

S&P 500 – Prices are stalling above the psychologically significant 1400 figure, a barrier reinforced by the 38.2% Fibonacci retracement at 1394.30. A Hammer candlestick hints a bounce may be ahead. Initial resistance lines up in the 1424.90-1425.10 area, with a break above that exposing the underside of a rising channel set from early June (now at 1438.40).

Daily Chart - Created Using FXCM Marketscope 2.0

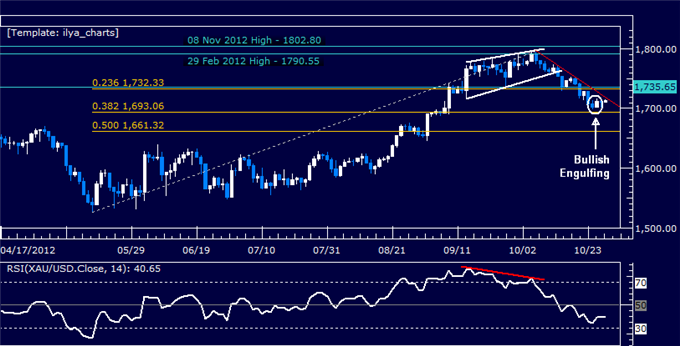

GOLD – Prices put in a Bullish Engulfing candlestick pattern above support at 1693.06, the 38.2% Fibonacci retracement, hinting a bounce may be ahead. Initial resistance lines up at a falling trend line set from the October 5 swing high (1717.66). A break above that exposes the 1732.33-35.65 area, marked by a horizontal pivot level and the 23.6% Fib. Alternatively, a drop below support targets the 50% level at 1661.32.

Daily Chart - Created Using FXCM Marketscope 2.0

Want to learn more about RSI? Watch this Video.

CRUDE OIL – Prices are stalling above the 85.00 figure, a barrier reinforced by the 50%Fibonacci expansion at 83.76. Initial resistance lines up at 87.66, the 38.2% Fib, with a break above that targeting a falling trend line set from late September (now at 91.66). Alternatively, a break below 83.76 targets the 80.00 figure and 61.8% level at 79.84.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.