FX Markets Shift Attention to FOMC as AUD, NZD Lead JPY, USD

Talking Points:

- Appetite for risk in FX returning as Chinese fears abate, Fed eyed on Wednesday.

- EURUSD and GBPUSD treading water near $1.3800 and $1.6200, respectively.

- Monday’s mixed US calendar might not help US Dollar.

To receive this report in your inbox every morning, sign up for Christopher’s distribution list.

INTRADAY PERFORMANCE UPDATE: 09:45 GMT

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.09% (-0.36% prior 5-days)

ASIA/EUROPE FOREX NEWS WRAP

Chinese liquidity fears that gripped global markets in the second half of last week failed to swell over the weekend, and with the Federal Reserve’s Wednesday policy meeting expected to show a continuation of QE3 at $85B/month, investors are happily ditching the safe haven assets in favor of higher yielding currencies and risk-correlated assets.

The US Dollar continues to broadly underperform, though with gains accruing versus the Japanese Yen and the Swiss Franc, it appears that the overall mood of the market is being lifted. While US Dollar selling against the European currencies accelerated over the past few hours (suggesting a more USD-centric focus), the scope of the declines is far less dramatic than what was seen during the US government shutdown.

That being said, with FX pricing in a dovish Fed, a look at bond markets shows that the previously observed “untapering” of the US yield curve hasn’t continued. US Treasury yields are a touch higher on the day, with the 2-year note yield having increased to 0.303% (+0.4-bps) and the 10-year note yield up having increased to 2.520% (+1.1-bps). If the run-up to FOMC on Wednesday was going to be more about USD-selling and less about “risk”-buying, US yields would be continuing their fall.

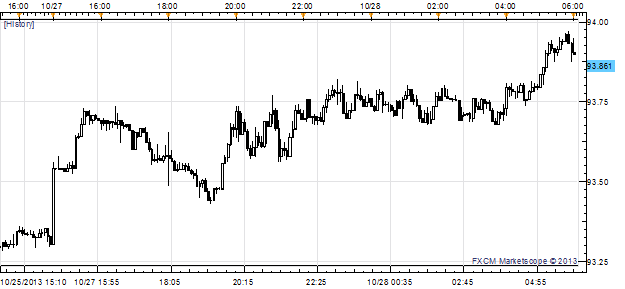

AUDJPY5-minute Chart: October 28, 2013 Intraday

Accordingly, the move in FX markets may be a “catch up” of sorts after the dislocation in the Australian and New Zealand Dollars and the Japanese Yen on Wednesday, with the AUDJPY and NZDJPY as harbingers of risk in FX. Barring a greater leg down in US yields, AUDJPY and NZDJPY would be preferred to AUDUSD and NZDUSD, respectively if risk appetite continues to build going into the Fed meeting.

Read more: Europe’s Relative Calm Boosting Interest in the Euro

ECONOMIC CALENDAR – UPCOMING NORTH AMERICAN SESSION

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators. Want the forecasts to appear right on your charts? Download the DailyFX News App.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.