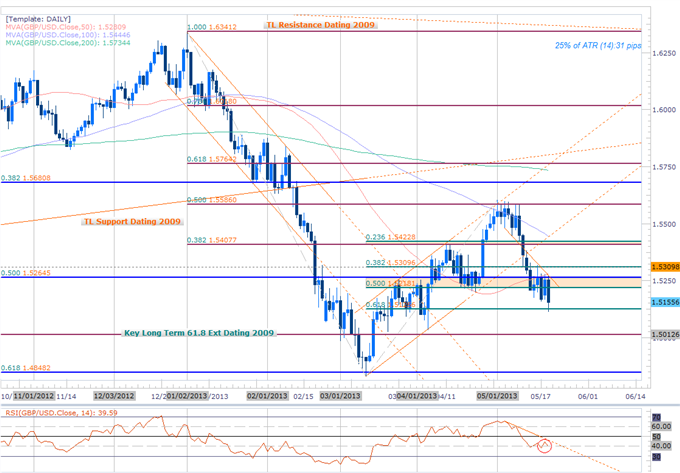

GBPUSD Triggers 1.5127 Target- Cautiously Bearish Below 1.53

GBPUSD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

Third objective at 1.5127 has now been achieved (61.8% retracement of the mid-March rally)

Reaction at 1.5127 mark / Daily RSI hold above 40 – Suggests increased risk of near-term pullback

Broader bias remains bearish below 1.5310 – Breach targets resistance range 1.5407-1.5423

Break below today’s low (on a close basis) offers further conviction on short scalps

Support break eyes objectives 1.5012, 1.4920

Scalps look cautiously higher, medium-term corrections to be sold

Key Events Ahead- BoE minutes tomorrow morning

GBPUSD Scalp Chart

Scalp Notes: Bottom Line: Although our longer-term bias remains weighted to the downside, the pair may continue to correct higher in the near-term, offering nimble long-scalps on breaks of resistance and favorable medium-term short entries higher. Intra-day RSI has remained bearish since Monday evening in New York with a breach above trendline resistance dating back to this week’s high offering further conviction on long entries. The broader outlook remains bearish so long as price respects the 1.5310 resistance barrier.

*We will remain flexible with our bias with a break below 1.5112 eyeing subsequent support targets. It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases. Use this app to distinguish the various trade sessions.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Significance |

Resistance Target 1 | 30min | 1.5186 | 23.6% Fib Retracement |

Resistance Target 2 | 30min / Daily | 1.5218 | 50% Fib Retracement |

Resistance Target 3 | 30min | 1.5260 | Soft Resistance / Pivot |

Bearish Invalidation | 30min / Daily | 1.53 – 1.5310 | 38.2% Fib Retracement(s) |

Break Target 1 | 30min | 1.5335 | Soft Resistance / Pivot |

Break Target 2 | 30min | 1.5359 | 50% Fib Retracement |

Break Target 3 | 30min | 1.5380 | Soft Resistance / Pivot |

Break Target 4 | 30min / Daily | 1.5407 - 1.5423 | 23.6% & 38.2% Retracements |

Bullish Invalidation | 30min / Daily | 1.5112-1.5127 | May Low / 61.8% Retracement |

Break Target 1 | 30min | 1.5080 | Soft Support / Pivot |

Break Target 2 | 30min | 1.5040 | Soft Support / Pivot |

Break Target 3 | 30min / Daily | 1.4996-1.5012 | 618% Fib Extension / 78.6 Retrace |

Break Target 4 | 30min | 1.4920 | 88.6% Fib Retracement |

Daily | 121 | Profit Targets 27-30pips | |

Other Scalp Setups in Play- Scalping the USDCHF Correction- Buying Dips Above 0.9540

For updates on this scalp and more setups follow him on Twitter @MBForex

---Written by Michael Boutros, Currency Strategist with DailyFX

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael Tuesday, Wednesday and Thursday mornings for a Live Scalping Webinar on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Introduction to Scalping Strategies Webinar

Beginner Fibonacci Expo Presentation

New To Forex? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.