High-Yield, Emerging Market Bond ETFs Lead Outflows on Pullback

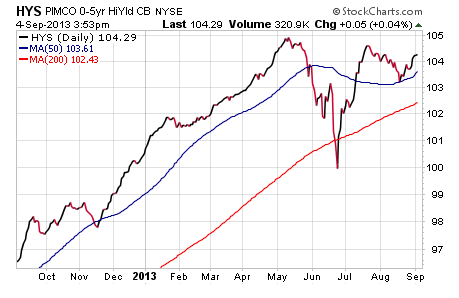

ETFs tracking high-yield corporate bonds and emerging market debt saw the highest outflows last week amid a sell-off. Investors have been chasing these hot-performing sectors in an effort to boost yield in a low-rate environment for bonds, but the recent pullback has some analysts worried about the health of credit markets.

The iShares iBoxx High Yield Corporate Bond (HYG) and SPDR Barclays High Yield Bond (JNK) recorded net outflows of $460.9 million and $347.5 million, respectively, last week. [High-Yield Bond ETF Pullback a Warning Signal for Equity Bulls?]

Meanwhile, investors pulled $418.8 million from iShares JPMorgan USD Emerging Markets Bond (EMB), according to IndexUniverse flow data. [Why Emerging Market Bond ETFs Could Stay Hot in 2013]

These three fixed-income funds experienced the highest selling activity among all ETFs last week. Still, the outflows aren’t significantly large when considering how big these ETFs are, and the massive inflows they’ve attracted over the past year from yield-hungry investors.

Junk bond ETFs have been attractive to investors given the low yields in U.S. Treasuries and money market funds. Also, companies have strengthened their balance sheets after the financial crisis and corporate defaults are very low.

Additionally, emerging market bond ETFs have been popular due to their above-average yields. Emerging economies also have better economic growth combined with lower debt-to-GDP ratios and fiscal deficits, relative to developed markets in Europe and the U.S.

Last week the Dow Jones Industrial Average cleared 14,000 for the first time since 2007. However, Pension Partners chief investment strategist Michael Gayed is warning investors to keep a close eye on junk bond and emerging market debt ETFs for any signs of weakness.

A move lower in junk bonds could be a warning signal of a risk-off period after a rush to risky paper that has tightened credit spreads.

“[I]f credit spreads begin to widen in a sharp and sudden way, a correction in stocks becomes highly likely as a lagged response,” Gayed writes for MarketWatch.

“But it is not just junk debt,” he adds, pointing to the recent pullback in EMB, the emerging market bond ETF.

Gayed points out that credit spreads in emerging market debt are starting to widen. “While perhaps early, the fact that this is happening now is a concern,” he wrote.

iShares JPMorgan USD Emerging Markets Bond

SPDR Barclays High Yield Bond

Full disclosure: Tom Lydon’s clients own JNK, HYG and EMB.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.