The Historical Trend of Altman Z-Scores for 6 Major U.S. Companies

- By James Li

A company's financial strength depends on several factors, including the Piotroski F-score and the Altman Z-score. Even though historical scores cannot accurately predict the expected trend of financial strength scores, the historical trend of scores still provides important information about a company's sustainability throughout the company's life.

Warning! GuruFocus has detected 3 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL

An earlier article discussed the historical trends of Piotroski F-scores for six major companies: Apple Inc. (AAPL), Berkshire Hathaway Inc. Class A (NYSE:BRK.A), Berkshire Hathaway Inc. Class B (NYSE:BRK.B), General Electric Co. (GE), Alphabet Inc. (GOOG), Microsoft Corp. (MSFT) and Exxon Mobil Corp. (XOM). This article will discuss the historical trend of Altman Z-scores for the above companies.

As mentioned in the previous article, the F-score grades the company's sustainability on a scale of 0-9 based on balance sheet data. On the other hand, the Altman Z-score measures the likelihood of bankruptcy. Unlike the Piotroski F-score, the Altman Z-score can potentially range from negative infinity to positive infinity. Additionally, the Altman Z-score does not apply to financial and insurance companies; therefore, Berkshire Hathaway has no data on Altman Z-scores.

Apple

Although it had increasing Piotroski F-scores since 2013, Apple generally had decreasing Altman Z-scores during the past four years. During August 2012, Apple's Z-score eclipsed 10.00, but then sharply decreased near 6.00 by the end of 2012 and close to 4.00 by the end of 2015.

The issuance of long-term debt presents one likely reason for the sharp decline in Apple's Z-scores. While the company only had about $16 billion of debt in 2013, Apple increased their long-term debt to about $29 billion by July 2014. Currently, Apple's long-term debt is almost twice as high as it was July 2014.

Despite the decreasing Altman Z-scores, Apple has a profitability rank of 8 out of 10. The company's operating margin and Greenblatt return on capital currently outperform 98% and 99% of global consumer electronics companies, respectively. As the company presents high upside potential, the T Rowe Price Equity Income Fund (Trades, Portfolio) purchased 720,000 shares of Apple in the second quarter. You can read more about the fund's new buys here.

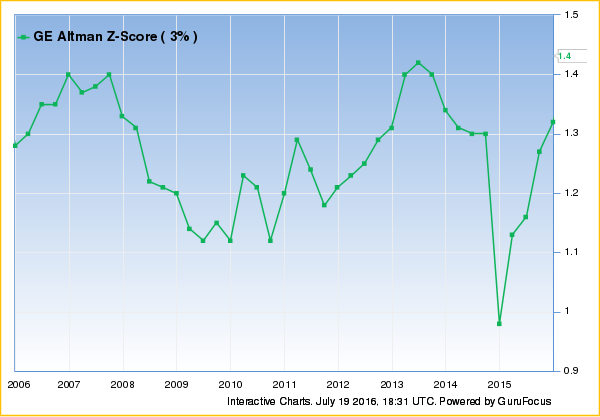

General Electric Co.

General Electric Co. has Altman Z-scores languishing in distressed zones since 2006. However, based on the newly defined distress levels, the diversified industrial company is only mildly distressed. Even though the company has poor financial strength, GE historically had high Piotroski F-scores, implying a strong business operation.

Throughout the 10-year period from 2006-2016, GE's Altman Z-scores initially decreased for three years and then increased near 1.42, its current value. While it sharply tumbled toward the end of 2014, the Z-score climbed back above 1.3 by the end of 2015.

Since 2013, online media company Alphabet Inc. had increasing Altman Z-scores, implying a strengthening business operation and decreasing bankruptcy risk. Even though Google's Z-score declined to a 5-year low of 7.63 around July 2012, Google generally had almost no distress during the past five years.

As mentioned in the previous article, Google has a financial strength of 9, which implies a strong business operation. In addition to having high interest coverage, the online company currently has an equity to asset ratio that outperforms 85% of global Internet content and information companies. Despite decreasing from 2007-2011, Google's equity to asset ratio increased during the past three years.

Microsoft

Although Microsoft had relatively steady Altman Z-scores during the past three years, the company experienced moderately declining Z-scores during the past 10 years. This suggests that Microsoft's business operating is weakening, and if the current trend continues, Microsoft may become distressed in the upcoming years.

The computer software company currently has seven medium warning signs, including: operating loss, decreasing per share revenue and high valuation / dividend payout ratios. Additionally, Microsoft experienced contracting margins, likely due to loss of competitive power to Apple and Google.

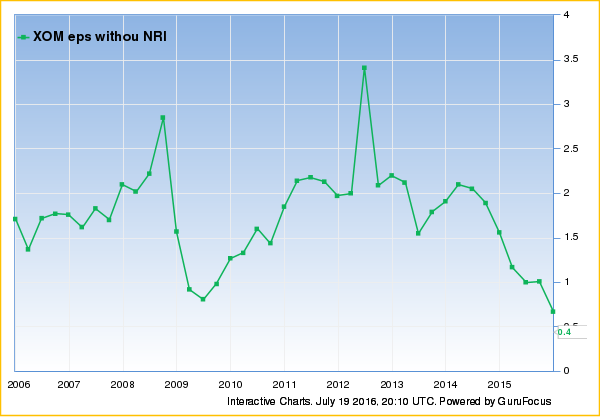

Exxon Mobil

While the company had volatile Piotroski F-scores (as mentioned in the previous article), Exxon Mobil had decreasing Altman Z-scores throughout the past 10 years. Since 2007, when the Z-score peaked just under 7.00, Exxon Mobil seldom had increasing Z-scores. Currently, the integrated oil company has a Z-score of 3.94.

With a profitability rank of 5, the oil and gas - integrated company has slight trouble making a sustainable profit. The company currently has negative 3-year EBITDA and EPS growth, which likely suggests a decrease in net income during the past three years. According to the company's recent 10-K, Exxon Mobil's 2015 net income decreased about one-half from its 2014 net income (Page 44).

Additionally, the company has contracting margins and per share revenue, suggesting that Exxon Mobil has a weakening business operation and is likely to go into distress.

Conclusions and see also

Except for Google, the above companies all had decreasing Altman Z-scores throughout the past few years. While this implies weakening business operations, the companies, except for GE, still have strong Altman Z-scores as they are still in safe zones.

Columnist The Science of Hitting's article further details the history of Altman and his measure of financial strength. Additionally, the All-in-one Guru Screener allows users to generate their personal screeners based on selected criteria.

Disclosure: The author has no position in any of the stocks discussed in the article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL