Investor says advertisers lack 'common sense' if they ignore Snapchat

Snap Inc., Snapchat’s parent company, has filed confidentially for its initial public offering, according to Reuters. The photo-messaging app filed IPO papers with the US Securities and Exchange Commission (SEC) before the US presidential election.

The offering could value the company at $20 billion to $25 billion and take place as early as March, according to Dow Jones. Sources told Bloomberg News the valuation could reach as much as $40 billion. Because its revenue is less than $1 billion it was able to file for its IPO confidentially.

Snapchat has not only been the most frequented app for millennials and Gen Zers, but also for advertisers looking to capture their attention.

Earlier this year, tech entrepreneur Gary Vaynerchuk told Yahoo Finance, “If I’m a company and my target demographic is 21 and under, I would spend every marketing penny on Instagram (FB), Snapchat and Musical.ly right now. It would be a grave mistake to neglect them.”

Vaynerchuk told Yahoo Finance that he was “stunned that people don’t understand” that social media apps are where advertising needs to be focused.

“I’ll even give them a pass on missing out on the opportunities with Facebook,” he says, adding that companies have to “be lacking common sense” not to see the opportunities with Snapchat.

The average person spends 25-30 minutes creating and consuming content on the app every day, according to recent research from Jefferies. ComScore estimates that 76% of Snapchat’s users are less than 34 years old and Snapchat has stated that 41% of 18- 34-year-olds in the US use Snapchat daily (compared to the top 15 US TV networks which only reach 6% of the same demographic), according to the report by Jefferies.

Indeed, marketers have expressed their desire to advertise on Snapchat and take advantage of its large audience of notoriously hard-to-reach millennials. In fact, more than 50% claimed to have interest, according to an RBC Capital Markets’ report from last month.

Snap’s private market value reached $18 billion during its last round of funding in May. This would be the biggest IPO of a social media company since Twitter (TWTR) went public in November 2013.

In addition to the app, Snap Inc. has debuted a limited number of its sunglasses, “Spectacles,” this weekend. The glasses record 10-second video clips that can be uploaded into your Snapchat story and cost $130.

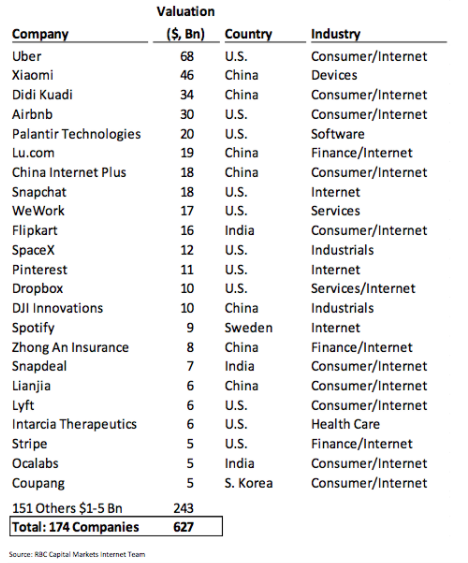

Snapchat is among the growing group of unicorns that have resisted going public. Uber is the world’s highest valued startup; its latest round of funding has it at $66 billion. Chinese companies Xiaomi and Didi are valued at $46 billion and $34 billion, respectively, and Airbnb is currently valued at $30 billion. According to RBC Capital Markets, 174 companies are valued at $5 billion or more.

Melody Hahm is a writer at Yahoo Finance, covering entrepreneurship, technology and real estate. Follow her on Twitter @melodyhahm.

Read more:

A bunch of celebrities are backing an organic grocery service for middle class moms

How the gig economy will fare under President Trump

Pixar’s first finance chief on why he decided to work for Steve Jobs

Silicon Valley giant Max Levchin shares his hopes for a Trump presidency