Japanese Yen and US Dollar Weaker as Chinese Data Bucks Worries

News was light over the weekend, although data out of Asia proved to be materially important for global investor sentiment. Headed into the weekend, there were two concerns for the week ahead: what will the swath of Chinese data bring; and what will happen in Europe this week with respect to the Spanish bailout?

The first answers regarding China began to trickle in the past few days, with Chinese September trade data showing that Exports increased by more than expected while Imports held steady, allowing for a wider surplus despite forecasts for a narrower one. Alongside headline inflation pressures that continue to trend lower, in both the Consumer and Producer Price Indexes for September, the view that China is headed for a ‘hard landing’ is indeed softening. With the third quarter GDP on tap for this Thursday, we expect Chinese-linked currencies (the Australian and New Zealand Dollars and the Japanese Yen) to see a bit more action in the coming days.

In Europe, it appears that there’s a growing consensus for “more time” for Greece, with reports indicating that Greek Prime Minister Antonis Samaras will agree to new austerity measures with international lenders by this week’s Euro-zone Summit, slated for October 18 to 19. Greek bond yields sank today, so perhaps there is some credibility to these reports.

Also out of Europe has been the ceremonial pre-Summit jawboning from various leaders and institutions, but the outlook is surprisingly dull. In fact, taking a look at bank research this morning, expectations for the Summit this week are “quite low to begin with,” says Deutsche Bank, while JPMorgan’s European political analyst Alex White wrote over the weekend that no significant progress should be expected on Greece or Spain. I however take a different view: although expectations are low, there have been some more than curious developments over the past few weeks that suggest something bigger may be going on.

Taking a look at credit, peripheral European bond yields are mixed, holding back further Euro strength. The Italian 2-year note yield has increased to 2.092% (+0.6-bps) while the Spanish 2-year note yield has increased to 3.055% (+5.3-bps). Similarly, the Italian 10-year note yield has decreased to 4.952% (-0.9-bps) while the Spanish 10-year note yield has increased to 5.695% (+11.1-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 10:55 GMT

CAD: +0.22%

EUR:+0.05%

CHF:+0.02%

AUD:-0.03%

GBP:-0.07%

NZD:-0.15%

JPY: -0.42%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.04% (+0.15% past 5-days)

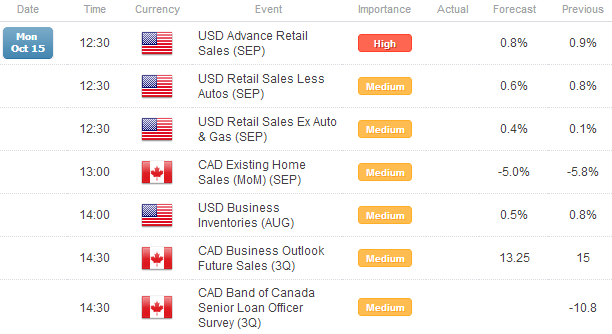

ECONOMIC CALENDAR

There are a few important data releases to start the week, most of which are due within an hour of the US cash equity open. At 08:30 EDT / 12:30 GMT, the USD Advance Retail Sales (SEP) report is due, and should show an uptick in consumption in the United States, coming in line with the recent boost in consumer sentiment. Even the USD Retail Sales Less Autos (SEP) figure should be strong, which bodes well for headline GDP growth (though growth is projected at +2.0% annualized at best given current sales rates). At 09:00 EDT / 13:00 GMT, the CAD Existing Home Sales (SEP) report is due, which should show continued to declines. At 10:00 EDT / 14:00 GMT, the USD Business Inventories (AUG) report will be released, though the tepid figure shouldn’t stoke much volatility.

TECHNICAL OUTLOOK

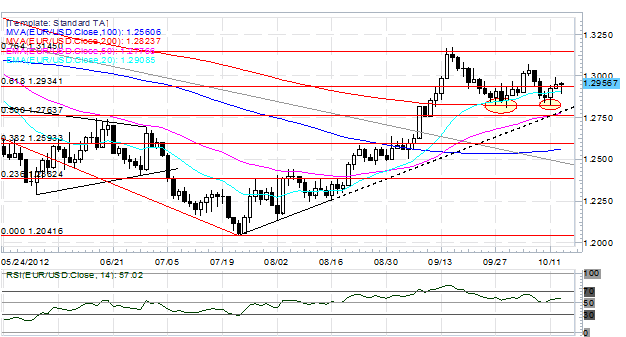

EURUSD: I remain neutral (but biased bullish) on the EURUSD as prices remain within our key levels. Resistance comes in at 1.3000, 1.3070/75 (October high), 1.3145, and 1.3165/75 (September high). Support comes in at 1.2930/35 (61.8% Fibo on February 2012 high to July 2012 low), 1.29005/10 (20-EMA), 1.2820/30 (200-DMA, late-April swing high), and 1.2760/70 (ascending trendline off of July 24 and August 2 lows, 50-EMA).

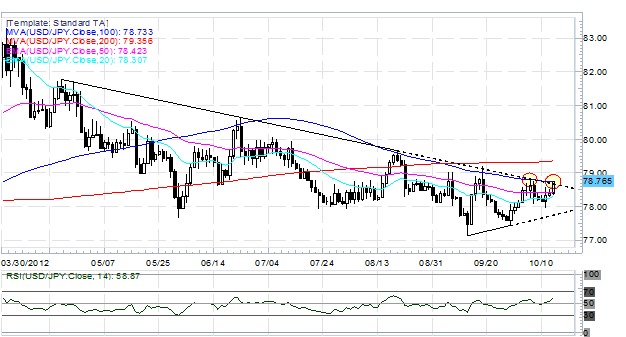

USDJPY: The recent streak of improved US data has the USDJPY back testing key resistance at 78.70/80 (100-DMA, descending trendline off of the April 20 and June 25 highs), a level that has proven too great to overcome on three prior tests in August, September, and early-October. If this level holds today, the downtrend from April remains. A close above said level switches our bias to bullish. Resistance comes in at 78.70/80, 79.20/30, and 79.60/70. Support is78.40/60, 78.10/20, 77.90, and 77.65/70 (June 1 low).

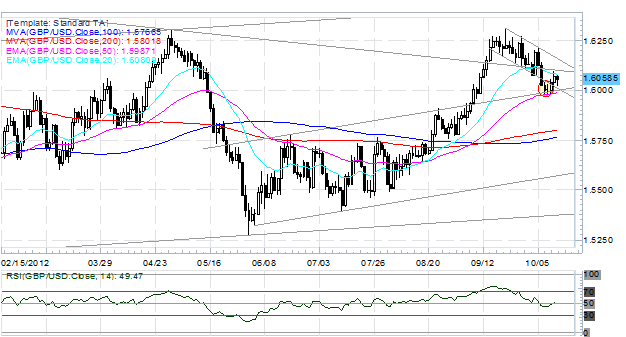

GBPUSD: The GBPUSD has based in the near-term at 1.5975/95 (former channel resistance off of June 20 and August 23 highs, 50-EMA), allowing the pair to continue its modest rebound. However, price remains capped by the 20-EMA (1.6080/85) and the descending trendline off of April 2011 and August 2011 highs (1.6100/20). Until the GBPUSD gets back above this trendline, we remain neutral. Support comes in at 1.5975/95 and 1.5770/85 (late-August swing lows). Resistance comes in at 1.6080, 1.6100, 1.6135, and 1.6260 (the former April swing highs by close).

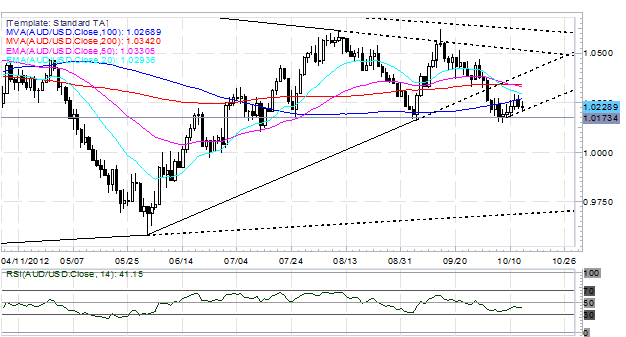

AUDUSD: Last week I wrote: “The short-term bottom is in place but for how long? The 100-DMA at 1.0265 has proven a daunting obstacle the past two-days, with failure to reach the 20-EMA at 1.0300/10 twice. [Thursday], it appeared that the pair had broken free of the congestion between 1.0150 and 1.0270 to the upside, but should we close back below the 100-DMA today, our bias is back to neutral.” As such, we are neutral at this point. Resistance is at 1.0265/70, 1.0330, and 1.0405/25 (mid-August swing lows). Support comes in at 1.0200, 1.0160/75 (mid-July and early-September swing levels), 1.0145/50 (October low), 1.0100/10, and 1.0000.

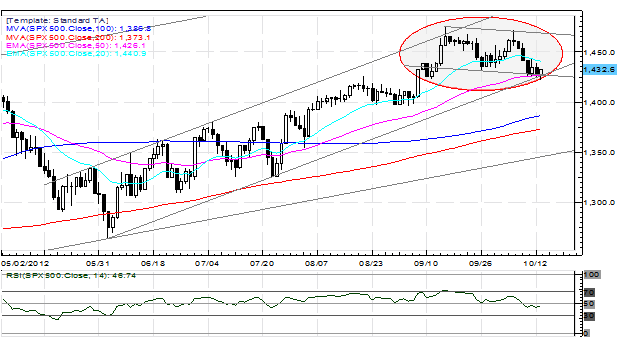

SPX500: No change from last week: “Crucial support at 1420/25 (the 61.8% Fibo retracement on June 2012 low to September 2012 high, ascending trendline off of the June 4 and July 24 lows, 50-EMA) held, and upon further examination, it appears a Bull Flag off of the September 14 and October 5 highs may be forming; a break above 1470 could signal a move to 1500. However, the SPX500 continues to hold below its 20-EMA, and the daily RSI has steadied below 50 – not a bullish development.” A close above the 20-EMA today at 1440 would be very bullish (a sign bulls remain adamant). Support comes in at 1420/25 and 1400. Resistance comes in at 1443/45, 1460, 1470, and 1498/1504.

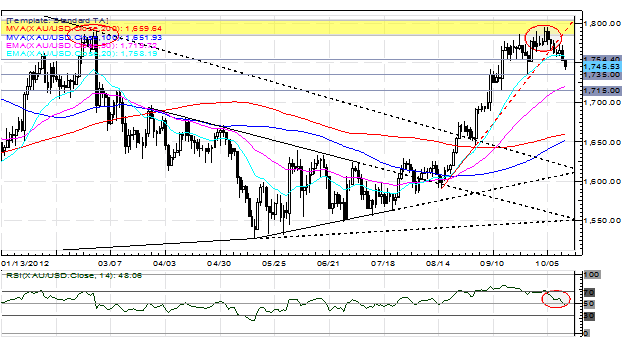

GOLD: Precious metals continue to decline, and Gold has broken down through some key support giving scope to a deeper pullback. The 20-EMA at 1758 has cracked, giving way to losses all the way down to 1735. If risk-off trends accelerate, we look lower towards 1715/20 (former swing levels, 50-EMA). Resistance is 1758 and 1785/1805.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.