This Momentum Play Could Make Traders Almost 30% -- If They Act Now

I love listening to music, but I hate listening to the radio. Outdated formats, a barrage of commercials and lack of programming variety all have me, and millions of other people, turning away from terrestrial radio and tuning in to Internet radio streams for our audio content -- and these days that predominately means Pandora Media (NYSE:P).

The Internet radio giant has been pilfering market share from the estimated $15 billion terrestrial radio market, and the growing audience of listeners like me means Pandora can charge its advertisers more.

In a note to clients early this week, Cowen & Co. analyst John Blackledge upgraded Pandora shares to "outperform" from "market perform" and raised his price target on the stock to $22 from $15. The analyst cited Pandora's ad revenue gains as the main reason, along with the company's ability to manage the 800-pound gorilla in the space, the recently unveiled Apple (AAPL) iTunes Radio service.

Blackledge wrote that he expects Pandora's audio advertising revenue to climb from $293 million in 2014 to $1.8 billion by 2019. This prediction for such massive long-term growth will, according to Blackledge, come as people listen to Pandora's stations longer and as the number of advertisements increases, along with the price the company will be able to charge for that advertising.

Now, as a listener, I am not a fan of Pandora's potential for increasing the number of commercials during its programming. However, as a trader and investor, I am a fan of the potential growth in the company's top and bottom line. I'm also a huge fan of what that means for the price action in the stock, which at current levels looks to me to be a great momentum play.

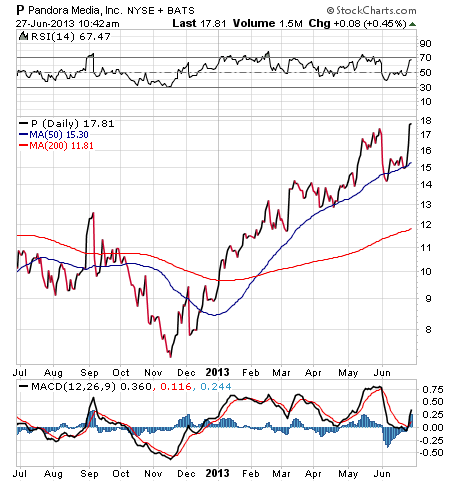

Shares of Pandora spiked more than 8% in Wednesday trade after the Blackledge note, and the gains continued into Thursday. This move comes on top of a huge run higher in Pandora stock of late. Volume has increased dramatically and the stock has surged an incredible 96% year to date.

The one-year chart here of Pandora stock shows the buying that began in earnest in November and has basically continued ever since. Even the late May Fed taper talk that's taken a bite out of the majority of stocks only caused shares to wobble. After a brief stay below the 50-day moving average in early June, the stock is back up near 52-week highs.

So, after such a big run higher since late last year, what's likely to keep driving buyers other than just a momentum play?

According to Blackledge, the growth in smartphone use, and the inclusion and integration of Internet radio services in the new car market, mean huge potential upside for Pandora stock. In his note, Blackledge wrote that he expects total web-radio listening hours to rise to 19% of total U.S. listening hours by fiscal 2019. That's a huge jump from the estimated 10% of listening hours spent in fiscal 2014.

If Blackledge is right about his price target of $22, we are staring at a roughly 23% gain from current levels. And while this price target may seem optimistic to some, I suspect it's actually a little conservative.

Internet radio is for real, not just from a listener's perspective, but also from a trader's perspective. Getting in on the stock now, despite the rise already this year, will likely pay off big in the months ahead.

Recommended Trade Setup:

-- Buy P at the market price

-- Set initial stop-loss at $16.38, approximately 8% below the current price

-- Set initial price target at $23 for a potential 29% gain in six months

Related Articles

Bold Analyst Call Says This Sector is an 'Immediate Buy'

Fallen Blue Chip Could Stage a Double-Digit Rally This Year

Discount Retailer Offering Income Traders a Chance to Make 24% a Year