More to Come for a Dominant Asset-Gathering ETF

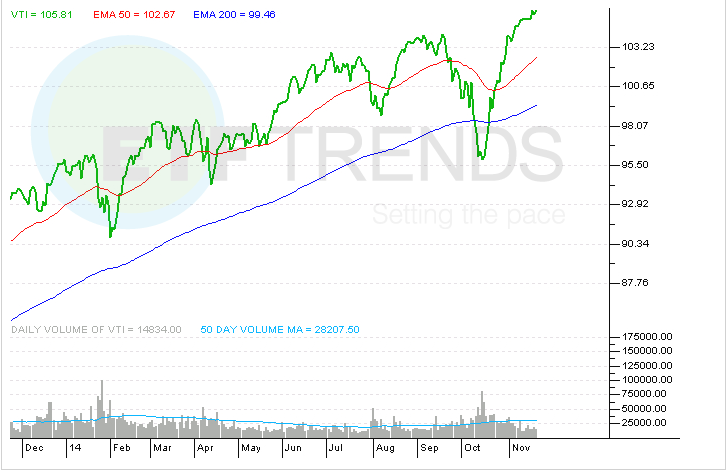

The Vanguard Total Stock Market ETF (VTI) is an investor favorite among broader market exchange traded funds.

Over $6.52 billion in year-to-date inflows says as much, a number surpassed by just two other ETFs – the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO) . VTI is one of five Vanguard ETFs that rank among the top-10 ETFs in asset-gathering proficiency this year. [Behind Vanguard's Asset Gathering Dominance]

The ETF has justified investors’ faith in it, delivering returns that are mostly inline with the S&P 500 with only slightly more volatility. Over the past three years, VTI has outperformed the S&P 500 by 10 basis while being 40 basis points more volatile, but VTI’s run of success may not be over.

Home to nearly 3,800 stocks, VTI offers a deeper bench than S&P 500 funds while giving investors ample access prominent themes, such as the strengthening U.S. economy and the potential continuation of the Federal Reserve’s low interest rate policy.

“One of the biggest trends over the past six years has been towards dividend paying ETFs, as investors have sought the low cost and reliable income stream they provide. VTI has been no exception to this trend, as it costs a fraction of what mutual funds charge and also has an, albeit small, dividend yield to provide some downside protection. With a cheap money policy all but guaranteed to continue in to the new year, the stock market, and VTI along with it, should continue to trend higher in the short-term,” notes McPiro in a post on Seeking Alpha.

VTI has gained legions of devoted fans due in part to its scant 0.05% expense ratio, which makes the ETF less expensive than 95% of comparable funds. [ETFs for College Savings Funds]

As its name suggests, the fund holds pretty much everything in the U.S. markets, with at least a $10 million market-cap, weighted by market capitalization. However, the index may exclude business development companies, American Depository Receipts, royalty trusts and limited partnerships.

“Investing in VTI still gives investors a chance to benefit from the next iPhone or the next investment move by Warren Buffett, while at the same time holding over 3700 more stocks, cushioning the blow should any one company fall on hard times,” according to the Seeking Alpha post.

VTI’s top-10 holdings combine for just 14.9% of the ETF’s weight and no stock accounts for more than 2.9% of the fund. Top-10 holdings six Dow components along with Apple (AAPL), Google (GOOG), Wells Fargo (WFC) and Warren Buffett’s Berkshire Hathaway (BRK-B).

The ETF had a P/E of 20.2, a price-to-book ratio of 2.7 and a return on equity of 18.1% at the end of October, according to Vanguard data.

Vanguard Total Stock Market ETF

Tom Lydon’s clients own shares of Apple and IVV.