Morning Coffee: Widely Held Guru Stocks Historical Low P/S

This morning we are going to take a look at guru held stocks that are trading near historical price-to-sales (P/S) ratios.

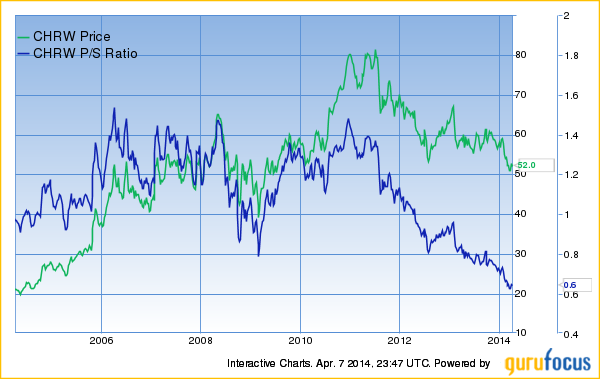

CH Robinson Worldwide (CHRW) is trading at a P/S of 0.60, its 10-year low. The company provides freight transportation services and logistics solutions to companies in various industries worldwide. It is held by 16 we follow.

Market Cap: 7.73B, P/E: 19.70

Business Predictability: 3/5, Financial Strength: 7/10, Profitability & Growth: 6/10

ChinaMobile (CHL) is trading at a low P/S of 2.10, near its 10-year low of 1.88. The company provides mobile telecommunications and related services primarily in China and Hong Kong. It is held by 11 gurus we follow.

Market Cap: 185.25B, P/E: 9.10

Business Predictability: 3.5/5, Financial Strength: 8/10, Profitability & Growth: 8/10

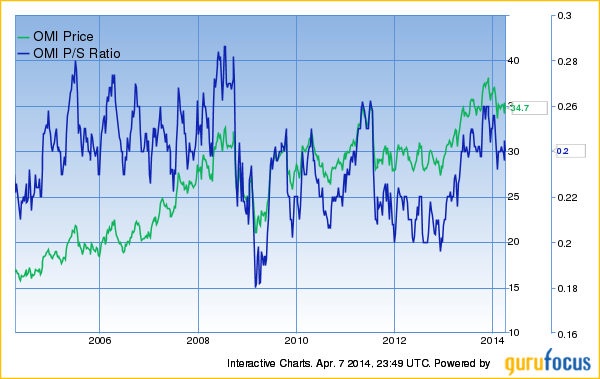

Owens & Minor (OMI) is trading at a low P/S of 0.20, near its 10-year low of 0.18. The company offers supply chain assistance to the providers of healthcare services; and the manufacturers of healthcare products, supplies, and devices. It is held by 10 gurus we follow.

Market Cap: 2.19B, P/E: 19.70

Business Predictability: 3/5, Financial Strength: 5/10, Profitability & Growth: 6/10

PetroChina (PTR) is trading at a low P/S of 0.60, its 10-year low. The company produces and sells oil and gas in China. It operates in four segments: Exploration and Productions, Refining and Chemical, Marketing, and Natural Gas and Pipeline. It is held by nine gurus we follow.

Market Cap: 204.64B, P/E: 11.20

Business Predictability: 3.5/5, Financial Strength: 7/10, Profitability & Growth: 8/10

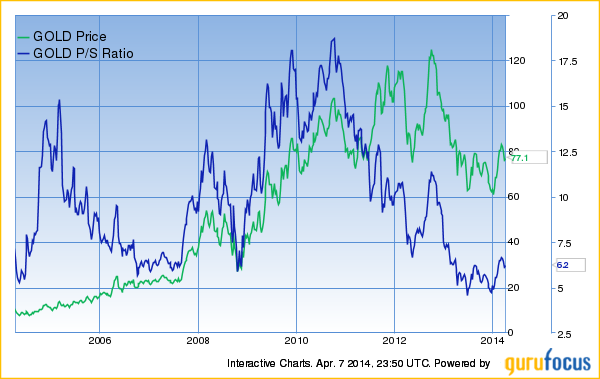

Randgold Resources (GOLD) is trading at a low P/S of 2.70, near its 10-year low of 2.59. The company explores and develops gold deposits in Sub-Saharan Africa. It is held by eight gurus we follow.

Market Cap: 7.12B, P/E: 11.20

Business Predictability: 3.5/5, Financial Strength: 8/10, Profitability & Growth: 8/10

This article first appeared on GuruFocus.