Now that the 'Trump trade' is over, here's what's next for stocks

The “Trump trade,” which defined the market in the weeks following the U.S. election, is over.

So now, stocks will focus on the only thing that really matters over the long term: earnings.

The “earnings recovery is resilient and we remain confident in our policy neutral [earnings per share forecast] of $129 for 2017,” writes JP Morgan equity strategist Dubravko Lakos-Bujas.

“After S&P 500 companies delivered a record-high EPS of $31.28 in 4Q16, we are expecting growth to accelerate further to >10% in 1Q, highest growth rate since 2011. Additionally, company guidance activity has been encouraging YTD, which reflects strengthening global growth, healthy labor market as well as strong business survey data and consumer confidence.”

Accordingly, Lakos-Bujas and his team maintain a “broadly constructive view” on the market.

“Uncertainty around the upcoming French election and lack of clarity on timing of the US tax reform could continue to weigh on the market in the near term,” Lakos-Bujas writes.

Setting the stage for new highs

Lakos-Bujas and his team also see the current environment, despite uncertainty related to international politics and domestic legislation, as posing a “limited risk” of a big pullback for the stock market.

“We see limited risk of a larger pullback and recommend buying the dip(s),” Lakos-Bujas writes.

“The market is likely to remain resilient and supported by the Trump and Fed ‘puts’ as well as the continued improvement in the fundamental backdrop both domestically and abroad. If anything, we see a confluence of conditions potentially coming together in the months ahead and setting the stage for the market to reach new highs.”

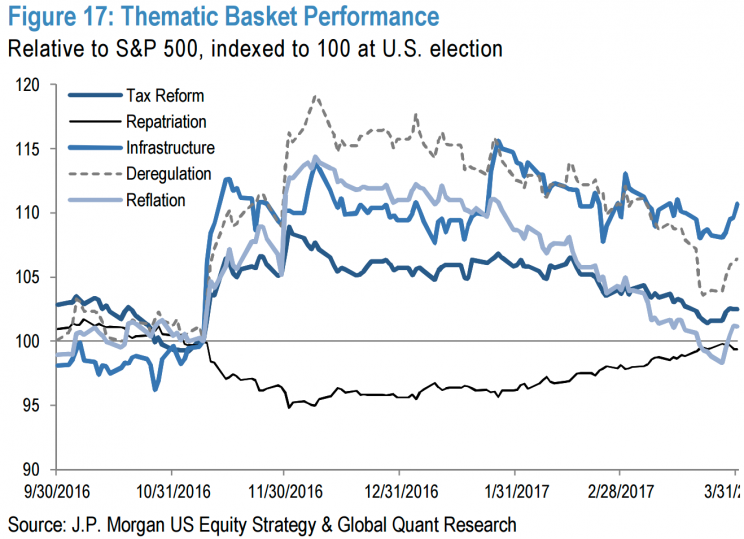

Following Donald Trump’s presidential election win, big bets were made by investors on stocks set to gain — or lose — from economic policies touted by Trump during the campaign. Namely, lower corporate taxes, big infrastructure spending, slashing of regulations (particularly in banking), faster economic growth, and more restrictive trade policies.

But we are now a bit more than two months into the Trump presidency and so far little progress has been made by the administration on any significant piece of legislation related to these goals.

Accordingly, investors have pared their bets, as this chart from JP Morgan shows.

Economic activity rising

But in the background of these deflating “Trump trades,” along with an improvement in earnings and the smallest cut to forward earnings estimates in the last five years, global economic conditions have also improved.

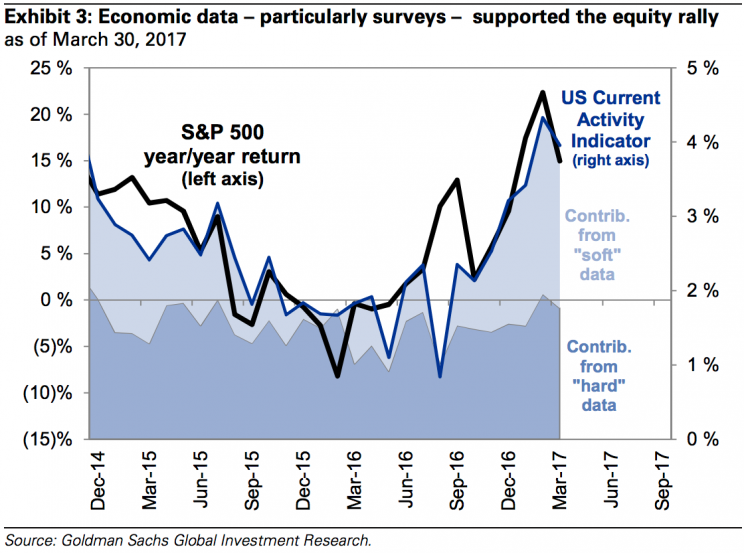

“Despite the political uncertainty, the backdrop of strong economic data has helped drive and sustain the equity market rally,” writes David Kostin, U.S. equity strategist at Goldman Sachs.

“Our economists’ MAP index of data surprises broke into positive territory in mid-November and this week reached the highest level since 2013. The data reflect the pace of real US economic growth rising from 2.1% in October to 4.3% in February. This marked the strongest reading of our Current Activity Indicator since 2006 and alone could explain the rise in equities to record highs.” (Emphasis added.)

Kostin notes — and as the chart highlights — that this bump in economic activity has been driven by so-called “soft data,” or data based more on survey responses than the collection of data from purchases and sales (which is considered “hard data”).

“The contribution of ‘soft’ data to the recent economic surge suggests that the Trump trade and growth trade are not truly independent,” Kostin writes.

“Survey data such as the ISM and regional Fed manufacturing surveys have driven most of the CAI improvement in recent months. In contrast, ‘hard’ data have improved much less and generally continue to reflect the 2%-3% pace of growth they exhibited prior to the election. This divide suggests that rising policy uncertainty may also pose a risk to the economic data.”

Readings like blockbuster consumer and business confidence, for instance, have been criticized as showing merely an intention to either spend or invest more. It is the follow-through from this optimism that creates better overall economic growth.

Strong hard data like a better-than-expected February jobs report, for example, have led some economists to argue that the focus on comparing these two types of economic data is misguided.

“No one is talking about the hard vs. soft data trope today,” Neil Dutta, an economist at Renaissance Macro wrote following the February jobs report.

“The data comes from thousands of firms and worksites throughout the country. Aggregate hours worked are up 3.1% annualized in the last three months.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: