Pinterest prices IPO at $19 per share, above original range

Pinterest, the web-based scrapbook company that became a Silicon Valley darling worth billions, priced its initial public offering at $19 late Wednesday, and will begin trading on the New York Stock Exchange in one of 2019’s hottest stock offerings.

Strong demand for the stock may have helped to bid up the price from its original range of $15-$17. At that price level, the company raised more than $1 billion, Bloomberg reported, implying a valuation of around $10 billion.

Pinterest joins Lyft as one of several so-called “unicorns” — private companies that have raised more than $1 billion in venture capital— to float an IPO. The stampede of these companies to market has some market participants dubbing 2019 “the year of the unicorn.”

That includes software company Zoom, which is also floating an offering that values the company at around $9 billion.

Pinterest’s current list of investors reads like a who’s who of marquee Silicon Valley investors, including names like Bessemer Venture Partners, Andreessen Horowitz, and Valiant Capital Partners.

‘Attractive investment’

Pinterest raised concerns when it revealed in early April that it was pricing its offering at a lower valuation than its latest round of public financing. The company set a price range of between $15 and $17 per share when it filed an amended S-1 form.

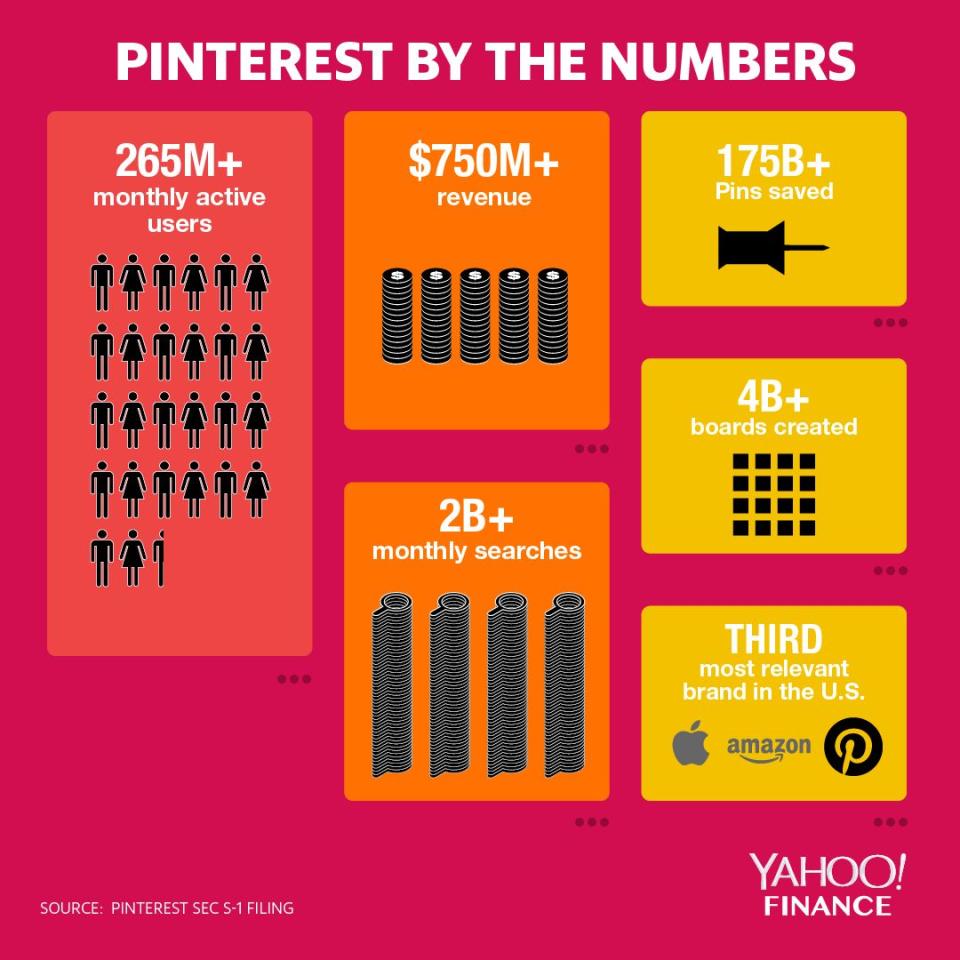

Yet the company’s 265 million-plus average monthly users suggest Pinterest is more than just another Silicon Valley company with big aspirations.

The platform’s users “access Pinterest with the intention of not only discovering ideas or products but also purchasing them immediately or in the future, we think the firm can attract more online ad dollars,” research firm Morningstar said in a recent report.

Calling Pinterest “an attractive investment opportunity,” Morningstar added that Pinterest “can attract various types of ad campaigns through the marketing funnel... We think opportunities exist for the firm to gradually increase its share of the U.S. digital advertising market,” it added.

However exuberant Pinterest’s first day of trading goes, the days that follow could be sobering as investor enthusiasm wears thin—as demonstrated by the case of Lyft. The ride-sharing company saw its stock price soar on the first day, only to collapse immediately into a bear market that dragged its stock well below IPO.

Data from UBS shows that around 60% of IPOs have negative total returns in their first five years.

“There are very few losers on the first day,” the firm said.

“Distinguishing between potential winners and losers at any horizon is difficult, but there are issuer and IPO characteristics that do correlate with performance,” UBS added.

“The take-away from this research: getting IPO allocations is highly rewarding, but after the first day performance depends heavily on which companies you buy,” the firm noted.

Correction: An earlier version of this story incorrectly described Pinterest as profitable. The error has been corrected.

—Yahoo Finance’s JP Mangalindan contributed to this article.