Popular Japan ETF Falls Harder than Rivals as Yen Soars

An immensely popular ETF that invests in Japan was down over 3% in U.S. trading Monday, falling harder than other Japanese ETFs due to its hedged currency strategy as the yen staged a furious rally against the dollar.

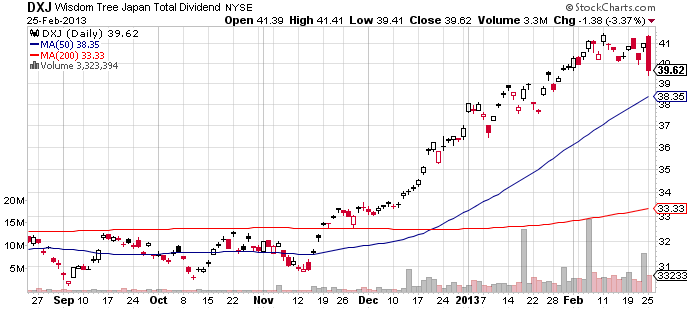

WisdomTree Japan Hedged Equity Fund (DXJ) lost 3.4% heading into the closing bell.

CurrencyShares Japanese Yen Trust (FXY) vaulted 2.3%, a huge move for a currency ETF. FXY saw its heaviest one-day trading volume since February 2012.

DXJ is second on the list of best-selling ETFs so far this year with inflows of $2.6 billion, according to IndexUniverse data. [WisdomTree Japan ETF Creates ‘Windfall’]

The ETF tracks Japanese stocks but hedges its exposure to the yen. It has been a favorite among traders and investors positioning for rising Japanese stocks and a weaker yen following the election of Shinzo Abe as prime minister. Abe is committed to pressuring the Bank of Japan to take further easing measures to weaken the yen. [Japan Currency-Hedged ETF Hauls in Over $2 Billion]

A falling yen has helped DXJ outperform unhedged currency ETFs such as iShares MSCI Japan (EWJ). However, Monday’s rally in the yen caused DXJ to lose over 3% while EWJ fell 1.3%. In other words, a rising yen provides a tailwind for EWJ.

DXJ is “suitable as a satellite holding for those who want to invest in Japanese equities but don’t want exposure to changes in the rate between the Japanese yen and the U.S. dollar,” Morningstar analyst Patricia Oey writes in a report on the ETF. “This fund is an attractive option during periods when the yen is falling against the dollar … with its hedged strategy, this exchange-traded fund’s returns will not be negatively impacted by the falling yen, unlike unhedged peers such as iShares MSCI Japan (EWJ).”

Of course, Monday’s sell-off illustrates that currency hedging is a two-way street.

WisdomTree Japan Hedged Equity Fund

CurrencyShares Japanese Yen Trust

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.