Prem Watsa Eliminates 3 Positions in 1st Quarter

- By James Li

Prem Watsa (Trades, Portfolio), commonly referred to as the Warren Buffett (Trades, Portfolio) of Canada, eliminated his position in three companies, Overstock.com Inc. (OSTK), Baldwin & Lyons Inc. (BWINB) and Team Health Holdings Inc. (TMH), during first-quarter 2017.

Warning! GuruFocus has detected 3 Warning Signs with OSTK. Click here to check it out.

The intrinsic value of OSTK

Overstock.com

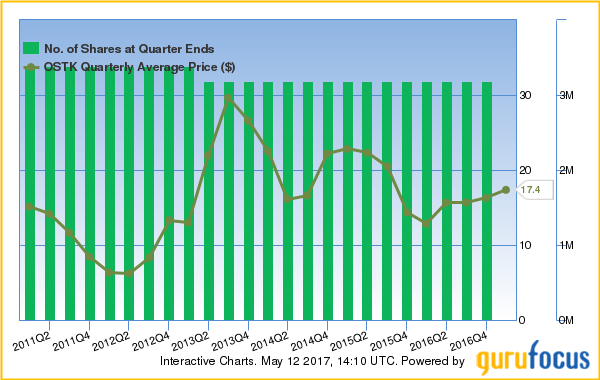

Watsa sold his 3,184,677-share stake in Overstock.com for an average price of $17.36 per share. The guru trimmed 4.77% of his portfolio with this transaction.

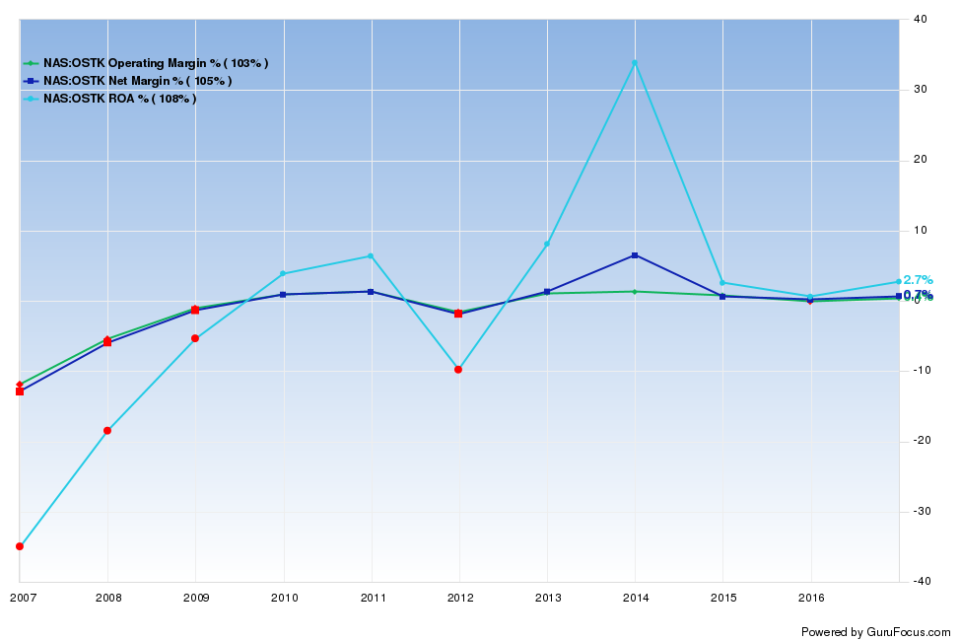

While the company's profitability ranks a 6 out of 10, online retailer Overstock.com has weak margins and returns. The company reported a net loss of $5.9 million (about a 23-cent loss per diluted share) for the quarter ending March 31. The pretax loss of $6.6 million included a $8 million charge to the company's Medici business.

Baldwin & Lyons

The Fairfax CEO sold 377,524 shares of Baldwin & Lyons for an average price of $24.04. With this transaction, Watsa pared 0.81% of his portfolio.

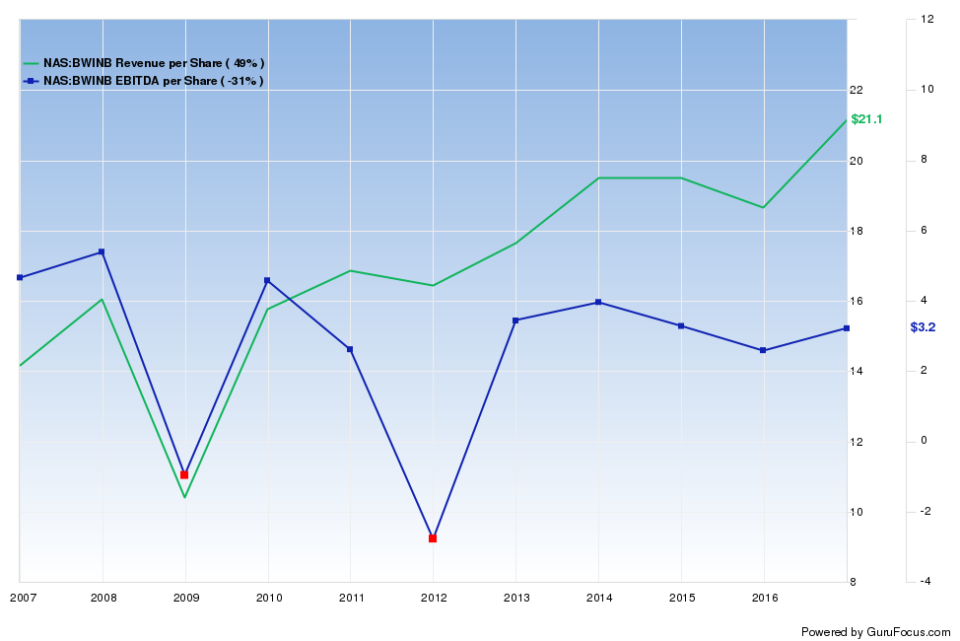

Baldwin & Lyons, an Indiana property and casualty insurance company, reported poor first-quarter 2017 earnings compared to results from first-quarter 2016. Although the company had higher net premiums and investment income, net earnings tumbled approximately $7.5 million from March 2016 to March 2017. Baldwin & Lyons incurred $48.6 million in losses during first-quarter 2017, about $10 million higher than that of first-quarter 2016. The losses contributed to lower revenue and earnings growth rates, which underperform over 64% of competitors.

Team Health

Watsa sold 6,000 shares of Team Health for an average price of $43.43. The guru pared 0.02% of his portfolio with this transaction.

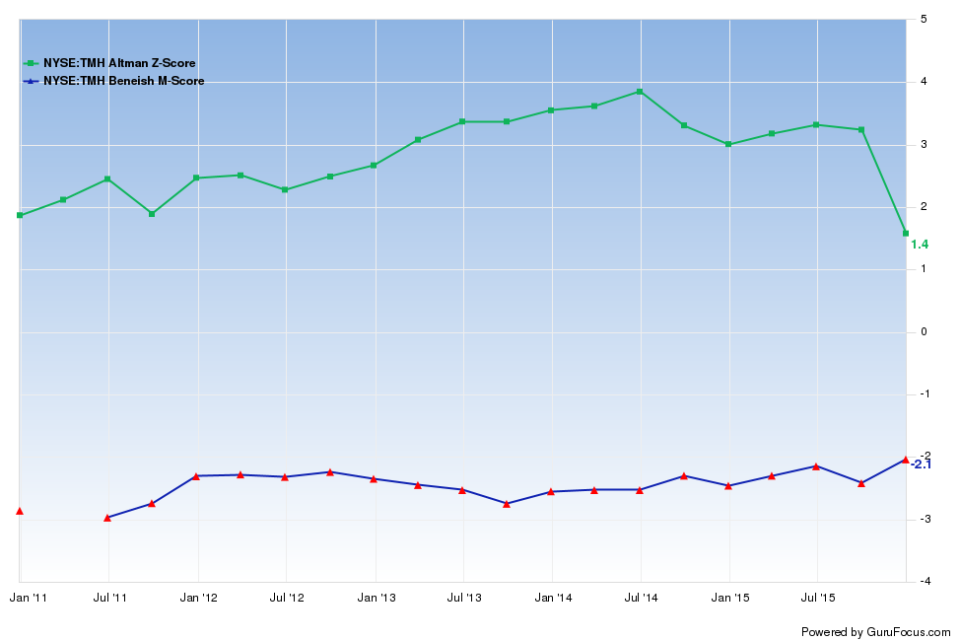

Team Health Holdings, a U.S.-based health care professional staffing company, exhibits moderate financial distress. The company's interest coverage of 2.27 is near a 10-year low and underperforms 92% of global competitors. Team Health's Altman Z-score of 1.52 suggests potential bankruptcy within the next 48 months. Finally, the company is a possible manipulator based on its Beneish M-score.

Several gurus axed their Team Health positions during first-quarter 2017 as the company has low growth and value potential: Mario Gabelli (Trades, Portfolio), Columbia Wanger (Trades, Portfolio) and Jana Partners (Trades, Portfolio).

Disclosure: No positions in the stocks mentioned.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with OSTK. Click here to check it out.

The intrinsic value of OSTK