Price & Time: Important Cyclical Pivot Here In Gold

Talking Points

EUR/USD takes out important Fibonacci resistance

USD/JPY pulls back from multi-month highs

Gold at important cycle points

Looking for real time Forex analysis throughout the day? Try DailyFX on Demand.

Weekly Foreign Exchange Price & Time at a Glance:

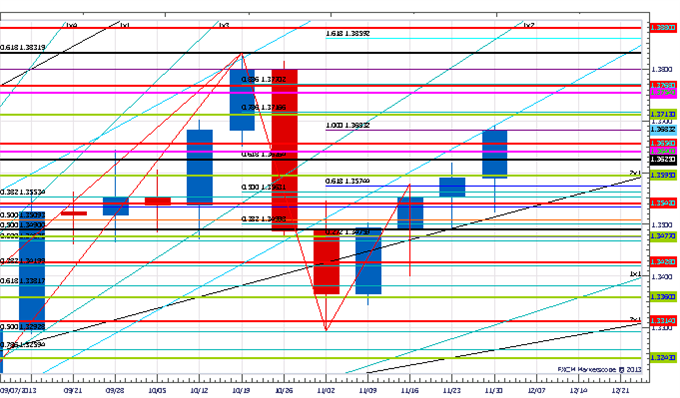

Weekly Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD extended the advance from the 50% retracement of the July to October advance to trade to its highest level in over a month on Friday

Our broader bias is positive on the Euro and will remain so while above 1.3540

The 78.6% retracement of the October/November decline at 1.3715 is the next important upside pivot with traction above exposing the year’s high

A medium-term cycle turn window ends early next week with the next window of significance coming near the end of the month

A move under the 7th square root relationship of the year’s low at 1.3540 would turn us negative on the Euro

Weekly EUR/USD Strategy: Square here, but may look to buy on weakness if current turn window fails to trigger a reversal.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.3540 | 1.3595 | 1.3680 | 1.3715 | 1.3770 |

Weekly Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/JPY traded to its highest level since May earlier this week before encountering Gann resistance near 103.50

Our broader trend bias is positive in the exchange rate while above the 2nd square root relationship of the years’ high at 101.70

A move through 103.50/70 is needed to signal that another leg higher is underway

A medium-term cycle turn window is seen over the latter half of next week

Only a move below101.70 would shift our broader-term trend bias to negative

Weekly USD/JPY Strategy: Like being long against 101.70.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | *101.70 | 102.00 | 102.75 | 103.05 | *103.70 |

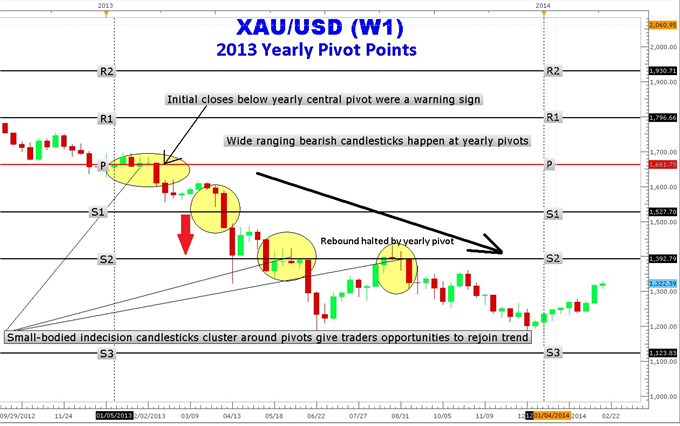

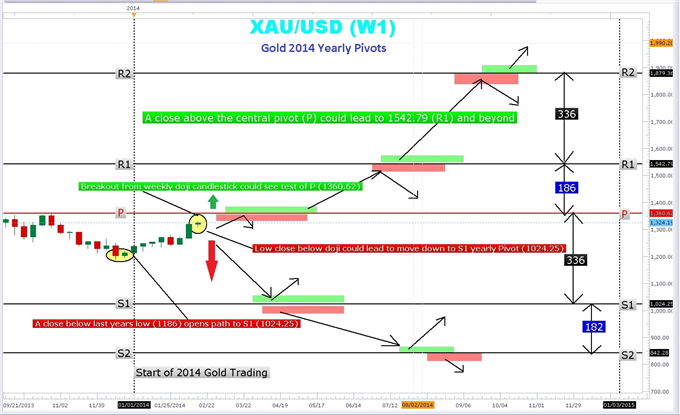

Weekly Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

XAU/USD traded this week to its lowest level since late June before finding support at the 1st square root relationship of the year’s low

Our broader trend bias is negative in the metal while below last week’s high at 1258

A daily close under 1219 signals a resumption of the broader decline

A Fibonacci time relationship related to the August high and June lowcould influence over the next few days

A daily close back over 1258 would turn us positive on the metal.

Weekly XAU/USD Strategy: Like being square here into this turn window. A close over 1258 would get us long.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

XAU/USD | 1180 | *1219 | 1233 | *1258 | 1282 |

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.