REIT ETFs: A Word of Caution

In my past post on dividend-paying stocks, some responded with questions about REITs (real estate investment trusts). You asked whether REITs are effective “bond substitutes,” whether they are a “defensive” equity investment, whether they’re good short-term hedges against inflation, and about their recent outperformance versus the broader stock market.

My answers are “No,” “not recently,” “no,” and “be cautious.”

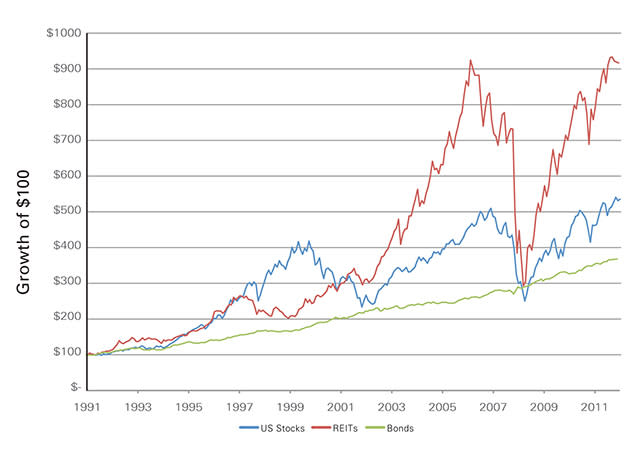

With current yields on broad fixed-income portfolios less than appealing to many investors, some have argued the merits of substituting dividend-paying stocks—and REITs, in particular—for bonds. They base their argument on the fact that current bond yields are lower than the dividend yield for REITs—1.7% for the Barclays U.S. Aggregate Index versus 3.4% for the FTSE NAREIT All Equity REITs Index—and that the upside potential for stocks in any equity rally is higher than for bonds. However, as you’ll see in the chart below, REITs tend to correlate with the broader equity market, not with bonds. This is especially true in down stock markets, such as 2008-2009. [Global Real Estate ETF with 4% Yield]

At times, REITs may outperform the broader equity market (as they have over the past several years), and vice versa. But, as the chart illustrates, if you substitute REITs for bonds in order to generate greater income, the final result is a more aggressive and more stock-heavy strategic asset allocation. In doing so, we would expect an increased likelihood of higher nominal returns over long periods of time, but that’s not necessarily because of the higher anticipated income stream. Rather, it’s because stocks are riskier and more volatile than bonds.

While I certainly sympathize with investors struggling in this low-yield environment, I just hope that we all appreciate that dividend-paying stocks, including REITs, are not substitutes for bonds. That’s not to say they won’t outperform a broad bond portfolio over the next several years. Rather, my point is that such an income-focused strategy is not a no-brainer, nor is it risk-free.

Sources: Vanguard calculations based on data from Dow Jones, MSCI, FTSE, and Barclays. U.S. stock returns represented by Dow Jones Wilshire 5000 from 1991 through April 2005 and MSCI U.S. Broad Market Index since May 2005; REITs returns represented by FTSE NAREIT All Equity REITs Index; and bond returns by Barclays U.S. Aggregate Bond Index.

REITs as an inflation hedge? It depends

Assets can be considered an “inflation hedge” if either their purchasing power is maintained over the long run or their nominal returns closely track realized inflation over shorter horizons. Assets whose returns go up with inflation are considered good inflation hedges. Treasury Inflation Protected Securities, or TIPS, are designed to be good inflation hedges. And many consider that “real” assets, such as gold and commodities, also protect a portfolio’s purchasing power because they offer the prospect of both positive expected long-run returns over inflation and a positive correlation with inflation over shorter horizons.

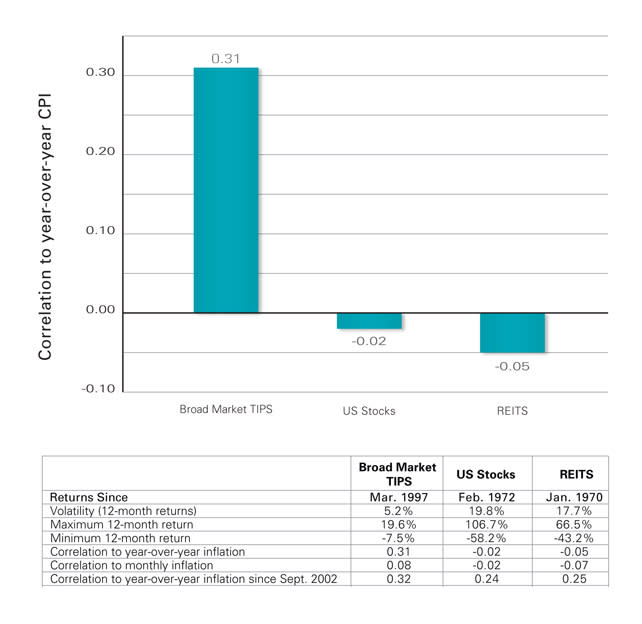

But what about stocks and REITs? To help answer this question, we compared the historical correlation of year-over-year CPI inflation with the returns of both TIPS and these other investments. We also compared these observed correlations with inflation with the historical volatility of the total returns on the assets themselves.

The chart below presents our results using monthly returns since 1970. The bars are sorted left to right by their average correlation to year-over-year percentage changes in actual CPI inflation. The correlation of TIPS with annual inflation is positive, indicating decent inflation-hedging characteristics (for details, see our white paper on this topic). But in this context, REITs have fared poorly, with average inflation correlation effectively zero. Investors should consider the inflation-hedging potential of REITs, like U.S. stocks in general, based on the likelihood of generating positive long-run real returns, not short-term sensitivity to inflation.

Sources: Vanguard calculations based on data from Barclays, FTSE, Dow Jones, Standard & Poor’s, and U.S. Bureau of Labor Statistics. TIPS returns are represented by Barclays U.S. Treasury Inflation Protected Index; REITs returns represented by FTSE NAREIT All Equity REITs Index; U.S. stock returns represented by Dow Jones Wilshire 5000 from 1991 through April 2005 and MSCI U.S. Broad Market Index since May 2005; commodity futures returns represented by S&P GSCI Index; gold represented by the average price for each month from Moody’s Analytics Data Buffet.

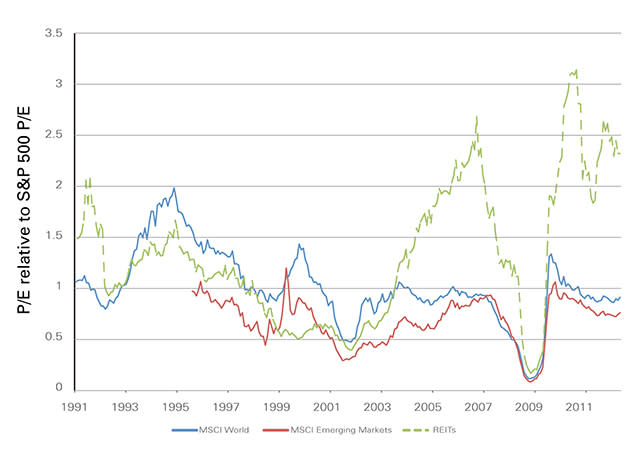

Finally, a word of caution: the first chart showed REITs rebounding nicely after March 2009. However, on a relative basis, REITs are more expensive than other segments of the stock market—U.S. stocks, as represented by the S&P 500 Index, or international stocks as represented by the MSCI World Index (for developed market equities) or the MSCI Emerging Markets Index. The figure below shows the P/Es of each index divided by the P/E of the S&P 500 Index. As of the end of October 2012, the P/E for REITs was 2.4 times that for the broader-based S&P 500 Index.

Source: Thompson Reuters Datastream. Data through October 31, 2012.

Now, I am not saying that REITS are in a bubble. But their striking outperformance versus the broad U.S. stock market has to come to an end at some point, just as other hot sectors have done in the past.

(I would like to thank Karin Peterson LaBarge, Yan Zilbering, and Kyle Ashinhurst for some great assistance in this blog post.)

Joe Davis, Ph.D., is Vanguard’s chief economist and head of Vanguard Investment Strategy Group.

Notes: All investments, including a portfolio’s current and future holdings, are subject to risk, including the loss of principal. Diversification does not ensure a profit or protect against a loss. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer’s ability to make payments. While U.S. Treasury or government agency securities provide substantial protection against credit risk, they do not protect investors against price changes due to changing interest rates.