Russell Investments to Close its Last ETF

Russell Investments, the index provider for some of the largest U.S. exchange traded funds, will close its last ETF.

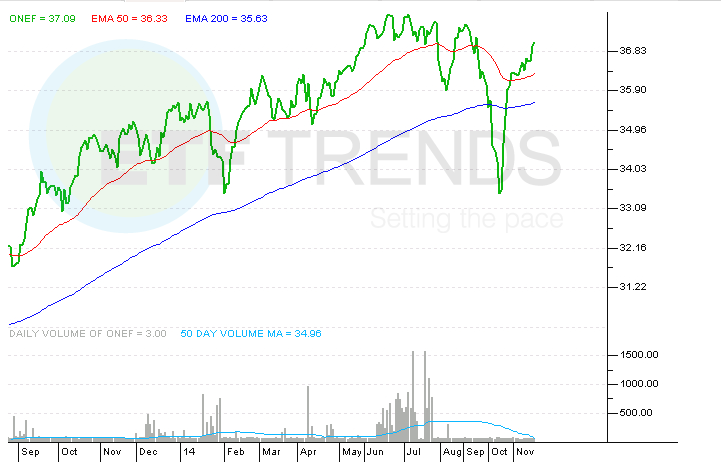

After the close of U.S. markets Tuesday, Russell said it is liquidating the Russell Equity ETF (ONEF) . ONEF, which debuted four and a half years ago, will close to new investment on Jan. 26, 2015 and will suspend trading on Jan. 27. In a statement, the firm said it intends to have ONEF fully liquidated by Feb. 6.

ONEF had just $7.4 million in assets under management as of Nov. 25.

While Russell is shuttering ONEF, “it does not mean Russell is abandoning the ETF market. Russell continues to offer ETFs in the Australian market and believes the active U.S. ETF market still presents viable and important investment opportunities,” said the firm in a statement.

ONEF was Russell’s one remaining ETF after the firm closed its expansive lineup of factor-based funds in 2012.

News of ONEF’s closure means ETF issuers have announced at least five closures this week. On Monday, Teucrium Trading said the Teucrium Natural Gas Fund (NAGS) and Teucrium Crude Oil Fund ETF (CRUD) will be shuttered after the close of business on December 18, 2014.

On Tuesday, EGShares said it will close the $1 million EGShares Emerging Markets Dividend Growth ETF (EMDG) and the $3 million EGShares EM Dividend High Income ETF (EMHD) . [EGShares to Close two ETFs]

ETF closings are part of a healthy industry, reflecting providers’ responsiveness to investors’ needs. For instance, year-to-date, 189 new funds were launched while 67 ETFs were delisted, according to XTF data.

Russell Equity ETF

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.