Singapore ETFs Gain Cash, but There’s a Catch

Despite its developed market status and AAA-credit rating, Singapore has been passed over by investors amid fears of an over-heating property market and stagnant economic growth.

The trend of investors ignoring the city-state’s equities is reversing, but there is a catch. “Ten exchange-traded funds that track Singapore saw about $338 million of net inflows in the first six weeks of this quarter following five quarters of outflows,” Bloomberg reports, citing Markit data.

The catch is that while the aforementioned ETFs, comprise of seven equity-based funds with bonds and cash funds making up the rest, according to Bloomberg, are hauling in cash, U.S.-listed Singapore ETFs are not among that group.

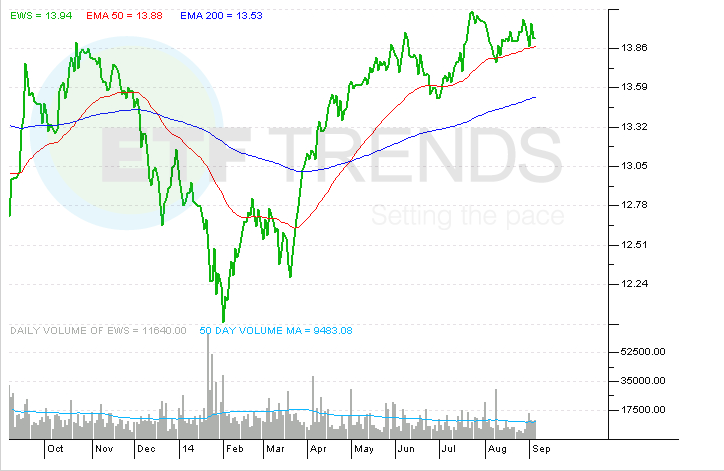

Since the start of the third quarter, the iShares MSCI Singapore ETF (EWS) has lost $41.7 million in assets while investors have pulled nearly $3 million from the iShares MSCI Singapore Small-Cap ETF (EWSS) .

EWS is up just 7.6% this year compared to a gain of 11.3% for the iShares MSCI Pacific ex Japan ETF (EPP) . [A Singapore ETF Slump]

That after 2013, a year in which Singapore’s benchmark Straits Times Index was the worst performer among developed markets, according to Bloomberg.

Morgan Stanley expects the MSCI Singapore Index will rise 8.78% over the next year, Bloomberg reported. That is the index tracked by the nearly $980 million EWS.

Making the outflows from EWS all the more concerning is investors obvious preference for Hong Kong equities, another developed, AAA-rated Asian market. Since the start of the current quarter, only five U.S.-listed ETFs have added more than the $1.21 billion gained by the iShares MSCI Hong Kong ETF (EWH) . [Hong Kong ETFs Keep Surprising]

Some analysts are optimistic about Singapore’s banks, which could prove to be good news for EWS as the ETF allocates 52.2% of its weight to the financial services sector. That is more than double the weight devoted to industrials, the ETF’s second-largest sector weight. EWS also features a trailing 12-month yield 3.18%, 140 basis points above the S&P 500.

iShares MSCI Singapore ETF

ETF Trends editorial team contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.