Small-Cap Growth ETFs Restore Leadership Role

Small-cap ETFs were shunned in 2014 for lackluster performance that lagged far behind their large-cap peers. Nevertheless, funds that track small-cap stocks are shaking off that weakness this year and attempting to restore faith in a forgotten growth story.

iShares Russell 2000 Index

The iShares Russell 2000 Index (ETF) (NYSE: IWM) is the most well-known and broad-based index of smaller companies with market capitalizations less than $2 billion. This exchange-traded fund just recently hit new all-time highs as investors gravitate away from larger companies.

One reason for this strength may be the attractiveness of smaller publicly-traded stocks that have less exposure to global currency fluctuations than large multi-national entities.

When the small-cap segment is broken down into growth and value characteristics, there is no denying the momentum that growth stocks have established.

Related Link: Top 4 Small-Cap Stocks In The Life Insurance Industry

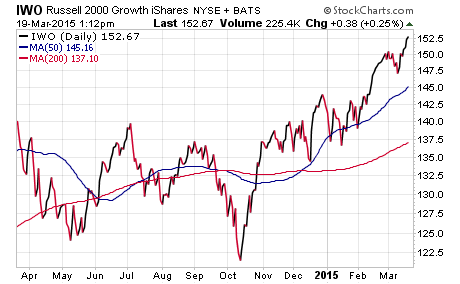

iShares Russell 2000 Growth ETF

The iShares Russell 2000 Growth Index (ETF) (NYSE: IWO) tracks a subset of 1,191 stocks within IWM with fundamental growth characteristics. This ETF has $7.5 billion in total assets and charges an expense ratio of 0.25 percent.

Since the start of the year, IWO has gained 7.21 percent compared to 4.10 percent in IWM and 1.79 percent in the SPDR S&P 500 ETF Trust (NYSE: SPY).

One of the reasons for the strength in IWO is the outsized exposure to technology, healthcare and consumer discretionary companies.

Biotechnology stocks in particular have been very strong this year and continue to reach for new heights on an almost daily basis. ISIS Pharmaceuticals, Inc. (NASDAQ: ISIS) and Puma Biotechnology Inc (NYSE: PBYI) are in the top three holdings of IWO and posted double digit gains this year.

Vanguard Small-Cap Growth ETF

The Vanguard Small-Cap Growth ETF (NYSE: VBK) is the second-largest competitor in this category, with $4.2 billion in assets. VBK tracks a smaller subset of 737 stocks, according to the CRSP US Small Cap Growth Index.

This ETF differs from IWO in that financials and industrials make up the two largest sector allocations, with technology and healthcare rounding out the top four.

Despite the divergences in the two most favored small-cap growth ETFs, these vehicles offer easy access to a diversified basket of companies exhibiting favorable momentum characteristics.

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.