The stock market is making no sense for a lot of investors

“We have never had so many client meetings starting with statements such as ‘we are totally lost’,” Credit Suisse equity strategist Andrew Garthwaite said on Thursday.

Indeed, the stock market doesn’t seem to be making a whole lot of sense lately.

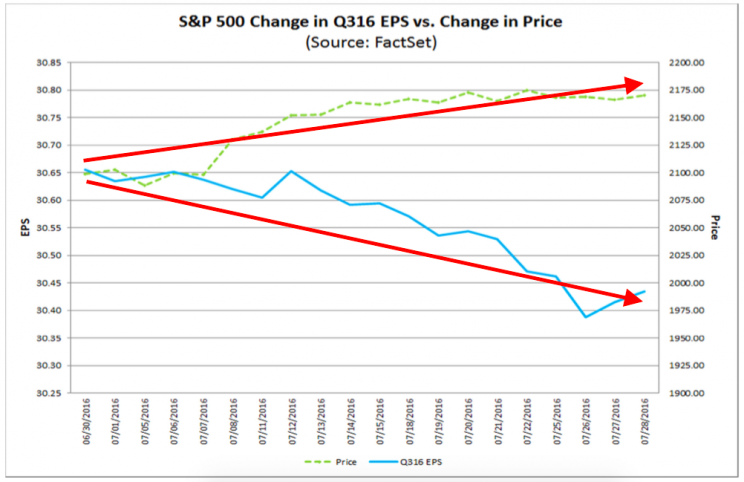

On Friday, the S&P 500 (^GSPC) set an all-time intraday high of 2,177.09, the latest milestone in what’s been an impressive seven year old bull market. Interestingly, this rally comes as expectations for earnings growth continue to sour. This is counterintuitive for investors since earnings are the most important drivers of stock prices in the long-run.

Stocks haven’t made sense in 10 of the past 16 quarters

“During the month of July, analysts lowered earnings estimates for companies in the S&P 500 for the quarter,” FactSet’s John Butters observed on Friday. “The Q3 bottom-up EPS estimate (which is an aggregation of the EPS estimates for all the companies in the index) dropped by 0.7% (to $30.44 from $30.66) during this period.”

“As the bottom-up EPS estimate declined during the first month of the quarter, the value of the S&P 500 increased during this same time frame,” Butters continued. “From June 30 through July 28, the value of the index increased by 3.4% (to 2170.06 from 2098.86).”

This is not the first time stock prices and earnings expectations have diverged in recent years.

“[July marks] the 10th time in the past 16 quarters in which the bottom-up EPS estimate decreased during the first month of a quarter while the value of the index increased during the first month of the quarter,” Butters noted.

In other words, the stock market has been doing the exact opposite of what investors would expect 62.5% of the time.

Valuations are stretched

It’d be one thing if the price-earnings ratio (P/E) was below its long-term average. Furthermore, this comes amid a backdrop of what feels like heightened uncertainty around the world.

“Clients do not find equity valuations attractive enough to compensate for the macro, political, earnings and business model risks,” Garthwaite said.

“Sell everything. Nothing here looks good,” DoubleLine Funds’ Jeffrey Gundlach said to Reuters on Friday. “The stock markets should be down massively but investors seem to have been hypnotized that nothing can go wrong.”

No fear

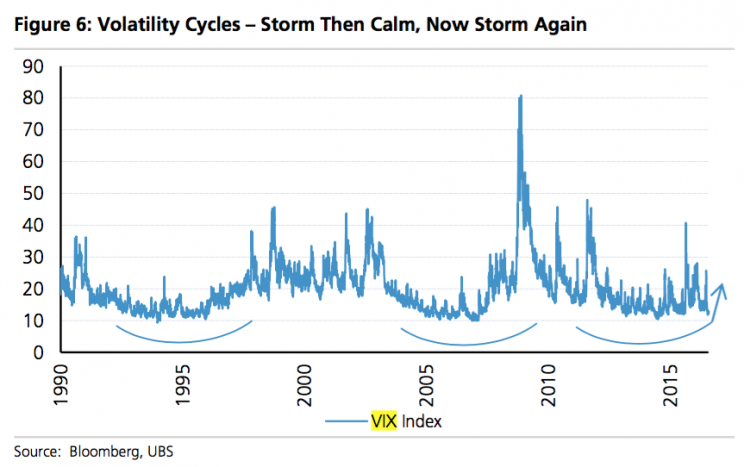

What makes some experts particularly troubled is the lack of volatility or fear — as measured by the VIX — being discounted in to the market.

“Will calm prevail?” UBS’s Julian Emanuel wrote. “Unlikely. We believe a VIX near 13 insufficiently discounts uncertainty in the form of political risk in the US and in Europe that is not likely to dissipate meaningfully prior to the US elections on November 8.”

“So, given the prospects for a contentious US presidential race where the outcome may not be certain until the day of the vote, November 8 (as a reminder, the pollsters were surprised by the 6/23 UK Referendum outcome) along with uncertainty about the economic future of the UK and the EU persisting, talk of volatility’s demise (VIX 13) may be greatly exaggerated,” Emanuel continued.

A spiking VIX is usually accompanied by selling in the stock market.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

How a bad story can cripple the economy

Forecasting 2017 earnings has become Wall Street’s most controversial task

You’re probably using P/E ratios incorrectly

Wall St. is betting on earnings growth in the second half of 2016