Trump speaks — What you need to know this week in markets

For the second week in a row, the Dow finished higher each day and brought its streak of record closes to 11 trading days.

Overall, markets are up more than 10% since Trump’s election, and the administration is loving it. In an interview with CNBC last week, Treasury Secretary Steven Mnuchin said the market is “absolutely” a scorecard for the economy. On that basis, then, everything is going well at the start of the Trump era.

Market history tells us, however, that a decline in stocks is coming. The only question is when.

Looking out to the calendar for this week, the economic schedule is quite busy. On Monday, we’ll get a second look at fourth quarter GDP, while on Wednesday the Fed’s preferred inflation reading will be released as will two manufacturing surveys and auto sales for the month of February. The only thing missing from the calendar is the jobs report, typically released on the first Friday of each month, but set to come out on March 10.

The week’s highlight, however, will be on Tuesday evening when President Donald Trump will address a joint session of Congress.

“Historically, this has been the speech in which the President has showcased his policies and priorities for the coming year,” writes Deutsche Bank economist Joe LaVorgna.

“Critical to the economic outlook, we expect President Trump to highlight the need to galvanize economic activity. Hence, tax reform will be at the top of his agenda. While Tuesday night’s speech may not provide us with many details, market participants are eager to learn whether President Trump supports the border adjustment tax, a central feature of House Speaker Ryan’s tax plan.”

This past week, recall, the president told Reuters in an interview that, “I certainly support a form of the tax on the border.” A report out from Axios on Friday, however, indicated that Gary Cohn, chief economic advisor to the president, told a group of CEOs on Friday morning the White House does not support the House Republican version of a border-adjustment tax. The White House later denied this report.

Mnuchin, in an interview with CNBC, said Thursday that the White House and Congress agree on the vast majority of a tax plan. The border-adjustment tax is aimed at making a tax cut revenue neutral.

But no matter which way the administration says it is or is not going on a border-adjustment tax, the president’s initial evaluation of the plan back in January is likely to be the reason something resembling what Paul Ryan and House Republicans want will not feature in a final tax package: It is simply too complicated.

Economic calendar

Monday: Durable goods, January (+1.9% expected; -0.5% previously); Pending home sales, January (+0.9% expected; +1.6% previously); Dallas Fed manufacturing, February (19.4 expected; 22.1 previously)

Tuesday: Fourth quarter GDP, second estimate (+2.1% expected; +1.9% previously); Fourth quarter personal consumption, second estimate (+2.5% expected; 2.5% previously); Case-Shiller home prices, December (+0.7% expected; +0.88% previously); Chicago PMI, February (53.0 expected; 50.3 previously); Conference Board consumer confidence, February (111 expected; 111.8 previously); Richmond Fed manufacturing, February (10 expected; 12 previously); Trump addresses joint session of Congress

Wednesday: Personal income, January (+0.3% expected; +0.3% previously); Personal spending, January (+0.3% expected; +0.3% previously); “Core” PCE, year-on-year (+2% expected; +1.6% previously); Markit manufacturing PMI, February (56.0 expected; 56.0 previously); ISM manufacturing PMI, February (56.0 expected; 56.0 previously; Construction spending, January (+0.6% expected; -0.2% previously); Auto sales, February (17.7 million expected; 17.48 million previously)

Thursday: Initial jobless claims (245,000 expected; 244,000 previously)

Friday: Markit services PMI, February (53.9 previously); ISM non-manufacturing PMI, February (56.5 expected; 56.5 previously)

“Full employment”

“Full employment” is something we’ve heard a lot about over the last two years or so.

It is, in economic parlance, the unemployment rate at which wages are supposed to accelerate. As this concerns the Federal Reserve, “full employment” is the point at which pressure for the central bank to raise interest rates is expected to increase.

With the unemployment rate at 4.7% and wages rising 2.5% year over year, many economists have argued we are either at or near “full employment.”

But this term, when said outside the confines of the economic profession, often makes little sense to the citizen who is either out of work, unhappy with the work they do have, or confused about why experts are saying the economy is at full employment when millions — yes, even at 4.7% unemployment, millions don’t have a job — are not working.

In a note to clients published this week, Goldman Sachs economist David Mericle explored the idea of why people are so upset if we’re so close to “full employment.”

“After a long recovery the US labor market has now reached roughly full employment, in our view,” Mericle writes.

“A frequent pushback to this claim is that it seems out of sync with the general mood of economic discontent that appeared to play such an important role in the 2016 presidential election. Can these two stories really be reconciled? A simple answer is that cyclical recovery certainly need not imply a reversal of the secular trends of income stagnation and dimmer economic prospects for much of the population.”

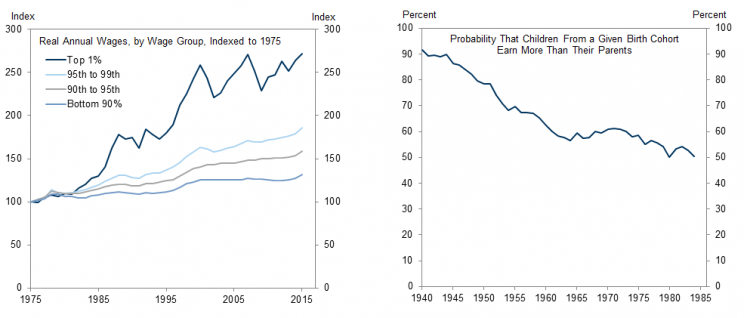

A couple of key charts highlighted by Mericle are below, showing that real wages have risen mostly for the top 1% of earners while the probability that children will be better off than their parents has collapsed, particularly for those on the lower end of the wage scale.

Additionally, Mericle’s work found that the post-crisis recovery has been uneven across the country. Employment growth in metro areas, for example, has been running about 1% higher per year than non-metro areas. The unemployment rate in metro areas is also about 1% lower than in non-metros.

And then there’s trade, China, manufacturing, and the data behind why “Make America Great Again” resonated in the states — Michigan, Ohio, Wisconsin, Pennsylvania — that swung the election.

“Research on county-level 2016 presidential election results has found that exposure to international trade, especially with China, was an important predictor of the degree to which President Trump exceeded the vote share of previous Republicans,” Mercile writes.

“This finding likely overlaps to some degree with the pattern of weaker job growth in nonmetropolitan areas, where tradeable goods industries account for a much larger share of employment and income than in metropolitan areas. While other factors also likely contributed to weaker employment growth, the past effects or feared future effects of trade appeared to resonate particularly strongly with voters.”

So while much of the discussion around “Why Trump Won” has largely moved past the serious and become snark directed at Hollywood celebrities who, you can be sure, will use this weekend’s Academy Awards as a platform for their anti-Trump politics, the obvious economic inequality we see across the country certainly underwrote this unexpected election result.

Mericle notes that middle-income stagnation, however, is not a new problem and it hasn’t suddenly gotten worse. “Creating good middle class jobs” has been a rallying cry for most every politician of either party over the last generation.

Perhaps, then, it is not so much that Trump highlighted a new economic anxiety, but that he tapped into it in a new way. Now, of course, the job of relieving those stresses is his.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: