U.K. ETF Flirts With Six-Year Highs

A United Kingdom country-specific exchange traded fund is trading near a six-year high Tuesday as U.K. stocks reached their highest level since 1999 on German Bundesbank support for additional stimulus in the Eurozone.

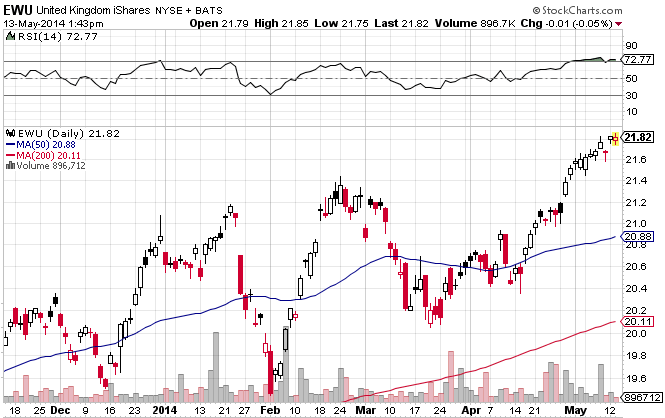

The iShares MSCI United Kingdom ETF (EWU) was slightly down after touching an intra-day high of $21.8 per share Tuesday. EWU has gained 4.6% year-to-date.

The FTSE 100 Index closed at 6,873.08 Tuesday, its highest level in 19 years, reports Trista Kelly for Bloomberg.

Gains were fueled by speculation that Germany, the largest economy in the Eurozone, would support the European Central Bank’s decision to increase stimulus measures. The ECB is set to meet next month to look over interest-rate cuts and other stimulus measures as the central bank projects a lower 2016 inflation outlook. [U.K. ETFs Could Rally if Sterling Slides]

Additionally, U.K. equities were strengthening on positive sentiment and economic data.

“The markets are focusing on wide-ranging factors that have been helping sentiment,” Henk Potts, a strategist at Barclays Wealth & Investment Management, said in the article. “M&A activity tends to be a big driving influence in terms of markets and we’re seeing the benefit of that coming through. There’s lots of be enthusiastic about given the surprisingly strong and improving economic backdrop.”

Moreover, the U.K. is seen a recovery in its housing market.

“The booming U.K. housing market continues to be strong indeed with improving confidence in that sector,” Potts added. “Expectations of the housing market are that demand will be strong for some time.

The iShares MSCI United Kingdom ETF tries to reflect the performance of the MSCI United Kingdom Index. There are no U.S.-listed ETFs that track the FTSE 100 Index, but EWU does a good job of providing similar exposure to a group of large-cap U.K. stocks.

iShares MSCI United Kingdom ETF

For more information on the U.K., visit our United Kingdom category.